Get latest financial information, tips, insights & more

Form 16 in Income Tax: Definition, Benefits, Eligibility & Filing Guide

Understanding your tax obligations is essential for effective financial management, and one key document in this process is Form 16. This guide will walk you through what Form 16 is, its importance, and how to use it while filing your income tax returns.

What is a Working Capital Loan and How Can It Benefit Your Business?

In the fast-paced world of business, maintaining a steady flow of working capital is essential for smooth operations. A working capital loan is designed to help businesses manage their short-term financial needs, ensuring they have sufficient funds to cover daily expenses and operational costs. This comprehensive guide will explore what working capital loans are, their features, types, pros and cons, and how they can be used effectively in business.

What is an MSME Loan & how does it work?

MSME loans, or Micro, Small, and Medium Enterprises loans, are designed to support the growth and development of small businesses. These loans provide the necessary funds for business expansion, operational expenses, and other financial needs. The MSME stands for Micro, Small, and Medium Enterprises.

Understanding the Differences Between Home Loans and Mortgage Loans

In the world of finance, loans are as diverse as the people who avail them. But there's one common misunderstanding that we'd like to address: the difference between home loans and mortgage loans. Many people believe these terms are interchangeable, but they are actually two distinct financial products with different purposes, features, and implications. To ensure you make informed decisions when it comes to your homeownership or financial goals, let's break down the key differences between mortgage loans vs home loans.

Personal Loans for Travel-Financing Your Dream Vacation Responsibly

Do you dream of exploring the world, but your bank account isn't quite ready to support your wanderlust? Don't worry, you're not alone. Many people face financial constraints when it comes to embarking on their dream vacations. Fortunately, personal loans for travel offer a viable solution, enabling you to transform your travel aspirations into a reality. In this blog, we'll dive deep into the realm of travel loans, uncovering why they are an astute choice, gaining insights into the various types available, and discovering how to select the right one tailored to your needs.

Understanding FOIR: Calculation, Significance & Impact on Loan Eligibility

Financial stability and responsible borrowing are crucial aspects of managing your personal finances. When you approach a bank or financial institution for a loan, they evaluate your financial health by assessing various factors, one of which is FOIR. In this blog, we will delve into what FOIR is, its significance, and how it is calculated. So, let's get started on this journey towards understanding this vital metric.

A Complete Guide to Get a Loan Against an FD

It's simple to borrow money against a fixed deposit to get quick access to cash. In addition, you have the option of borrowing a loan against an FD as opposed to losing all or a portion of your investment. The Bank of Baroda loan against the FD program allows you to borrow up to 90% of the overdraft on your loan. The only amount that must be repaid is the original loan amount plus interest.

Education Loans vs. Self-Finance to Study Abroad

Studying abroad is a dream for many students. It allows them to receive a quality education besides exploring new cultures and gaining global exposure; however, financing an international education can be a significant challenge for most students.

Common Overseas Education Loan Problems & Solutions

Pursuing higher education abroad is a dream for many students. However, the high costs involved in studying overseas can be a significant challenge. To overcome this obstacle, many students turn to overseas education loans. These loans provide the necessary financial support to fulfil the dream of such students.

How to Save & Invest for Your Child's Education Aboard

Quality education is one of the most important investments in your child's future. It equips them with the knowledge, skills, and opportunities necessary to thrive in today's globalised world.

Important Education Loan: Student Loan Terms You Should Know

Pursuing higher education is a dream for many individuals, but the rising education costs can often be a major hurdle. In such situations, education or student loans come to the rescue by providing the necessary financial support.

Understanding CIBIL Score Requirements for Education Loans

Learn the CIBIL score requirements for education loan and guidelines to secure funding. Ensure loan approval with a good CIBIL score for education loans.

How to Reduce Your Student Loan Debt

If individuals find themselves overwhelmed by the weight of their student loan debt and actively seek effective ways to reduce it, they need not look any further. This informative blog is dedicated to uncovering the secrets that can help them reduce student loan debt and regain financial freedom.

Understanding Personal Loan Part Prepayment and Closure

Personal loans are unsecured loans offered by banks and financial institutions to meet the financial needs of individuals. These loans may be used for buying a vehicle or a home, paying off a debt or funding an emergency; the list goes on. Personal loans are easy to obtain and come with a flexible repayment tenor. Nonetheless, these loans are often extended at high-interest rates and rigid terms and conditions. At times, a borrower may be instances where a borrower may want to close the loan before the due date. There are standard procedures for this, which can vary from one lender to another.

How to Get a Loan to Buy Agricultural Land

Agriculture has been the backbone of India's economy for centuries, and the country's farmers play a crucial role in feeding the nation. If you have a passion for farming and aspire to own agricultural land in India, but lack the necessary funds, there's good news for you. With the availability of agricultural loans, you can now empower your farming dreams and acquire the land you need to turn your vision into reality. In this blog, we will explore the various aspects of agricultural loans in India and how they can support your farming endeavors. Loan to buy agriculture land is one of the best value propositions available for prospect farmers in India.

Guide to Getting Agriculture Loan: Application, Eligibility & Required Documents

Agriculture is the backbone of the Indian economy, contributing significantly to its GDP and employing a large portion of the population. However, farmers often face financial challenges due to factors such as unpredictable weather conditions, high input costs, and limited access to capital. To support farmers and promote agricultural growth, the Indian government and financial institutions offer Agriculture Loan with attractive interest rates, various schemes, and eligibility criteria tailored to the needs of farmers. In this blog, we will explore the details on how to get agriculture loan, the applicable interest rates, schemes guidelines, eligibility requirements, documents required.

Applying for Loan Against Agricultural Land: A Step-by-Step Guide

Obtaining a loan against agricultural land in India can be a valuable financial tool for farmers and landowners looking to meet their financial needs. This type of agricultural loan allows individuals to unlock the potential value of their agricultural land and utilize it for various purposes. In this blog post, we will delve into the process of obtaining a loan against agricultural land in India, outlining the essential steps and factors involved. We are sure that after reading this article, you will get the answer of all your queries like how to get loan against farm land, how much loan can I get on agriculture land, interest rate on loan against agriculture land, how to get loan against agriculture property.

Types of Agriculture Loans and Financing Options

Agriculture is the backbone of India's economy, employing a significant portion of the population and contributing to the nation's overall growth. In order to support farmers and enhance agricultural practices, financial institutions in India offer a range of Agriculture Loans tailored to meet the diverse needs of farmers and agribusinesses. These loans play a crucial role in providing financial assistance, empowering farmers to invest in modern equipment, improve infrastructure, and increase productivity. In this article, we will delve into the different types of agriculture loans and explore their features and benefits.

Does a Co-Applicant's Income Improve Your Chances of Getting a Higher Home Loan Amount?

A Home Loan is considered a once-in-a-lifetime opportunity for many people. That is why it would help to maximise your potential loan amount. The best to go about is to opt for a joint Home Loan. Let's find out what is a joint Home Loan and how you can improve your chances of getting a higher Home Loan amount.

7 Step-guide to applying for a Home Loan

All of us dream of becoming homeowners. It is a way of ensuring lifelong financial security; the kind that does not come from living in a rented home. But buying a home is a complicated process. Whether it is years of savings to be given as down payment or finding the right locality to invest in; the process of buying a home is elaborate. And since property investments take a huge chunk of savings, most of us rely on home loans. Yes, you can take out a home loan and pay it off in easy equated monthly instalments (EMIs) for tenures lasting up-to 30 years. Let’s understand the home loan procedure.

What is a home loan Top-up-edited

It's a new year and a new normal in the lives of most people. Yet Buying a home of one's own continues to be one of the biggest aspirations. However, with skyrocketing prices of real estate, property purchase remains out of the reach of many individuals. For this very reason, homebuyers are now increasingly opting for Home Loans to fund their dream house purchase. Banks and several lenders these days offer housing finance at competitive rates of interest, subject to several terms and conditions.

