Why Consider Large and Mid-Cap Funds for Long-Term Growth?

26 सितम्बर 2024

Investment Reflections from Lord Ganesha

Drawing wisdom from Lord Ganesha, the remover of obstacles, it is time to explore timeless investment principles from the life of the Elephant God. Just as Ganesha embodies patience, foresight, and adaptability, investors can harness these qualities to navigate market challenges, optimize portfolios, and achieve long-term prosperity.

Consistency is the Key

In the grand tapestry of the Mahabharata, Lord Ganesha plays a pivotal role as the scribe who meticulously transcribes the epic. Legend has it that during the transcription, his tusk broke, a moment that could have halted the monumental task. Instead, Lord Ganesha demonstrated resilience and dedication by continuing with unwavering commitment, using his broken tusk as a writing instrument. This story symbolizes the power of persistence and adaptability. Just as Lord Ganesha turned a challenge into an opportunity, investing consistently, even in the face of obstacles, can yield significant rewards. It teaches us that enduring effort and steadfastness, regardless of the difficulties we encounter, are crucial to achieving long-term success

Stay committed with your SIPs through market fluctuations to maximize returns and achieve your financial objectives

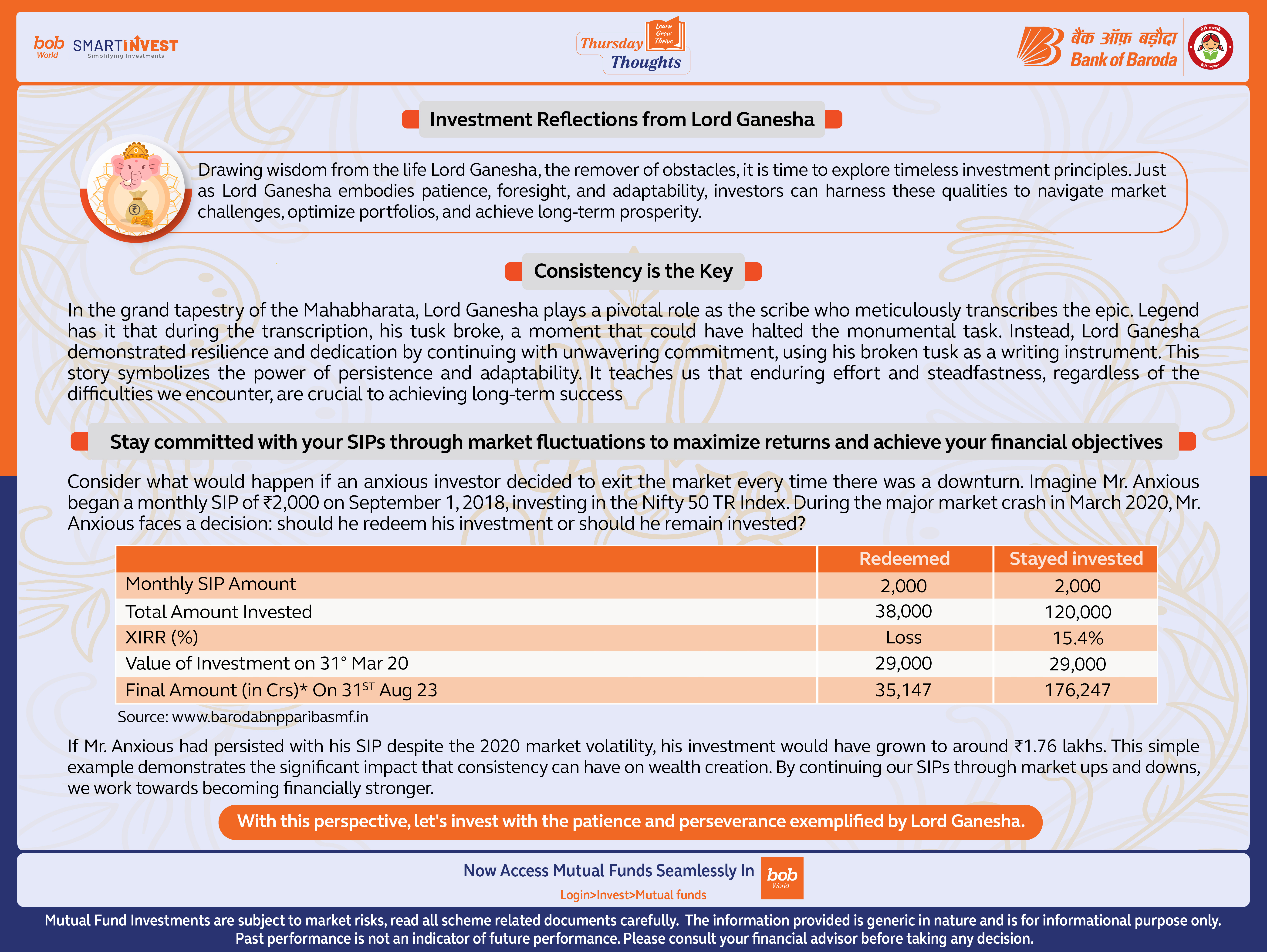

Consider what would happen if an anxious investor decided to exit the market every time there was a downturn. Imagine Mr. Anxious began a monthly SIP of ₹2,000 on September 1, 2018, investing in the Nifty 50 TR Index. During the major market crash in March 2020, Mr. Anxious faces a decision: should he redeem his investment or should he remain invested?

SIP Illustration

| Redeemed | Stayed invested | |

|---|---|---|

| Monthly SIP Amount | 2,000 | 2,000 |

| Total Amount Invested | 38,000 | 120,000 |

| XIRR (%) | Loss | 15.4% |

| Value of Investment on 31st Mar 20 | 29,000 | 29,000 |

