Bike Loan Documents

01 Mar 2023

Table of Content

Motorcycles, scooters, and mopeds are highly popular in India. In 2022, over 13 million two-wheelers were sold in the country. While it’s relatively easy to buy a two-wheeler with a bike loan, there is a set of documents required for two wheeler loans . These documents prove your eligibility for the loan as per the lender’s guidelines.

If you provide insufficient or wrong documents, your lender will ask for these documents all over again from you before processing your loan application. It will result in your two-wheeler loan application process getting delayed.

Given this, you must prepare the documents required for bike loan in advance and submit them carefully along with your application form.

In this post, we’ll discuss in detail all the documents required for two-wheeler loans for different categories of applicants.

General Documents for Two Wheeler Loan

Regarding bike loan documents, the requirements are not much different from other loans . The applicant needs to provide documents related to identity proof, age proof, residence proof, and income proof.

One appropriate document for each of these eligibility criteria can be sufficient. For example, any of the following can work for identity proof: Aadhar Card, Pan Card, Passport, Voter’s ID, and Driving License. Similarly, you must provide bike finance documents to meet other eligibility requirements.

A two-wheeler loan application can be submitted in both online and offline modes. However, be a bit careful while submitting the bike loan documents. In the online application, you need to submit scanned copies of the original documents, while in the offline mode, they need to be photo-state copies of the original.

The documents you submit should be in good condition. They should capture all the details cleanly and every detail should be legible. An incomplete set of bike finance documents will force your lender to demand them from you again. It will delay the processing of your loan application.

Given this, you should take care while preparing the bike finance documents and during their submission.

Two-Wheeler Loan Documents Required for Salaried person

Bike loans are available to a select category of applicants, including salaried persons. While some documents are common to all applicants, income and employment-related documents can vary for different categories of applicants. Regarding two-wheeler loans for salaried persons, salary slips, Form 16, ITR, bank statements, etc. can help you secure an instant two wheeler loan .

In the table given below, we have provided an exhaustive list of documents required for two-wheeler loans for salaried persons. Keeping original copies of these documents with you for physical verification and submitting scanned or photocopies are essential for a quick two-wheeler loan process .

|

Documents Required for Salaried Applicant |

|

|

ID Proof |

|

|

Mandatory Documents |

|

|

Address Proof |

|

|

Income Proof |

|

|

Age Proof |

|

|

Other Documents |

|

Two Wheeler Loan Documents Required for Self-employed Person

For self-employed applicants, income-proof documents are different. They need to furnish bank statements of a considerably longer period to establish the fact that they have been gainfully employed and are capable of repaying the loan amount along with interest. A two-wheeler loan for self-employed will also require them to provide documents related to their business.

As the category of self-employed two-wheeler loan applicants will also cover professionals and farmers, the exact documents required for the two wheeler loan process will differ on the case to case basis.

In the table given below, we present a comprehensive list of documents needed for two wheeler loan for self-employed. Preparing relevant documents in time and carefully submitting them along with the application can give you a smooth two wheeler loan process experience.

|

Documents Required for Self-employed Applicants |

|

|

ID Proof |

|

|

Mandatory Documents |

|

|

Address Proof |

|

|

Income Proof |

|

|

Office Address Proof |

|

|

Business Existence Proof |

|

Get a Quick Two Wheeler Loan at BOB

At BOB, you can get a quick two-wheeler loan at attractive interest rates, minimal processing fees, and no pre-closure charges. It means if you repay the loan before the loan tenure ends, you won’t have to pay any sort of penalty. It helps in reducing the debt burden and interest rates.

At BOB, you can get a bike loan of up to Rs10 lakhs with maximum 60 months repayment period. It can be availed by salaried persons, self-employed, businessmen, professionals, and farmers.

This guide should help you with the documentation process as it details all the documents you will need for your bike loan.

Popular Articles

Related Articles

Guide to Getting Agriculture Loan: Application, Eligibility & Required Documents

-

Disclaimer

The contents of this article/infographic/picture/video are meant solely for information purposes and do not necessarily reflect the views of Bank of Baroda. The contents are generic in nature and for informational purposes only. It is not a substitute for specific advice in your own circumstances. Bank of Baroda and/ or its Affiliates and its subsidiaries make no representation as to the accuracy; completeness or reliability of any information contained herein or otherwise provided and hereby disclaim any liability with regard to the same. The information is subject to updation, completion, revision, verification and amendment and the same may change materially. The information is not intended for distribution or use by any person in any jurisdiction where such distribution or use would be contrary to law or regulation or would subject Bank of Baroda or its affiliates to any licensing or registration requirements. Bank of Baroda shall not be responsible for any direct/indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information mentioned. Please consult your financial advisor before making any financial decision.

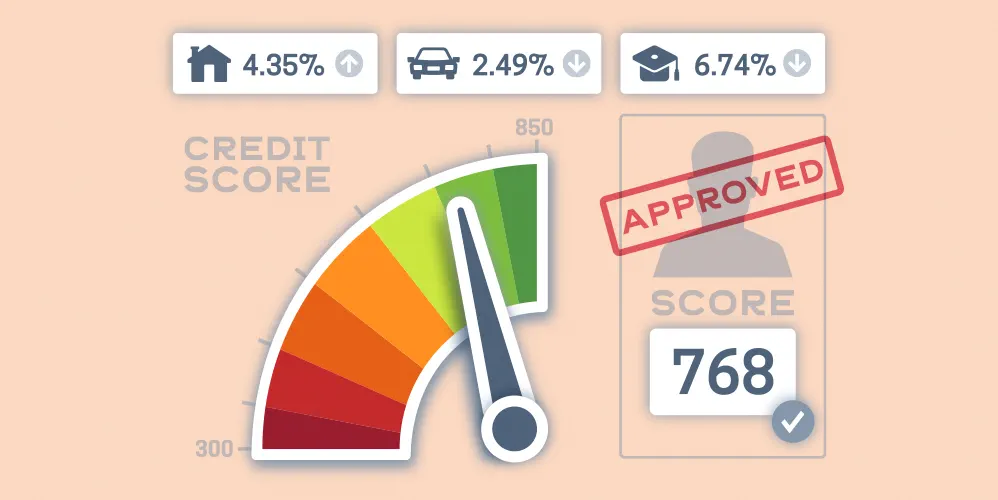

CIBIL Score for Bike Loan

CIBIL score is one of the critical factors for determining eligibility for a loan. Even if it’s a bike loan, borrowers need to have a minimum CIBIL score to avail of the bike loan. A CIBIL score depicts the borrower's credibility, credit performance and repayment history. It is the basis upon which the lender assesses whether the borrower will be able to repay the loan. But what’s the minimum CIBIL score for a bike loan? Let’s find out!

Get Instant Two Wheeler Loan Approval

Two-wheelers are an extremely popular mode of commute for a large number of people in India. According to Statista, 8.98 million motorcycles, 4.01 million scooters, and 0.62 million mopeds were sold in India during 2022, with the total sales of two-wheelers for the year standing at 13.61 million. Two-wheelers are also the first vehicle for most people.