Understanding Home Loan Prepayment - Rules, Benefits, and Charges

If you are looking to reduce your debt burden, you should consider prepayment of home loan. As soon as your finances improve, you can choose to finish your home loan, either in part or in full. If you repay your home loan completely or in part before the scheduled tenure, it is called prepayment of home loan.

What are the Consequences of Missing A Home Loan EMI?

A home loan can help you finance the purchase of your dream house. These loans are usually of a high value and, therefore, longer in tenure as well. Lenders typically sanction only 75% to 90% of the cost, and you are required to save enough to make

What is The Best Age to go For a Home Loan?

Buying a home is a dream for every individual across the globe. The only problem is affordability. Buying a house needs to fit the budget. One’s dreams need to be realistic to achieve it.

How Much Home Loan Can I Get As A Salaried Employee?

Real estate rates are rising with every passing day. It is no longer feasible for one to purchase a home simply with the help of their savings. You need to approach a bank to take out a home loan . But lenders need to be sure that you have the capacity to repay the loan, before passing your loan. To ensure you have the repayment capacity, they take a few important factors into consideration such as your net monthly income, credit scores, and credit repayment behaviour. If you are a salaried employee thinking how much home loan I can get on my salary, you need to read this article.

Home Loan Principal & Interest Rate Explained

Bank of Baroda offers a wide variety of Home Loans that you can choose from, based on your requirements. The bank offers loans of several lakh to a few crores in various Indian cities and towns. With its streamlined, online process, you can now apply for the loan online through the bank's website. You can even get a pre-approval for the loan, select a property based on your eligibility, and submit your documents online. But before you take a Home Loan , you should familiarise yourself with the various terminologies associated with the loan; two of which are most crucial. We are talking about the Home Loan principal amount and interest rates. Let's understand these in detail.

Your Complete Guide -To The Home Loan Disbursement Process

Now that you have a thriving career, you are done living on rent. You have already picked your dream house. You have also narrowed down on the bank that you want to borrow your home loan from-like for example Bank of Baroda, based on low attractive interest rates, flexible EMI options and speedy processing and simple straightforward documentation. Now before you approach a financial institution, it helps to know how a home loan is disbursed. Here is a simple guide to the home loan disbursement process where we discuss the three stages of home loan disbursement.

What is a Home Loan Processing Fee?

Banks and lending institutions levy a onetime charge on the different types of Home Loan products. This charge, known as the Home Loan processing fee. It is generally not deductible from the loan amount, and the borrower pays it separately. This is a fee to cover the loan processing cost incurred by the lender or the bank. Some banks may waive such processing charges for a Home Loan as part of special offers.

How does an EMI on debit card work?

With the exponential growth and increase in online shopping and the number of products available, the modes of payment for these purchases have also evolved. It is no longer necessary to pay upfront in cash. One very popular option that people use is to convert purchases into installments on their credit card. This system has become one of the preferred ways to buy consumer durables. However, for those people who do not have credit cards or who do not have a high limit on credit cards, there is another option; EMI on a Debit Card.

A Complete Guide to Two Wheeler Loan

A two-wheeler is more than just a mode of transport. It is someone's dream and, often, a necessity. On busy Indian roads, two-wheelers are more practical and efficient as they come with excellent mileage. However, this doesn't make them easier for everyone to afford. In such cases, a bike/two-wheeler loan can be very useful. Here is a complete guide to a two-wheeler loan process, starting with what it is, its benefits, the documents required to apply for it, etc.

How to Calculate EMI for Bike Loan: Tips and Tricks

A two-wheeler is a compact vehicle that gives excellent mileage and allows you to navigate through city traffic easily. It cuts down your travelling time and expenses while you can find parking easily. Whether you wish to buy a geared bike or a scooter, you can do so with two-wheeler loans. Let's understand what is two wheeler loan and learn about the factors affecting Two-Wheeler Vehicle Loan interest rates. Also, find out how to use a Bike Loan EMI calculator before sending your loan application.

Complete Bike Loan Closing Procedure

India is predominantly a two-wheeler marketplace when it comes to vehicles, with bikes being the most popular among them. It is convenient and offers a faster commute to and fro the workplace. However, when it comes to purchasing bikes, most buyers go for two wheeler loans with a tenure of 3 to 5 years. It helps them avoid a huge outflow of cash at once. However, when the bike loan approaches closure, what is the procedure that the borrowers should follow for closing the loan? What if the borrowers decide for foreclosure? Let’s find out!

CIBIL Score for Bike Loan

CIBIL score is one of the critical factors for determining eligibility for a loan. Even if it’s a bike loan, borrowers need to have a minimum CIBIL score to avail of the bike loan. A CIBIL score depicts the borrower's credibility, credit performance and repayment history. It is the basis upon which the lender assesses whether the borrower will be able to repay the loan. But what’s the minimum CIBIL score for a bike loan? Let’s find out!

Bike Loan Documents

Motorcycles, scooters, and mopeds are highly popular in India. In 2022, over 13 million two-wheelers were sold in the country. While it’s relatively easy to buy a two-wheeler with a bike loan, there is a set of documents required for two wheeler loans . These documents prove your eligibility for the loan as per the lender’s guidelines.

Get Instant Two Wheeler Loan Approval

Two-wheelers are an extremely popular mode of commute for a large number of people in India. According to Statista, 8.98 million motorcycles, 4.01 million scooters, and 0.62 million mopeds were sold in India during 2022, with the total sales of two-wheelers for the year standing at 13.61 million. Two-wheelers are also the first vehicle for most people.

Advantages of Bank of Baroda Two-Wheeler Loan

Motorcycles are the primary means of transportation in a vast majority of Indian households. Two wheelers also make it easier to manoeuver India’s busy streets very quickly. Hence, India is among the top 4 largest motorcycles markets across the world. Also, good two wheelers can get fairly expensive, costing above Rs 1 lakh. A two-wheeler loan can help you afford the bike of your dreams with ease. In this regard, the Bank of Baroda two-wheeler loan offers easy funding for your vehicle. Interested to know more? Let’s take a look at the features of the Baroda two-wheeler loan.

How To Get A Bike Loan?

Two-wheelers are necessary nowadays as they are convenient and practical on the road. But one might find it difficult to afford such a necessity out of budget constraints. However, that doesn't quite mean there is no way out. Two-wheeler loans are among the most reliable sources to avail of funds to afford such an efficient mode of transportation. Read on to understand the step-by-step two-wheeler loan process from the Bank of Baroda (BoB).

Tips to Qualify For Availing Loan Against Security

When funds are required, you tend to liquidate assets. Instead, go for a loan against your pledged securities as collateral to look after your immediate financial needs. You can take loans against shares, mutual funds, bonds, debentures and SGB that will fulfil your immediate cash obligations.

The Different Types of Loans Available in India

Loans are essentially capital borrowed from a bank or a financial institution. These institutions charge interest against lending money for a certain definite period. For some, bank loans are a way to meet emergencies while for others, loans act as a catalyst for growth. It all depends upon the purpose and the type of loans that the borrowers have availed. Various types of bank loans are available that a borrower can access. Here are the different types of loans that borrowers can avail of from lending institutions.

A Complete Guide to Car Loan

Buying a car is a dream for all. Looking at cars on road is one thing, but owning the car you desire, is a dream come true. Giving you the freedom to move as you want, a car is a social asset that leverages your position in society. Don't spend your savings on purchasing a car. Waiting till retirement to buy a car from your retirement fund is a bad choice. Why wait that long when you have the benefit of car loans? Buy your dream car while you are still young. Make full use of it with your family and pay it off with feasible loan EMIs. Sounds interesting? So let us understand what is a car loan and all that you need to know about loans in greater detail.

