What Is Overdraft Facility? All You Need To Know!

15 May 2019

When you open a bank account, you are provided with a bouquet of financial services. The bank provides a cheque book and a passbook to help you manage and maintain your accounts. Furthermore, you are provided with an ATM cum debit card, net and mobile banking facilities and so on. The bank also offers a financial service known as the overdraft facility. But what is overdraft facility? Here’s all you need to know.

What is overdraft facility in bank?

Overdraft facility is a financial facility or instrument that enables you to withdraw money from your bank account (savings or current), even if you do not have any account balance.. Like any other credit facility, the bank levies an interest rate when you avail the overdraft facility. You typically have to pay a fixed interest rate to avail an overdraft limit.

What are the features of the overdraft facility?

Having explained what is overdraft limit, let’s find out its features. These are as under:

- Banks offer overdraft facilities over a pre-determined limit, which may differ for every borrower.

- Overdraft limit account is a running account in which you can deposit/ withdraw amount anytime up to the specified limit.

- The bank levies the interest on the overdraft amount used by the borrower at predefined rate. The interest is calculated daily and billed/debited to your on monthly basis. The interest amount increases if you default on paying the due overdraft amount.

- Unlike most loans wherein you have to pay a prepayment penalty for repaying the loan before tenure; banks so not levy any prepayment charges on overdraft limits. You can pay off the overdraft amount cumulatively without incurring any prepayment penalties.

- You can repay the overdraft, in different amounts, whenever you have the money. The system of EMIs, which is prominent with most loans, does not exist in the case of overdraft limits.

- While there is no minimum monthly repayment schedule in the case of overdraft loans, the amount owed by you should be within the overdraft limit.

- Joint borrowers may avail overdraft limits. However, both the applicants are equally responsible for repaying the sanctioned Overdraft limit

Different types of collateral accepted by banks against overdraft loans

- Overdrafts against your house or property

- Overdrafts against your fixed deposits

- Overdrafts against your life insurance policy

- Overdrafts against your equity holdings

- Overdrafts against your salary

Final word: As is evident, the overdraft facility is one that can truly help you when you need money. Banks also fix decent repayment tenures, so that you can repay the overdraft loan flexibly. However, before availing this facility from your bank, you must ensure that you find out the overdraft facility advantages and disadvantages and then proceed with the limit.

Popular Articles

Related Articles

Guide to Getting Agriculture Loan: Application, Eligibility & Required Documents

-

Disclaimer

The contents of this article/infographic/picture/video are meant solely for information purposes and do not necessarily reflect the views of Bank of Baroda. The contents are generic in nature and for informational purposes only. It is not a substitute for specific advice in your own circumstances. Bank of Baroda and/ or its Affiliates and its subsidiaries make no representation as to the accuracy; completeness or reliability of any information contained herein or otherwise provided and hereby disclaim any liability with regard to the same. The information is subject to updation, completion, revision, verification and amendment and the same may change materially. The information is not intended for distribution or use by any person in any jurisdiction where such distribution or use would be contrary to law or regulation or would subject Bank of Baroda or its affiliates to any licensing or registration requirements. Bank of Baroda shall not be responsible for any direct/indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information mentioned. Please consult your financial advisor before making any financial decision.

EMI - Definition, Understanding & Why EMI is Important?

A loan is always taken for a specific purpose, be it a housing loan, an automobile loan, an education loan or a personal loan. Whenever a loan is taken it has to be returned to the lender. These repayments are done in a specific format where the amount is deducted from the borrower’s account on a particular day of every month. The amount so deducted is also pre-decided and depends on various factors. This standardised deduction in financial terms is called as Equated Monthly Instalment or EMI.

The value of the EMI depends on four main factors. These are the amount borrowed, the rate of interest to be charged on the amount borrowed and tenure for which the loan is borrowed and the type of loan fixed or floating. If the loan is a floating one then there is one more component that affects the EMI which is called ‘Rest’.

All other parameters being equal higher the principal amount borrowed higher will be the EMI. Similarly, a higher interest rate would mean higher EMI, all other things being constant. If the amount borrowed and the interest rate is constant then a higher tenure would mean lower EMI and a lower tenure would mean higher EMI.

In the case of both the fixed and floating interest rate loan, in the first EMI outgo, the interest rate component is the highest and the principal is the smallest. By the time the borrower reaches the last EMI, the interest component is the smallest and the principal is the maximum.