| Final Amount (in Crs) On 31st Aug 23 | 35,147 | 176,247 |

If Mr. Anxious had persisted with his SIP despite the 2020 market volatility, his investment would have grown to around ₹1.76 lakhs. This simple example demonstrates the significant impact that consistency can have on wealth creation. By continuing our SIPs through market ups and downs, we work towards becoming financially stronger. With this perspective, let's invest with the patience and perseverance of Lord Ganesha.

Mutual Fund Investments are subject to market risks, read all scheme related documents carefully. The information provided is generic in nature and is for informational purpose only. Please consult your financial advisor before taking any decision.

Read morePopular Infographics

Related Infographics

5 Simple Financial Resolutions for 2025: A Guide to Achieving Financial Security

-

डिस्क्लेमर

इस लेख/इन्फोग्राफिक/चित्र/वीडियो की सामग्री का उद्देश्य केवल सूचना से है और जरूरी नहीं कि यह बैंक ऑफ बड़ौदा के विचारों को प्रतिबिंबित करे। सामग्री प्रकृति में सामान्य हैं और यह केवल सूचना मात्र है। यह आपकी विशेष परिस्थितियों में विशिष्ट सलाह का विकल्प नहीं होगा । बैंक ऑफ बड़ौदा और/या इसके सहयोगी और इसकी सहायक कंपनियां सटीकता के संबंध में कोई प्रतिनिधित्व नहीं करती हैं; यहां निहित या अन्यथा प्रदान की गई किसी भी जानकारी की पूर्णता या विश्वसनीयता और इसके द्वारा उसी के संबंध में किसी भी दायित्व को अस्वीकार करें। जानकारी अद्यतन, पूर्णता, संशोधन, सत्यापन और संशोधन के अधीन है और यह भौतिक रूप से बदल सकती है। इसकी सूचना किसी भी क्षेत्राधिकार में किसी भी व्यक्ति द्वारा वितरण या उपयोग के लिए अभिप्रेत नहीं है, जहां ऐसा वितरण या उपयोग कानून या विनियमन के विपरीत होगा या बैंक ऑफ बड़ौदा या उसके सहयोगियों को किसी भी लाइसेंसिंग या पंजीकरण आवश्यकताओं के अधीन करेगा । उल्लिखित सामग्री और सूचना के आधार पर किसी भी वित्तीय निर्णय लेने के लिए पाठक द्वारा किए गए किसी भी प्रत्यक्ष/अप्रत्यक्ष नुकसान या देयता के लिए बैंक ऑफ बड़ौदा जिम्मेदार नहीं होगा । कोई भी वित्तीय निर्णय लेने से पहले अपने वित्तीय सलाहकार से सलाह जरूर लें।