Car Loan Foreclosure & Prepayment Process

While car loans are a great way of purchasing high-end new or used cars, repaying the loan is a responsibility that keeps borrowers on their toes. A good plan of repayment will help lenders systematically manage their EMI without delaying or defaulting. Once you calculate your EMI, based on the types of car loan , new or pre-used, ensure you have a well-researched repayment plan ready. No matter what the size of your loan, a properly researched repayment plan will increase the loan sanction eligibility from banks. Following the EMI repayment tenure that the bank has set, is one way to pay back a major part of the full loan through prepayment or foreclosure, closing the loan can ease a bit of the borrower’s pressure. Banks and financial institutes annually allocate large funding towards loans . Thus, repayment and foreclosure are attached to certain terms and conditions as lenders incur losses through foreclosure or part payment. The loan process rests upon an agreement where the borrower agrees to pay regular EMI to the bank or the lender, so borrowers may have to pay car loan closure charges when they choose these repayment options. Banks offer borrowers the flexibility to pay off the entire or part of the loan balance ahead of the term reducing the interest liability. In this article let us explore these repayment processes that lenders offer to borrowers.

Check Eligibility Criteria To Get A Car Loan

Owning a car is a dream of almost every individual in India. With the ease of securing loans, buying cars, either new or pre-owned, has become an achievable dream. Banks and other financial institutions are loaning sums to many for fulfilling aspirations. Is everyone eligible for car loans? Banks make it possible for everyone to apply for and receive a car loan as long as they fulfil some criteria. Private and popular financial FinTechs are easier on the eligibility criteria for car loans if borrowers are willing to pay high-interest rates. Banks are safe and dependable sources for borrowing funds. They have thus minimised their requirements but continue to hold some as essential for ascertaining the eligibility of the candidate along with reducing their risk percentage while loaning to individuals. Let us talk about eligibility for car loans in greater detail.

Documents for a Successful Car Loan Application

Applying for a car loan is a great way to own a car and repay by manageable EMIs. Loans are a powerful instrument planned by financial institutes like banks, for borrowers who can aspire to a better living by planning and calibrating expenses to achieve better material goals. Loan eligibility comes with certain criteria and documents are needed to qualify a candidate for a loan. The documents are evidence of loan eligibility and a transaction between the borrower and the lender.

Types of Car Loans

At Bank of Baroda, you can get financing of up to 90% of the on-road price of a brand new car of your choice if you opt for Car Loan . Anyone can avail of a Bank of Baroda Car Loan, subject to their eligibility. These are available for a maximum loan tenure of 7 years, and the loan amount can be as much as Rs 1 crore. The bank gives a 0.25% concession on the interest rate to its existing home loan customers with a clean credit history. What's more, Concession of 0.50% in rate of interest on Car Loans to those applicant/s who offer minimum 50% of Loan limit as liquid collateral security e.g. Fixed Deposit of our Bank, NSC, KVP or LIC Policy.

What Is The Ideal Tenure For Car Loan?

The desire for owning a car is gradually growing in India, according to TechSci Research (https://bit.ly/3OT1o5A). The Indian car loan market is poised for a “compounded annual growth rate (CAGR) of over 8 per cent in value terms and will reach USD60 billion by FY2026." A shift from combustion engine vehicles to electric vehicles seems to be the trend.

Features and Benefits of Car Loan

The greatest advantage of a car loan is the ease with which you can possess a car with a bit of planning. A loan allows you to improve your lifestyle if you create an advanced strategy to tackle expenses while meeting other investments that you are already committed to. Owning a car not just improves your social status, but also acts as a huge advantage offering freedom to travel where and when you want at your ease. Apart from these advantages, a loan comes with many other features and benefits. We will help you understand all the features and benefits of a car loan.

Car Loan Process in India - A Complete Guide

That expensive car you have your eyes on is now a possibility more than ever. You can get a loan from banks and other financial institutions to fund it. Not long ago, having a home of your own or a family car used to be considered luxurious most people found themselves unable to afford. But with the variety of loan products on offer these days, one does not have to have unfulfilled dreams anymore.

Documents required for home loan

When you apply for a Home Loan, a bank needs proof to verify your identity and assess your creditworthiness before sanctioning. It does that by requesting you to provide several documents. As such, you should ensure you provide all the documents required for Housing Loan as mentioned on the loan application form.

Home Loan Process

Owning a home gives you a sense of financial security. You can easily become a homeowner, thanks to a Home Loan. To make this type of loan more accessible to anyone in need, Bank of Baroda has made the home loan application process even more convenient. Now, you do not need to visit the bank several times to get your loan approved. Indeed, you can get approval for your home loan from the comfort of your home. Yes, Bank of Baroda has streamlined the Home Loan process. You can start the loan application process online.

Here are the steps you need to follow:

Different Types of Loans for Your Home

With property rates rising with each passing year, it is almost impossible to buy one from your savings. Thankfully, you do not need to worry about exhausting all your savings to become a property owner. You can get the necessary funds with the help of a Home Loan. You can also get a loan for construction or land purchase. Each type of loan is designed to help fulfil a specific objective. You can choose the type of Home Loan that best serves your needs. Let us take a look at the different kinds of Home Loans provided by banks in India.

A Complete Guide to Home Loan

For those looking to own a home, banks and other financial institutions offer loans for that purpose at competitive interest rates. So if you already have that dream house in sight, the next step isn't too hard.

Step by Step Guide on How to Calculate Home Loan EMI

Those who do not have a home to call their own, dream of buying a home. Those who own a home, dream of getting a bigger one. While those who own more than one home in one city, dream of owning homes in other cities too. Then there are dreams of country houses, duplex apartments and villas, the list is endless. But for a first-time homeowner, purchasing a home is fraught with doubts and uncertainties. Home loans are the most feasible option, but not everyone knows how to calculate home loan EMI. The challenges of long-time loan burden discourage many. In today’s age, home loans are a blessing for those who are seriously planning to purchase a home. All you need is willingness, preparation for taking a loan and planning out a way with information and knowledge on managing the monthly instalments while keeping yourself safe from pitfalls. A home is a necessity and with help from home loans, as Marissa Mayer says, even if you can’t have everything you want, you can have the things that matter to you.

CIBIL Score for Home Loan - Impact of Credit Score on Home Loan

Are you looking for information on CIBIL score for home loans? Have you been wondering what is the minimum CIBIL score for home loans and how you can bring your credit score within that range? If so, then you’ve landed on the right page! Continue reading the article to know all there is about CIBIL score for housing loan application.

Established in 2000, the Credit Information Bureau Limited (CIBIL) is a credit information company that maintains records of individuals and organisations. A lending agency/company/bank gives out loans on the basis of the CIBIL score generated.

What is the relevance of CIBIL Score for home loan?

The CIBIL score is basically a three-digit number that ranges between 300 and 900. The higher the score, the greater are your chances of getting a home loan easily. Lenders mandatorily check your credit score to know your creditworthiness when you apply for a home loan.

Here is a quick look at how the CIBIL score impacts your home loan application:

● The CIBIL score is essentially the first impression that your lender gets of you as a borrower

● Borrowers applying for home loans with low CIBIL scores might face a harder time in getting their applications approved

● Having a good or high CIBIL score allows you to get the better interest rate

Can a good CIBIL score help you get a home loan at a lower EMI?

Having a good CIBIL score when you apply for a home loan not only makes you eligible to get one but also helps you get funding at a lower interest rate. Lower EMIs will help bring down the overall cost of your housing loan. As we all know, a home loan is long term debt that runs into decades. So, even a small reduction in interest can see you potentially save lakhs of rupees.

Thus, having a higher CIBIL score can prove to be immensely helpful for a housing loan.

What is considered to be a good CIBIL score for home loan applicants?

Generally higher CIBIL score is considered good. It increases chances of getting easy approvals and better rates of interest. Bank of Baroda requires a minimum credit score of 701 for a customer to be eligible for a home loan.