In case of a fixed interest loan, the EMI remains the same throughout the period of the loan. While in the case of a floating interest rate loan, the borrower has the option of reducing the EMI amount periodically as per change in the interest rate or allowing the EMI to be constant and the period to reduce.

The borrower has the option of part prepaying his loan. Whenever this happens the option available to him is to either ask the lender to reduce his EMI amount from the date of repayment or to let the EMI amount remain the same but reduce the period of the loan.

In the case of a housing loan, the interest and principal that is being paid through EMI, is summed up at the end of the financial year to calculate its impact on tax benefits that the borrower can avail of.

In case a borrower defaults on any EMI the lender will impose a penalty on the non-payment or late payment that was missed/delayed..

In the case of regular - non-payment of EMIs, lenders will be taking more severe action to recover their money and the CIBIL score of the borrower is adversely effected, resulting in adverse effect on credibility of borrower for future loans.

The good part about EMI is that the borrower knows exactly the amount that will be going out from his bank account and on which date it will be deducted. The lender also benefits knowing the cash flow that will be coming into his account every month.

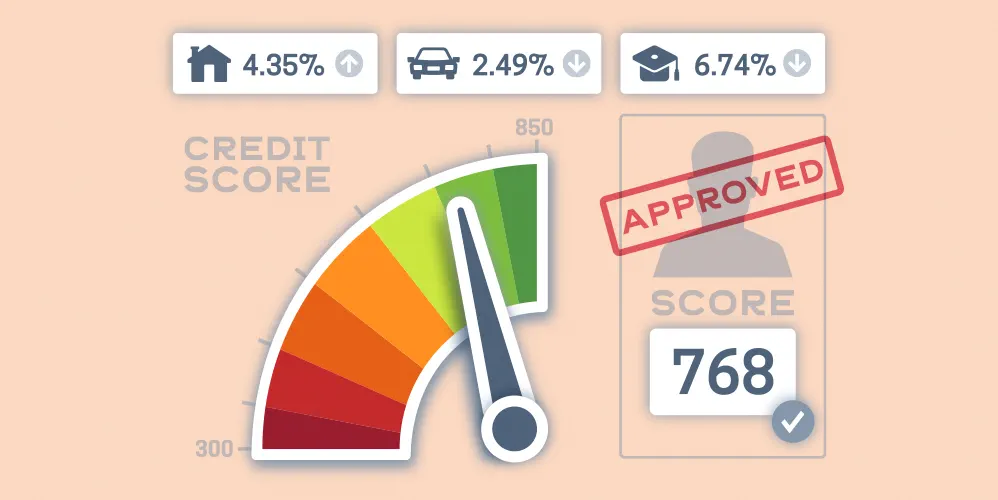

Why is a CIBIL Score Important?

Started in 2000, CIBIL or the Credit Bureau is an authorized credit information company that tracks debt repayment history and provides a credit score accepted by a vast network of financial institutions as a valid benchmark to examine a potential borrower’s credit quality. Here’s why a CIBIL score is important:

Lender considers the CIBIL score before approving a loan

The information collected and maintained by the bureau is gleaned from data collected from banks and other lending institutions on a monthly basis. On the basis of this data, CIBIL issues a score. This score is shared with the lenders on request, when an applicant applies for a loan.

What is an ideal credit score?

The range is from 300 to 900. Any score higher than 750 is a decent credit score. If an applicant has a credit score higher than 750, he/she is likely to get the loan approved and may get an attractive rate of interest. A loan application may be rejected if the credit score comes out to be too low.

How to source your CIBIL report?

Apart from a CIBIL score, you can also get your CIBIL credit information report. The report details the credit quality of your auto loan, home loan, credit card, over draft facility and personal loans. It carries your personal details, employment details and account information. The procedure to source your CIBIL report is exactly the same as getting your CIBIL Score.

Components of the CIBIL report

CIBIL Score

The first part of your CIBIL report has your CIBIL score, which is a value between 300 and 900. A score closer to green that is above 750 is preferable.

Personal information

Another section contains your personal information like name, date of birth, PAN number, Passport details and gender.

Contact information

The contact Information segment will capture all your address and contact details.

Employment information

The employment section will provide details about customer’s income and occupation at the time of a previous loan sanction.

Account information

An important section of the report is the account information which details the material about the borrower’s credit cards, loans, name of the lender, type of loan (whether secured or unsecured) and all the accounts held by the borrower.

Consumer Dispute Remark

The borrower can also put in their remarks about a particular loan transaction in the Consumer Dispute Remarks for evaluators to see every time the credit report is opened for assessment. The comments are presented for a year.