गृह ऋण संबंधी ई एम आई की गणना कैसे करें, इससे संबंधित चरणबद्ध मार्गदर्शिका

02 जनवरी 2023

Table of Content

Those who do not have a home to call their own, dream of buying a home. Those who own a home, dream of getting a bigger one. While those who own more than one home in one city, dream of owning homes in other cities too. Then there are dreams of country houses, duplex apartments and villas, the list is endless. But for a first-time homeowner, purchasing a home is fraught with doubts and uncertainties. Home loans are the most feasible option, but not everyone knows how to calculate home loan EMI. The challenges of long-time loan burden discourage many. In today’s age, home loans are a blessing for those who are seriously planning to purchase a home. All you need is willingness, preparation for taking a loan and planning out a way with information and knowledge on managing the monthly instalments while keeping yourself safe from pitfalls. A home is a necessity and with help from home loans, as Marissa Mayer says, even if you can’t have everything you want, you can have the things that matter to you.

Home Loan EMI Calculation

Before availing of a home loan your planning should include your loan-paying capacity while balancing your finances. When you calculate in advance the monthly outgo you can plan the rest of your spending better. Do this before you approach a bank as they will only give you a loan looking at your repaying capacity and you can verify the calculation that the bank puts up. The checks for repayment are planned which helps to secure the tenure of repaying the home loan in its course.

The repayment includes the principal sum and the interest. The payment is made monthly through equated monthly instalments, (EMI).

The Equated Monthly Instalments (EMI) includes two components

Principal Loan amount: The loan amount you have applied for and is disbursed to you.

Loan Interest: The cost added for borrowing the amount that keeps adding through the repayment tenure.

The fundamental of the EMI amount is based on these factors, however, the tenure of repayment you choose determines the EMI size.

Repaying the loan in a shorter duration increases the EMI value but you can save on the interest outflow. Stretching the EMI to a longer tenure makes the EMI easier to manage, but the interest or the borrowing cost keeps adding on. So, the choice of EMI should be based on your financial standing, repayment capacity, and future goals. Fix the repayment tenure accordingly.

So how to calculate EMI for a housing loan?

There is a three-way process of home loan EMI calculation formula, that informs individuals on how to calculate home loan EMI.

There is a simple mathematical formula. You can calculate by just fixing the numbers in the formula to get the right sum.

You can also calculate by using an excel sheet.

You will find online EMI calculators that will help to calculate your EMIs.

Home loan EMI calculation formula

Let us begin with the first, mathematical formula that calculates your EMIs for you.

Formula: EMI = P x R x [{(1 + R)^N} / {1 – (1+R)^N}]

Where,

P stands for the principal loan

R stands for your monthly interest rate [(annual rate/12)/100]

N stands for the total number of months during the loan tenure.

Check this example for a clearer understanding:

Say X took a loan of Rs 60 lakhs at an interest rate of 8.50 per cent. The loan tenure is 20 years. How to calculate home loan EMI?

R = [(annual rate /12)/100]= (8.5/12)/100= 0.70/100= 0.0070N = 240EMI = P x R x [{(1 + R)^N}/{1 – (1+R)^N}]= 60,00,000 x 0.00708333 x [{(1 + 0.00708333)^240}/{1-(1 + 0.00708333^240)}]= 50,00,000 x 0.00708333 x [{5.44123824}/{4.44123824}]= 60,00,000 x 0.00708333 x [1.22516243]EMI = Rs 52,069

How to calculate home loan EMI on an Excel sheet?

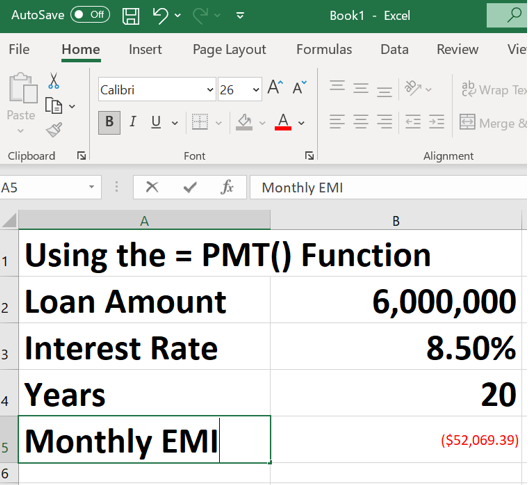

The home loan EMI calculation formula on the Excel sheet helps you to calculate the present value of payments (PMT) which is a simpler way of calculating the EMI.