Want to know how to increase your home loan eligibility?

Here are a few tips that can enhance your chances of getting a home loan:

● Paying off existing loans:

This is the major tip which will help you increase your chances of getting your home loan sanctioned. Ensure that you are paying your existing EMIs on time regularly and there is no default. If you have a habit of using your credit card, make sure you pay off your entire card debt on a regular basis so that you don’t have to pay any interest on those expenses. In short, pay the whole balance and not just the minimum due.

● Record your variable pay:

Another way to increase your eligibility is by giving the bank proof of your variable pay apart from submitting your income documents.

● Opt for a joint home loan:

You can add your close relatives as co-applicant, while reviewing an application for a joint home loan, the lender considers the income of both the parties. Hence, a combined monthly income will appear higher and increase your chances of getting the loan value you need.

Quick tip: You can use an online tool called the Home Loan EMI Calculator to understand what your monthly payments will look like for a certain loan amount. Knowing what kind of EMIs you can expect will help you plan your finances better. This will save you from defaulting on your payments and help you keep your credit score in good standing throughout the tenure of your home loan.

Steps to check your CIBIL score online

These days, we have become accustomed to the new normal of doing as many things as possible online, from transferring money to someone to applying for cards and opening bank accounts too. In the same way you also check your CIBIL score digitally!

Simply follow these quick steps to easily check your credit score online:

Step 1 - Go to the official CIBIL website, log in and select “Know Your Score”

Step 2 - Fill up the digital form that appears and enter relevant details such as your name, date of birth, past loan history, ID proof etc.

Step 3 - After the form has been properly filled, a payment page will appear. You can choose your preferred form of payment method like debit/credit cards or net banking.

Step 4 - After successful payment you will have to answer five questions CIBIL asks about your credit history, out of which three need to be correct, in order to get your identity authenticated from CIBIL.

On approval, you will get your credit report mailed to you in the next 24 hours, and you can check your CIBIL score, also existing BOB customer can check their CIBIL score through bob World mobile banking app.

Conclusion

Now you can be the proud owner of your very own dream home with the easy home loan options given by Bank of Baroda. Our home loans have low interest rates, affordable processing fees, and longer tenures too. At Bank of Baroda, you can also enjoy many other benefits such as a free credit card when you apply for a home loan. Choose from our wide range of home loans including pre-approved home loan, home improvement loan, and loan takeover scheme, among others. You can check your home loan eligibility online on our website and even apply for your home loan online too. It’s that convenient!

Get in touch with us today to know more.

Home Loan Eligibility - Guide for Beginners

Buying a house in today's real estate market may seem expensive, but it is not impossible. With Bank of Baroda's Home Loans, you can buy a ready-to-move-in home, an under-construction home or a plot of land and construct house within 36 months. You can even construct a house on any piece of land you own. The bank also provides the necessary finance to renovate your existing property. However, your loan is sanctioned only if you fit the bank's Home Loan eligibility criteria. Let's understand what is Home Loan eligibility, and the various criteria considered by the bank.

Fixed Vs Floating Home Loan Interest Rate - Which is Better

A person living in a rented apartment dreams of buying a home. However, buying a home or even preparing to buy one, is a story by itself. Eclipsing all the other concerns like the locality, amenities, and connectivity is finance. Potential homeowners search for lenders who can loan them the principal sum to build a house. While banks and other financial institutes are more than willing to disburse the loan, varying interest rates are a cause for concern. Home loans come at either floating interest rates or fixed interest rates. The decision to choose one over the other is vital for a borrower as that affects the EMI repayment rate plan. Floating interest rates, as the name suggests means that the rate of interest paid by the borrower is directly related to the current financial environment. If the bank interest rate falls, then the interest rate of the EMI too will fall and if the interest rate goes up the EMI rate too will move up. The term fixed rate is somewhat perplexing. The term gives assurance of a fixed value, but do not ignore the fine print where it may state that the loan provider can raise the interest rate at any time due to certain developments. These can be called fixed-floating rate home loans where the rate of interest may increase under some conditions but not to the extent of floating loans. Despite all the smart and clever terminologies, there is a fixed rate home loan but to be sure that you do not get trapped in any nuanced clauses it is best to have the document perused by legal experts before opting for this loan. Floating loans are offered at comfortable interest rates by lenders over fixed home loans. Let us take you through fixed vs floating interest rates in greater detail.

Home Loan Tenure

Home loans are a blessing for every home buyer. With the ease of repayment, a home loan fulfils the home buyer’s commitment to own a house. Even if you have an average income, you can dream of owning a home with the maximum tenure for a home loan, the duration at which the borrower repays the full loan amount, the principal sum and the accrued interest. Some might find the idea of loan and repayment discouraging, considering it to be a lifelong burden, but with a bit of planning the gains are much higher and you can repay home loans faster than you had planned. In a few years, you can see your world coming to shape little by little. As Earl Nightingale rightly remarked, all you need is the plan, the road map, and the courage to press on to your destination, if all three are in place, dreams happen. Home loans allow you to invest in a property with certain minimum margin. You are given the option to easily return the loan amount within a specific period. You can discuss the repayment tenure with your lender and choose the maximum tenure for a home loan or minimum tenure for a home loan, subject to your capability. Both repayment tenures have their advantages and disadvantages. We will help you understand how each stand against the other and when and why should borrowers choose the respective tenure options.

Key Benefits of Taking a Home Loan - A Complete A-Z Guide

A home is anyone’s dream. A small apartment is a dream utility a villa is a dream luxury. The best way to accomplish a dream home is through a home loan. You might fight shy of loans, but for building a home, falling back on savings is a bad idea. Not only is it time-consuming but it will deplete a chunk of your savings. A home loan is packed with benefits that not just help you to return debt on your asset but also help in making savings from taxes. While we discuss the home loan benefits, we will also offer an objective overview of the flip sides of the loan and how you can overcome them to sail through your loan period easily. A homeowner can also take the options of home renovation loans, especially during the festive season. While we discuss in-depth the benefits of a first-time home buyer loan, we will apprise you of all the related benefits of home loans. Let’s start with the most significant benefits of home loans in income tax.

All You Need to Know About Sovereign Gold Bonds

That Indians love investing in gold, is no hidden secret. We buy gold on big and small occasions. Gold is considered an excellent investment in India, irrespective of the form in which it is purchased. However, when you buy gold jewellery, you end up paying a lot more in making charges. How, then, can you get the benefits of gold loan in the long term? Well, you can invest in sovereign gold bonds. Let’s find out what is a sovereign gold bond and other essential facts about it.

How Does Gold Loan Affect Your CIBIL Score?

Gold is one of the most common options for secured loans among Indians. With a gold loan, you can borrow money at a reasonable interest rate in exchange for the gold you provide.

Repayment of Gold Loan: Everything You Need to Know

Gold loans have always been one of the popular ways to borrow funds due to ease in the process, less documentation, rapid availability of funding, and a variety of repayment options. Between personal loan and gold loan, a personal loan takes days or even weeks to avail, whereas a gold loan can be approved within hours as borrowers keep a sufficient quantity of gold as collateral against the loan amount. Moreover, gold loans' interest rate is lower than personal loans. Owning physical gold can act as an investment or a backup during an unexpected financial crisis. Banks and financial institutions offer different gold loan repayment methods. From regular EMIs to bullet repayments, borrowers can repay gold loans as per their suitability and financial situation. Below is detailed information regarding various aspects of gold loan repayment, including process, period, and best ways to repay.

What Are the Gold Loan Eligibility Criteria?

Data revealed by the World Gold Council showed that Indian gold consumption increased by 78% in 2021 to 797.3 tonnes. In India, gold’s financial value is accompanied by a deep sentimental connection as Indians purchase gold on numerous auspicious occasions.

A Complete Guide to Gold Loans in India

For generations, people have exchanged gold for cash. In addition to being an auspicious asset, gold is significant as a source of financial stability. But what are gold loans? Gold loans are secured loans where your gold items are pledged as collateral to obtain cash for your necessities and emergencies. Gold loans are more affordable than credit cards or personal loans, especially for those seeking short term finance. But before agreeing to a financial arrangement, full awareness is required.

Gold Loan vs Personal Loan - Which is Better & Why?

Financial contingencies generally come unannounced. Often, the only way to tide over such contingencies is by taking a loan. Whether you need to fund your sister’s marriage, or pay for a medical emergency, a loan can prove to be a lifesaver. While many types of loans are available in the market to meet your needs, personal loans and gold loans are two of the most popular ones.

A Step-by-Step Guide to Apply For an Education Loan

We have all heard the age old saying that the path to a great career and successful life is paved through a quality education. Holding a higher education degree opens up many career avenues and helps you secure your financial future. But with the ever-rising cost of college and university fees, students and parents have no choice but to take on an education loan to fund higher studies. Education loans cover a host of expenses related to higher education such as the tuition and examination fees, hostel fees (if applicable) cost of books and apparatus, conveyance charges and so on.

Benefits of Education Loan To Raise Funds

As the cost of education continues to sky-rocket, students have little choice but to take out an education loan. Thankfully, the government offers some respite on education loans in the form of education loan tax benefits. Here’s all you need to know about education loan tax benefits under Section 80E of the Income Tax Act:

Documents Required for Education Loan

Every national and international bank offers education loan to students at low-interest rates to help them to pay for their higher education costs. It is a kind of advance financial aid given to students to study in institutes in India and abroad. Banks offer educational loans with flexible terms and conditions to qualified applicants. Furthermore, the documentation process is maintained and the submission of documents required for education loan is one of the important steps involved in availing of an education loan.

What are the Different Types of Education Loan?

There is no doubt that education is of prime importance not only in India but globally as well. It is one of the sole factors that help us become literate, well-mannered and responsible individuals personally, socially, and professionally. Though a basic education is generally accessible, people prefer quality education to elevate their educational qualifications to get high-paying jobs.

A Complete Guide on Education Loan

An Education Loan is a loan borrowed for funding higher education and higher-education related expenses. These loans cover the cost of tuition, books accommodation and other expense required to complete the course.

6 Best Tips to Repay Your Student Loan Early

An education loan is truly a boon for students who want to pursue higher studies but cannot afford to do so on their own. Many people end up selling family assets - such as gold – in order to pursue their higher studies. With the help of an education loan, you can protect these valuable assets and still not miss out on studying further.

Benefits of Personal Loan To Raise Funds

There are times in everyone’s life when there is a sudden need for money. The immediate choice is generally to use a credit card or to borrow money from friends or family members.

With net-banking now in place and more lenders chasing fewer borrowers, raising money through other sources is now possible at a faster pace.

Gold loans are normally a preferred and cheaper source of the loan, where banks and gold loan companies process the papers fast to give the borrowers the money he or she needs. However, personal loan are now being offered at a faster speed too. There are lenders who advertise that they will disburse the loan within a day.

Under such circumstances, it is always better to go in for a personal loan rather than using your credit card to meet any emergency need. Firstly, because the personal loan is far cheaper than any credit card loan and secondly because the personal loan can be of a bigger size than what the credit card can offer.

But before one takes a personal loan it is important to have a good CIBIL score. With a CIBIL score of over 750, a person can be choosey in picking up the personal loan with the lowest interest rates. A person with a lower score may still get a personal loan but the interest rates may be higher.

The biggest advantage of a personal loan from the point of view of the borrower is that it is an unsecured loan. The borrower need not pledge or mortgage any of his assets to raise funds.

For an entrepreneur, a personal loan can act as a stop-gap arrangement till he is able to raise money from other sources to meet his urgent business requirements.

Like any loans, personal loans need to be repaid periodically in equated monthly installments (EMI). These loans can run from a short tenure of one year to a four-years loan. These days there are lenders who offer personal loans for a period of seven years also.

While taking a personal loan is easy, it should be taken only in case of emergency. Personal loans, being unsecured are costly. It would be foolish to buy an asset with a personal loan, especially when there are financial products available these days to buy a mobile or any other household equipment.

One should avoid using personal loans to repay loans that are cheaper in cost. But they can be used to repay higher cost loans like credit card bills or something similar.

If one is using personal loan to meet the operating expenses of the house then he or she is falling in a debt trap. One loan will lead to another and before the person understands it, he would have fallen in a debt trap. Rather than using the personal loan as a saviour to come out of the debt trap the person would have fallen in it using personal loans. Personal loans should be used only for intermittent emergencies.

CIBIL Score for A Personal Loan

Do these lines look familiar to you? You must have come across such messages while inquiring or applying for a personal loan. Well, CIBIL score or credit score is one of the common types of checks in the basic Know Your Customer (KYC) documentation process for personal loan approval.

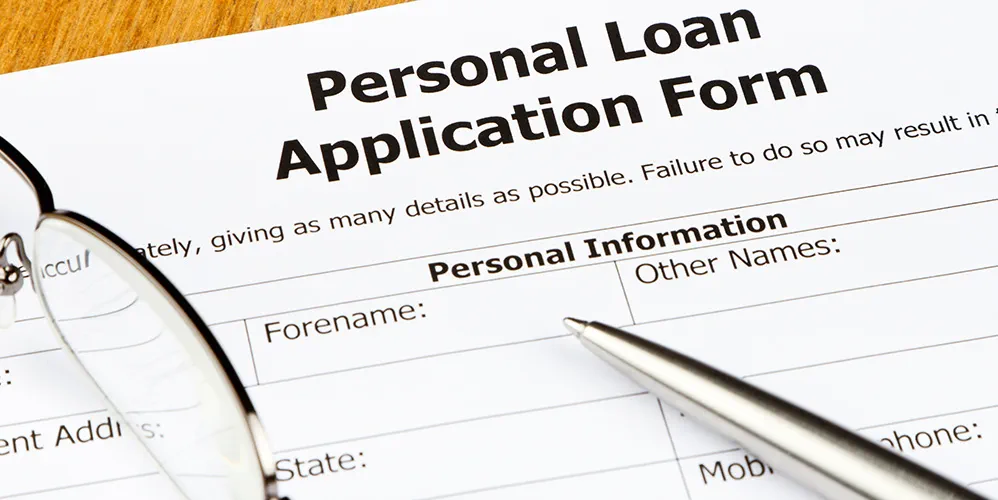

Documents Required for Personal Loan

A personal loan is a friend in need when it comes to emergency cash requirements as it helps you meet your immediate financial needs. All sorts of government and private banks in India give personal loan facilities if you have correct documents ready.

How to Apply for Instant Personal Loan

Making small savings is a sheer way to beat the blues of cash shortage. As the adage goes, a penny saved is a penny earned. However, the saved amount is largely dependent on your income and your ability to keep away from your saving. When unexpected financial troubles loom, instant cash is not always handy, in the words of Martyn Kenny, an instant personal loan will assist you in such conditions. They are an excellent financial deal that is specially planned to assist the borrowers at the time of sudden monetary emergency. To make things simpler, a quick personal loan online is readily available with verification, approval and disbursement managed online. This blog discusses in greater detail how to get an instant personal loan from any bank or financial institution.

Personal Loan Processing fee and Charges

Loans are backbones that offer a financial equilibrium. As India prepares to enter the festival season, it's time to amp your finances. Spendings are on an upward spiral from September to December for almost all families across the nation. Indian festivals are elaborate and expensive, but if you have your financial goals sorted, getting a loan should not be a problem. While saving for the festival every month is a great idea, it may not be sufficient. So some manage their festival season’s financial overheads with loans quite effectively. Learn more about the nuances of personal loan processing fees and personal loan process steps (PLPS). This complete insight will make loan procurement a more informed exercise.