The formula (r, nper, pv)

Where,

R here stands for rate of interest (8.50 per cent)

NPER stands for the number of months over which the money has to be paid. (240 months)

PV stands for the present value of the loan, meaning the principal amount (Rs 60,00,000).

The Stepwise Process:

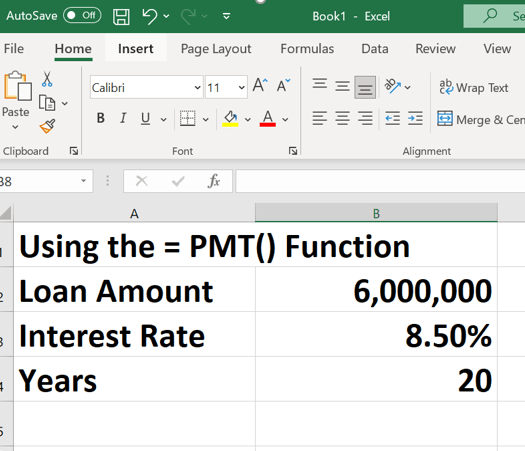

The first key in loan amount is the interest rate and the tenure in years.

Don't forget to mention the currency and while logging the interest rate, add the percentage sign. You can also mention the term in years here.

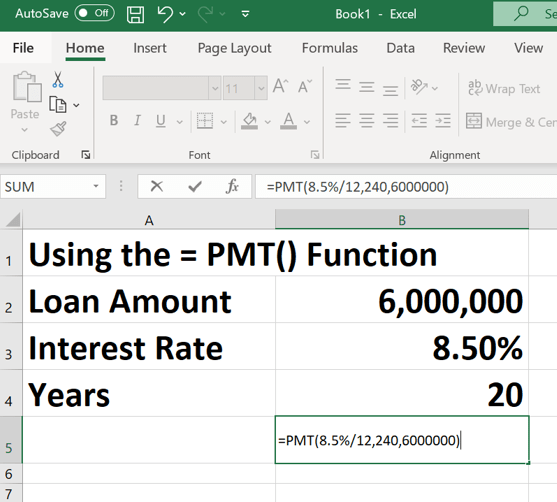

Now key in the formula, PMT= r, nper, pv. The loan tenure needs to be keyed in every month

=PMT(8.5%/12,240,6000000)

After pressing Enter you get the payable EMI value

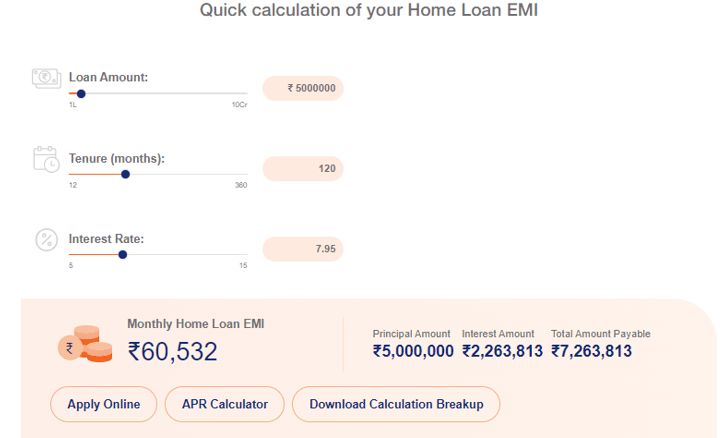

How to calculate EMI for housing loans using the online EMI calculator?

Online EMI calculators are readily available by banks and financial institutes. Enabling easy user-friendly calculations, you just key in the loan amount, interest rate and loan tenure. The tool helps you get a precise breakup of the loan.

Benefits of calculating home loan EMI

Once you get a complete calculation of the home loan EMI, it helps you to get a view of what you are embarking on. The figures help in calculating making additions or subtractions to the principal sum based on your capacity for repayment. So, what are the Benefits of calculating home loan EMI in short?