Types of Personal Loans in India

Loans fulfil quick cash requirements and are thus anyone’s best financial friend in times of need. With skyrocketing prices and limited income, it's hard to save from your earnings or make short-term financial investments. So, where do you find funds when you need them immediately? Several types of personal loans are first partner of choice for emergencies and money management mantras for smart spenders. Taking loans are not a bad habit if you can repay timely in disciplined manner.

A Complete Guide to Personal Loan

A personal loan does not require the borrower to provide collateral and so it is an unsecured loan. The purpose or intention of a personal loan is to fund immediate financial contingencies. It could be for business capital, marriage, medical expenses or even foreign trips, though the end use of the capital really depends on the borrower, as long as it is for a legitimate financial need.

Eligibility for a personal loan?

Since these loans are unsecured- at what rate of interest you will get the loan and how much, whether or not you will get the loan-depend on the credit quality of the borrower. If you have good creditworthiness, you are likely to get the loan at an attractive rate of interest. If you have been a long time customer with the bank, with sound track record of financial discipline, you may also get a pre-approved personal loan sanction.

Bank of Baroda lists the following types of employees/self-employed individuals who are eligible for personal loans.

Employees of Central / State Govt. / Autonomous Bodies/ Public / Joint Sector Undertakings, Public Limited Co. / MNCs & Educational Institutions – with minimum continuous service for 1 year

Employees of Proprietorship, Partnership firms, Private Limited companies, Trust - with minimum continuous service for 1 year

Insurance Agents- doing business for minimum last -2- years

Self Employed Professionals (Doctor, Engineer, Architect, Interior Designers, Tech. and Management Consultants, Practicing Company secretaries etc) -- with minimum 1 year stable business.

Self Employed Business persons - with minimum 1 year stable business.

Some of the benefits of a personal loan are

Urgent financial requirement

If there is an immediate need for money, personal loans are the best option. They are considered better than credit cards or loans from family members or unorganized lenders, since the rate of interest is reasonable and the lender is a credible organization. Credit cards come with strict credit limits, which is not the case with personal loans. Funds taken from the bank as personal loan also resolve the issue of certain vendors not accepting payment through credit cards.

Breathing time for repayment

Also, the credit card bills need to be paid off by the due date which generally falls in the next month whereas you get some breather in repaying a personal loan EMI over a period of time, generally ranging from 3-4 years.

Flexibility of use

Funds from a personal loan are flexible in the way you use them. They can be used for several purposes- home renovation, travel, wedding and medical expenses or for any other purpose as per one’s personal obligations..

Loan amount

The loan amount you can borrow under a personal loan is also significant. For example, with Bank of Baroda offer personal loan amounts based on the eligibility of applicants

Confidential

Personal loans may also be private loans since these loans are often used to meet cash requirements or personal contingencies and thus kept private to a great extent.

Flexible repayment structure

These loans are generally of the nature of short to medium term loans and come with a flexible repayment structure.

Easy to get

For example, Bank of Baroda is popular for personal loans that are quick to get, fast processing, minimal documentation required and offered at attractive rate of interests. Most salaried persons, self-employed and professionals can apply for these personal loans.

Smart Ways to Calculate EMI on Personal Loan

A personal loan does not require the borrower to provide collateral and so it is an unsecured loan. Since these are unsecured loans, the rate of interest on these loans are believed to be quite higher than all other types of loans. The purpose or intention of a personal loan is to fund immediate financial contingencies. It could either be for business capital, marriage, education or even foreign trips, though the end use of the loan really depends on the borrower, as long as it is for a legitimate financial need.

Before you apply for a Personal Loan, you may want to get down to the basics, to shop for the best offers on personal loans in the market. Among the most popular ones is the Bank of Baroda’s Personal loan product which apart from having the pedigree of belonging to one of the oldest and largest Indian banks, comes replete with some amazing features like flexible repayment options, affordable EMIs (Equated Monthly Instalments) that sit easy on your pocket and sizable loan amount among others in the category of personal loans.

Calculating the EMI on personal loans

The EMI calculations mainly rely on three variables- the loan term or the tenure of the loan, the loan value and the rate of interest. The rate of interest is one of the aspects that comes determined by the bank.

Calculating using the PMT formula

This is a longer, tedious and round about approach to calculating the EMI on your personal loan. Here, you can run the PMT formula on Microsoft Excel to calculate the EMI, where

PMT is your EMI,

NPER or number of periods is the total number of payments for the loan

PV is the loan value or the principal

Rate is the rate of interest/12

The formula is

PMT (Rate, NPER, pv).

You can keep trying the formula for various combinations and then choose the one with the lowest EMI, though this is a roundabout approach that could be prone to human error.

Online EMI Calculator

Or a far easier option to calculate the affordable EMI, is using, for example, Bank of Baroda’s online personal loan EMI calculator.

Here, you will find a slider on the range of each of the three basic variables on your screen- the loan amount you are likely to need, the tenure or the repayment period of the loan that suits your finances and the rate of interest.

Now, the rate of interest is what you get from the bank, while the other two aspects, i.e., the loan amount and the tenure of the loan are the ones you can play around with here.

When you place the cursor on a particular value of the loan term, rate of interest and loan amount, the calculator throws up a monthly payment value, which is your EMI. You can move the cursor horizontally along the range provided to pick the various values.

Here’s why using a Bank of Baroda personal loan EMI calculator works.

If EMI is too high

You can pick a longer loan term or

You can make the loan amount smaller.

If you find the EMI is affordable or even lower than ideal then you can plan to repay faster by either

Taking a larger loan value or

A shorter loan term.

Step by Step Guide to Check Your Personal Loan Eligibility

If you want access to immediate cash without providing collateral, a Personal Loan can prove to be an incredible option. With a Personal Loan, you can fund any expense, be it medical emergencies, a dream wedding, long-awaited vacations or home improvement projects. This article explains the eligibility criteria for a Personal Loan, how you can use a Personal Loan Eligibility Calculator and the measures you can take to improve your loan eligibility. Read on.

Loan Against Shares - What You Need To Know

Are you in need of urgent funds? Have you invested a significant sum of money in the stock market? Did you know you can get a loan by pledging your shares? Yes, you can take out A Loan against Shares, a type of secured loan where your shares act as collateral. Lenders typically offer a high loan amount, levy competitive interest rates, and provide flexible repayment tenures. Plus, you only have to pay interest on the loan amount you use and not the entire principal loan amount. Read on to know more about what shares are, how to get a Loan Against Shares, the importance of a DEMAT account and how you can open an online DEMAT account.

Benefits of Reverse Mortgage Loans for Senior Citizens

Mrs Patel is a 65-year-old retiree. She lives in a self-owned flat while her son resides overseas. Mrs Patel is unable to keep up with the rising costs with her savings alone. She seeks financial advice from her relationship manager, who informs her about Reverse Mortgage Loans, where she can make money using her self-owned property. Let's understand what a Reverse Mortgage Loan (RML) is and how it works.

Key Features & Benefits of a Gold Loan

When you require funds urgently, you can consider using your gold as collateral to obtain the funds your need. Gold Loans are secured loans offered by most banks and non-banking financial companies (NBFC). The lender assesses the current market value of the gold and determines the loan amount. Such a loan helps you get access to cash instantly. Let us analyse the various features and benefits of Gold Loans, the loan application process, and more. Read on.

How to Calculate EMI for Bike Loan: Tips and Tricks

A two-wheeler is a compact vehicle that gives excellent mileage and allows you to navigate through city traffic easily. It cuts down your travelling time and expenses while you can find parking easily. Whether you wish to buy a geared bike or a scooter, you can do so with two-wheeler loans. Let's understand what they are and learn about the factors affecting Two-Wheeler Vehicle Loan interest rates. Also, find out how to use a Bike Loan EMI calculator before sending your loan application.

What is Vehicle Loan and its Different Types

Buying a vehicle is a dream for many. Owning a car or a bike gives you the freedom to commute at your own time and pace. However, with every passing year, the prices of vehicles are increasing. Thanks to the growing lending sector in India, you can easily apply for a Vehicle Loan to fulfil your dream of owning a vehicle. Read on to understand what a Vehicle Loan is and its various types and features.

What is a Fintech Loan and How Does it Work?

Fintechs are playing a pivotal role in revolutionizing credit ecosystem by creating alternative lending channels that offer significant advantages to both Bank and borrowers. Fintechs creates seamless customer on-boarding and credit disbursement processes with tech-enabled, mobile-friendly platforms that can replace physical interactions with remote loan applications.

What is Mudra Loan? - A Complete Guide

In its bid to make an ‘Atmanirbhar Bharat’, Government of India has introduced several schemes and campaigns. The Make in India campaign is one of the most popular ones, aimed at promoting the growth of homegrown companies. Thus was born the Pradhan Mantri MUDRA Yojana. Launched in 2015, this scheme has proven to be extremely successful. Over the past 6 years since its establishment, the PMMY scheme has offered INR 15.52 Lakh Crore to over 29.55 crore loan applicants. The scheme provides a level playing field to all sections of society. Here, we talk about the MUDRA Loan scheme and its features.

Benefits of A Joint Home Loan

A home is a special place where we go to feel safe and comfortable. It is also the place where we spend some of the best moments of our lives with our loved ones. Almost everyone wants to be able to buy their own home at some point. However, sometimes prices of property make that dream a difficult one indeed. Fortunately, home loans step in to save the day. A home loan helps you easily afford to buy the house or apartment you want. You can even apply for a joint home loan in order to improve your eligibility for home financing.

Know How to Avoid Hidden Charges in Personal Loan

When you find yourself in a financial emergency, a Personal Loan can be a boon. You can use funds from the loan to pay for all kinds of emergencies and planned expenses. But, like every other loan, Personal Loans come with certain unavoidable costs like interest rates, processing fees, GST, etc. While lenders inform you about these costs upfront, they mention other additional charges in fine print under the terms and conditions section of the loan agreement. Here’s a breakdown of all possible Personal Loan charges you must know.

Complete Guide On Pre-Approved Personal Loans

If you need money urgently, you may consider taking out a collateral-free and unsecured Personal Loan. You can choose the Personal Loan amount and wait for the lender to confirm the eligibility, while the final approval process may take time. However, sometimes lenders notify you that you are eligible for a Personal Loan, even if you don’t apply for one. Such loans are known as Pre-approved Personal Loans. Read on to learn more about these loans.

Home Improvement Loan - Everything You Need to Know

As per an old adage, ‘a person’s house tells you a lot about them’. Your home mirrors your taste and your lifestyle. It tells your guests how you lead your life. But like anything you own, your house, too, goes through some wear and tear every few years. Now, it may not be possible to sell off your home just because it has suffered some minor damages. But you can always renovate or remodel it and give it a facelift. One way to do so is through Bank of Baroda’s Home Improvement Loans. The below article explains the various benefits of taking a Home Loan to spruce up your house. Read on.

When And How To Refinance A Personal Loan

Loan refinance is a great way to pay off existing debt at a lower and more favourable interest rate. Now, did you know that you can refinance a personal loan? When we think of refinancing, we often think of heavier debt, such as a home loan or an education loan. However, personal loans too can be refinanced if you are looking for better terms of repayment. Read on to understand a bit more about how to refinance a personal loan.

JanSamarth Portal by PM - A Complete Guide

Over the years, the Government of India has rolled out numerous welfare schemes. For instance, there is the Central Sector Interest Subsidy Scheme by the Ministry of Education or the MUDRA Loan scheme under the Department of Financial Service. Users can access these schemes on the respective Ministry's websites. However, tracking applications on various websites can be cumbersome. Keeping this in mind, the government has unveiled the JanSamarth portal, enabling applicants to avail of up to 13 credit-linked government schemes under one roof. Read on to know more about the schemes, its objectives, the registration process and more.

What is a Home Loan Balance Transfer & How does it work?

Having a home of your own is a huge life milestone and achievement for most people. Since purchasing a home is an expensive affair that requires financial planning, you can rely on financial aid in the form of home loans. However, often when you opt for a home loan offered by a bank or financial institution, you might find yourself unhappy with the terms attached. Rather than stick it out with terms that are not favourable to your situation, you can later choose to opt for a home loan balance transfer. Let’s look at the benefits of home loan balance transfer and show you how the process works.

How Does Home Loan Verification Process Works in India?

A home loan provides easy and affordable financing for you to purchase or construct the home of your dreams. The good news is that home loan interest rates are currently at an all-time low. Thus, if you are planning to apply for a home loan, now might be the right time to do so. However, do remember that your application process does not end after you submit the documents required for home loan financing. The lender must also verify your loan request before sanctioning the requested amount. To help you gain a better understanding, here is everything you need to know about the home loan verification process.

Personal Loan Vs Car Loan - Which Is Better?

Owing a car is a dream for many. A vehicle offers you the convivence of travelling when you want to and saves you from the rush of local commute. Having your own car also helps in times of emergency. With the outbreak of novel coronavirus, using local commute or public transportation can be daunting. Your own vehicle ensures your safety in such trying times.

Why should you choose a Floating rate Home Loan?

Taking a home loan is one of the most common ways to finance the purchase of your dream home. The home loan provider can either charge you a floating or fixed rate of interest on your debt. While a fixed interest rate can help you get a sense of security, a floating interest rate can potentially help you generate savings. For this reason and a few more, many people prefer to procure a floating rate home loan.

Know Why Your Home Loan Application May Get Rejected?

Home loans are usually of a high value and have a tenure of around 20 to 30 years. Thus, lenders follow a well-defined and stringent process to approve and sanction such loans. This ensures that the lenders do not build any NPAs (Non-Performing Assets). Consequently, procuring a home loan is a rigorous process, and if your application gets rejected, you have to start this process all over again. Hence, it can be pretty disheartening to have your home loan application rejected.

Get Education Loan for Studying MBA in Abroad

Higher education helps extra edge to boost your career. It offers you an opportunity to explore your chosen field in great depth and helps you mould yourself into a knowledgeable professional. One of the most popular postgraduate degrees that students opt for these days is an MBA (Master of Business Administration).

Why You Should Prepay Your Student Loan? Know the Benefits

When taking an education loan, you need to carefully plan loan repayment even before your EMIs are due. This way, you can save yourself from falling into a financial crisis in the first few years of your career. Now, you may wonder - should I pay off my student loans before the tenure of the loan is complete?

Government Subsidy on Electric Vehicle Purchases in India 2022: Here's How to Save Lakhs

A cleaner and greener planet is the need of the hour. While changing the environment in a day’s time is implausible, we can certainly take small steps that will show results over time. One such measure is shifting to fossil-fuel-free Electric Vehicles (EV). Did you know that India had electric vehicles back in the late 1990s? However, due to insufficient technology, these vehicles saw a rapid decline. However, with today’s advanced technology and alternative commuting options, now is the best time to adopt greener modes of transportation. Moreover, the Government of India offers subsidies on electric vehicles, leading to savings in Lakhs. Here’s what you need to know about the Electric Vehicle Subsidy in India.

Know How to Check Your CIBIL Score for Car Loan?

The Credit Information Bureau (India) Limited (CIBIL), now TransUnion CIBIL, is one of the 4 credit information companies. It is licensed by the Reserve Bank of India to collect and maintain the credit information of borrowers. Banks pass on your debt information to TransUnion CIBIL, which then collates the data to form an indicator to measure your credit, i.e., the CIBIL score.