- You can choose a home loan amount according to your comfort

- The amount that helps you manage your EMIs better

- The amount that doesn't strain your financial balance

Conclusion

Whatever may be your EMIs, this is one task that all home loan seekers should follow. Once you know the monthly expenses you are looking at, your EMIs will not press on your regular financial plans. So even before you apply for a home loan with a bank or any financial institution, you have a clear and calculated sheet that gives you an insight into what your loan repayment entails. Once you learn how to calculate EMI for a housing loan, you can compare the best deal and start paying it off at your convenience.

Popular Articles

Related Articles

What is CVV on a Debit Card? Understanding Its Importance and Security Features

How to Update Your FASTag KYC: Step-by-Step Guide for Online & Offline Methods

The Importance of Pension Funds: Secure Your Future with Steady Retirement Income

-

डिस्क्लेमर

इस लेख/इन्फोग्राफिक/चित्र/वीडियो की सामग्री का उद्देश्य केवल सूचना से है और जरूरी नहीं कि यह बैंक ऑफ बड़ौदा के विचारों को प्रतिबिंबित करे। सामग्री प्रकृति में सामान्य हैं और यह केवल सूचना मात्र है। यह आपकी विशेष परिस्थितियों में विशिष्ट सलाह का विकल्प नहीं होगा । बैंक ऑफ बड़ौदा और/या इसके सहयोगी और इसकी सहायक कंपनियां सटीकता के संबंध में कोई प्रतिनिधित्व नहीं करती हैं; यहां निहित या अन्यथा प्रदान की गई किसी भी जानकारी की पूर्णता या विश्वसनीयता और इसके द्वारा उसी के संबंध में किसी भी दायित्व को अस्वीकार करें। जानकारी अद्यतन, पूर्णता, संशोधन, सत्यापन और संशोधन के अधीन है और यह भौतिक रूप से बदल सकती है। इसकी सूचना किसी भी क्षेत्राधिकार में किसी भी व्यक्ति द्वारा वितरण या उपयोग के लिए अभिप्रेत नहीं है, जहां ऐसा वितरण या उपयोग कानून या विनियमन के विपरीत होगा या बैंक ऑफ बड़ौदा या उसके सहयोगियों को किसी भी लाइसेंसिंग या पंजीकरण आवश्यकताओं के अधीन करेगा । उल्लिखित सामग्री और सूचना के आधार पर किसी भी वित्तीय निर्णय लेने के लिए पाठक द्वारा किए गए किसी भी प्रत्यक्ष/अप्रत्यक्ष नुकसान या देयता के लिए बैंक ऑफ बड़ौदा जिम्मेदार नहीं होगा । कोई भी वित्तीय निर्णय लेने से पहले अपने वित्तीय सलाहकार से सलाह जरूर लें।

गृह ऋण के लिए संपूर्ण मार्गदर्शिका

घर की तलाश करने वालों के लिए, बैंक और अन्य वित्तीय संस्थान प्रतिस्पर्धी ब्याज दरों पर ऋण प्रदान करते हैं। इसलिए यदि आपका कोई सपनों का घर है, तो आगे की राह अधिक कठिन नहीं है।

गृह ऋण हेतु CIBIL स्कोर – गृह ऋण पर क्रेडिट स्कोर का प्रभाव

क्या आप गृह ऋण के लिए आवश्यक CIBIL स्कोर के बारे में जानना चाहते हैं? क्या आप यह सोच रहे हैं कि गृह ऋण के लिए न्यूनतम सिबिल स्कोर क्या है और आप अपने क्रेडिट स्कोर को उस सीमा के भीतर कैसे ला सकते हैं? यदि हां, तो आप सही स्थान पर आ गए हैं! गृह ऋण आवदेन के लिए आवश्यक CIBIL स्कोर के बारे में सभी जानकारियाँ प्राप्त करने के लिए इस आलेख को पढ़ना जारी रखें.

वर्ष 2000 में स्थापित, क्रेडिट सूचना ब्यूरो लिमिटेड (CIBIL) एक क्रेडिट सूचना कंपनी है जो व्यक्तियों और संगठनों के रिकॉर्ड रखती है। ऋण देने वाली कोई एजेंसी/कंपनी/बैंक इनसे प्राप्त सिबिल स्कोर के आधार पर ऋण प्रदान करती है।