Advantages of Bank of Baroda Two-Wheeler Loan

Motorcycles are the primary means of transportation in a vast majority of Indian households. Two wheelers also make it easier to manoeuver India’s busy streets very quickly. Hence, India is among the top 4 largest motorcycles markets across the world

Types of Mortgage Loans: Which Is Best for You

Emergencies are unpredictable, especially financial ones. Sometimes these expenses can be too high to seek financial aid from friends and family. In such times, you can make your idle assets work for you. If you own assets like properties, you can get a loan against them. You can mortgage them as collateral with your lender and avail loan. Read on to understand what a mortgage loan is and the various types of Mortgage Loans.

Getting A Car Loan Soon? Make Sure To Avoid These 7 Mistakes!

These days, cars have become more of a necessity for us than a luxury. As a result, there are about 1.4 billion cars on the road in the world today! A car is more than just a means of transport for many.

What Is Loan Against Securities – A Complete Guide

When you need cash, especially a lump sum amount urgently, a loan is one of the best facilities at your disposal. The loan allows you to attend to your expenses, while you can return the funds borrowed from the bank in pocket-friendly instalments over a stipulated tenure. Today, you can mortgage more than your home or any property you may have to procure a loan; you can take out a loan against securities. Let us attempt to understand the meaning, features, benefits and application process for a LAS loan.

What's the Difference Between a Gold Loan and a Loan Against Property?

Loans are one of the best ways to access funds in an emergency or to pursue your goals. There are broadly two types of loans that you can procure - a secured loan and an unsecured loan. If you offer collateral to the lender in exchange for the loan, you

are said to have taken a secured loan. Many people prefer to take a secured loan as it helps them receive funds on suitable loan terms and conditions such as lower interest rates and higher loan amounts. When offering a secured loan, lenders usually

accept gold, securities, property, and other similar assets as collateral. Out of all these types, a loan against gold and a loan against property are the two most common types of secured loans.

7 Amazing Benefits Of Taking A Gold Loan

Almost no auspicious occasion or family function is complete without gold jewellery. In fact, gold is also one of the most precious gifts to pass on to your descendants. But the value of gold doesn’t simply end there; did you know that you can also get a loan against gold jewellery/Ornaments? In fact,

6 Benefits of A Digital MSME Loan for Business Owners

MSMEs, or Micro, Small, and Medium Enterprises, contribute about 29% of the country's GDP in India. These small to medium scale enterprises often require financial aid to continue their business operations. This is where an MSME loan can prove to be quite

Everything you need to know about Loan Against Securities

Loans can be broadly classified into two forms, secured debt and unsecured debt. Home loans, car/bike loans, and secured lines of credit are all examples of a secured form of debt. This means that to procure such loans, you need to pledge collateral to the lender. Collateral, in simple words, is a valuable item of a certain value that the lender can sell to cover your loan if you fail to make payments. Banks and financial institutions usually accept real estate, gold, and other such assets as forms of collateral. Now, did you know that you can also get a loan against securities?

Features and Benefits of Digital e-Mudra Loan

Setting up a business requires a lot of capital both for the initial investment and for operational costs. While a few people save their way to starting a business, many others take a business loan to meet these capital requirements. To boost entrepreneurship and help small businesses pursue their goals, Bank of Baroda offers a digital e-Mudra loan. This is a credit facility made available by Bank of Baroda for MSMEs that operate in the manufacturing, trading, and services sectors of the economy. One of the best features of the <a href="https://www.bankofbaroda.in/business-banking/msme-banking/loans-and-advances/digital-mudra-loan">Bank of Baroda digital Mudra loan</a> is that it is an unsecured form of debt. This means that you do not need to provide any collateral to procure funding. This is one of the best ways to finance the operations of your business. Read on to know more about this loan.

What is Tenure in a Personal Loan and How to Choose the Loan Tenure Smartly?

A personal loan is an unsecured type of a loan which means that you can borrow the funds without handing over any collateral. The borrowed money can be used for various purposes such as tackling an emergency, financing your business, or pursuing your

educational goals. However, since you do not need to provide collateral to procure a personal loan, the interest rate charged on these loans is relatively higher when compared to other types of loans, such as home loans or student loans. Due to this,

5 Key Factors That Affect Your Personal Loan Interest Rate This Year

Do you need money to pay the security deposit on your rented flat? Or perhaps you are facing a medical emergency that goes beyond the coverage of your health insurance plan. A personal loan is a type of unsecured loan that helps you get access to quick

cash in such situations of need. Features of personal loans include collateral-free applications, speedy approvals and disbursals, attractive interest rates, and no end-use restrictions, to name a few. Now, let us look at the factors affecting personal

5 Smart Tips to Reduce EMI Of Your Existing Personal Loan

Personal loans offer a great way of meeting your financial requirements without compromising your assets.

6 Easy Ways to Choose the Best Personal Loan in 2022

There are multiple personal loan providers present in the market today; thus, you get a plethora of personal loans options to choose from. However, it is important to ensure that you get the best personal loan for yourself by choosing the right creditor.

This will ensure that you can clear off your debt easily without taking on any unnecessary stress.

Give Your Home a Festive Makeover with an Instant Personal Loan

The festive season is the time for celebration, indulging in good food, and exchanging gifts. Festivals are also considered auspicious for making big purchases such as a new vehicle, jewellery, and gadgets. Many people also opt to renovate their homes just before the festive season to add some sparkle and glamour to the celebrations. Now, renovating your home can be quite a costly affair. Fortunately, lenders offer attractive interest rates and even help you get an instant personal loan online during the festive season.

How to Get a Personal Loan Without a Salary Slip in India?

Personal loans can prove helpful in consolidating your existing debts and helping you meet financial emergencies. You can even procure a personal loan to finance special occasions such as a marriage ceremony or an anniversary holiday. It is one of the

most popular types of loans available in the market today.

How to Pay Off Your Personal Loan Quickly?

A personal loan can prove to be a boon in helping you meet planned and unplanned expenses. Many borrowers often prefer personal loans over other types of loans as these loans are apt for all purposes. Whether you need to fund your home renovation or take that long-overdue family vacation, a personal loan can help fund a variety of expenses.

9 Best Home Loan Tips 2022

A home not only provides a roof over your head, but also doubles up as an investment. Your property can be sold for money at some point in the future. It can also function as collateral for a loan. Home loan is one of the best ways to finance the purchase of your dream flat or house. A home loan helps you safeguard your savings and gives you all the required flexibility to repay the cost of your property with comfort and ease by the way of EMI.

Now, there are so many options of home loans available out there. Choosing just one among all these can be quite confusing. To help you get the best option, here are a few home loan tips that can prove helpful.

1. Check your CIBIL score

Home loans are typically of high amounts and long tenures; thus, they can only be given to individuals who have a good credit history. The minimum home loan credit score required by most of the banks in India is ranges between 650-750. Furthermore, your CIBIL score is directly proportional to the loan amount you are eligible for. This means that having a higher CIBIL score helps you procure loans of higher amount. Generally, having a CIBIL score of 750 and above is considered ideal for procuring a good and substantial value of a home loan. If you check your CIBIL score and find it to be below 650 or just at par with 650, it is better to work on increasing your score before applying for a home loan. Having a good CIBIL score can also help you procure a loan at a relatively lower interest rate.

It is recommended to check your CIBIL score every 3 to 6 months. This will help you keep track of your creditworthiness and devise a strategy to increase your score.

2. Start saving for a down payment

It is important to plan your finances and save up for the down payment before initiating your application for a home loan. This is, perhaps, the best home loan advice that anyone can give you. Lenders typically require you to pay 10% to 30% of the total purchase value of the house or property as down payment depending on your loan amount.

With increasing expenses, it can be quite difficult to save for your home loan down payment. However, making small changes in your monthly budget can ensure that a portion of your income is put aside in a savings account/Investment account etc. to build a corpus for the down payment.

3. Get your financial documents in order