Unlocking Financial Efficiency: How Cash Management Services Transform Banking

07 अगस्त 2024

Table of Content

Introduction

In the dynamic world of finance, Cash Management Services play a pivotal role in helping businesses maintain liquidity, optimize cash flow, and ensure smooth financial operations. Banks offer these services to manage their clients' cash transactions efficiently. This blog delves into the nuances of cash management services, highlighting their importance, types, functioning, and benefits.

What is Cash Management Services (CMS)?

What is Cash Management Services (CMS)? Cash management services encompass a range of financial tools and services provided by banks to help businesses manage their cash flow effectively. These services include handling payments, collections, liquidity management, and providing solutions for short-term investments. The primary goal of CMS is to ensure that businesses have adequate cash flow to meet their operational needs while optimizing the use of their financial resources.

Cash management services are designed to streamline the financial operations of businesses by offering a comprehensive suite of tools that assist in managing cash inflows and outflows. These services are essential for businesses of all sizes, as they help in maintaining financial stability, improving liquidity, and ensuring efficient use of resources.

Importance of Cash Management Services

The importance of Cash Management Services in banking cannot be overstated. Effective cash management ensures that a business can meet its financial obligations, invest surplus cash wisely, and plan for future growth. By leveraging CMS, businesses can streamline their financial operations, reduce the risk of cash shortages, and enhance overall financial stability.

Cash management services help businesses in several ways:

1. Ensuring Liquidity: By managing cash flow effectively, businesses can ensure that they have sufficient liquidity to meet their short-term obligations.

2. Optimizing Cash Utilization: CMS helps businesses optimize the use of their cash resources by investing surplus funds in short-term investments that generate returns.

3. Reducing Financial Risks: Effective cash management reduces financial risks by ensuring that businesses can meet their financial obligations and avoid cash flow problems.

4. Improving Financial Planning: CMS provides businesses with real-time data on their cash position, helping them make informed financial decisions and improve their financial planning.

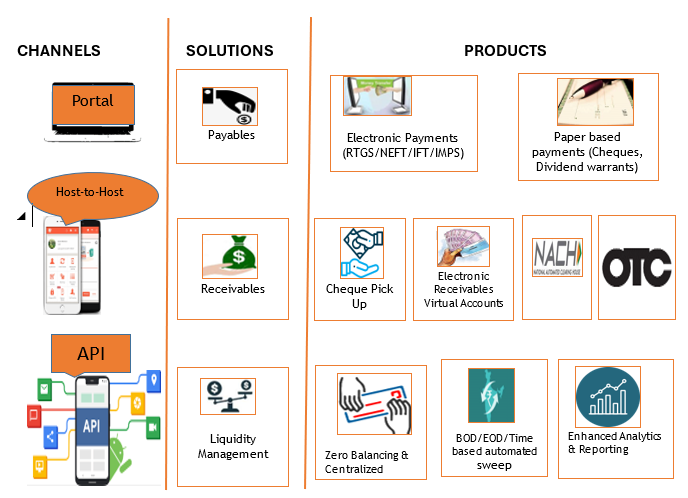

Types of Cash Management Services

How CMS Works

Understanding how CMS works is essential for businesses looking to optimize their cash flow. CMS typically involves a combination of technology, financial expertise, and banking services. Here's a simplified breakdown of how it works:

1. Integration with Business Systems: CMS integrates with a company's accounting and financial systems to provide real-time data on cash flow.

2. Automation of Transactions: Many cash management tasks, such as payments and collections, are automated to reduce manual effort and minimize errors.

3. Monitoring and Reporting: CMS provides detailed reports and analytics on cash flow, helping businesses make informed financial decisions.

For example, a business can use CMS to automate its accounts receivable and accounts payable processes, ensuring that payments are collected and disbursed efficiently. By integrating CMS with the company's accounting system, the business can monitor its cash position in real-time and make informed decisions about its cash management strategy.

Benefits of Using Cash Management Services

Utilizing cash management services offers numerous benefits for businesses, including:

- Improved Cash Flow: CMS ensures timely collection of receivables and efficient payment processes, leading to better cash flow management.

- Cost Savings: By automating financial transactions and reducing manual intervention, businesses can save on administrative costs and reduce the risk of errors.

- Enhanced Financial Planning: With real-time data and analytics, businesses can make more accurate financial forecasts and plan for future growth.

- Risk Mitigation: Effective cash management helps mitigate financial risks by ensuring that businesses have sufficient liquidity to meet their obligations.

- Increased Efficiency: CMS streamlines financial operations, reducing the time and effort required to manage cash flow and freeing up resources for other business activities.

- Better Decision Making: Access to real-time data and analytics helps businesses make informed financial decisions and improve their overall financial performance.

- Customized Solutions: Banks offer customized cash management solutions tailored to the specific needs of businesses, helping them achieve their financial goals.

Conclusion

In conclusion, Cash Management Services are indispensable tools for businesses aiming to maintain liquidity, optimize cash flow, and achieve financial stability. By understanding the various types of CMS, how they work, and the benefits they offer, businesses can make informed decisions and leverage these services to enhance their financial operations. In today's competitive business environment, effective cash management is not just a necessity but a strategic advantage.

In the case of Integrated solution like H2H or API transaction flow is based on encrypted logic resulting into not only error free but also fast and efficient flow of transaction. Apart from these services we also offer various other facilities to our corporates such as Cash and Cheque Pick up facility under Door Step Banking Services.

For businesses looking to improve their financial management, partnering with a bank that offers comprehensive cash management services can provide the support and expertise needed to achieve their financial goals. By leveraging the tools and services provided by CMS, businesses can ensure that they have the liquidity and financial stability needed to succeed in today's dynamic business environment.

Popular Articles

Tag Clouds

Related Articles

-

डिस्क्लेमर

इस लेख/इन्फोग्राफिक/चित्र/वीडियो की सामग्री का उद्देश्य केवल सूचना से है और जरूरी नहीं कि यह बैंक ऑफ बड़ौदा के विचारों को प्रतिबिंबित करे। सामग्री प्रकृति में सामान्य हैं और यह केवल सूचना मात्र है। यह आपकी विशेष परिस्थितियों में विशिष्ट सलाह का विकल्प नहीं होगा । बैंक ऑफ बड़ौदा और/या इसके सहयोगी और इसकी सहायक कंपनियां सटीकता के संबंध में कोई प्रतिनिधित्व नहीं करती हैं; यहां निहित या अन्यथा प्रदान की गई किसी भी जानकारी की पूर्णता या विश्वसनीयता और इसके द्वारा उसी के संबंध में किसी भी दायित्व को अस्वीकार करें। जानकारी अद्यतन, पूर्णता, संशोधन, सत्यापन और संशोधन के अधीन है और यह भौतिक रूप से बदल सकती है। इसकी सूचना किसी भी क्षेत्राधिकार में किसी भी व्यक्ति द्वारा वितरण या उपयोग के लिए अभिप्रेत नहीं है, जहां ऐसा वितरण या उपयोग कानून या विनियमन के विपरीत होगा या बैंक ऑफ बड़ौदा या उसके सहयोगियों को किसी भी लाइसेंसिंग या पंजीकरण आवश्यकताओं के अधीन करेगा । उल्लिखित सामग्री और सूचना के आधार पर किसी भी वित्तीय निर्णय लेने के लिए पाठक द्वारा किए गए किसी भी प्रत्यक्ष/अप्रत्यक्ष नुकसान या देयता के लिए बैंक ऑफ बड़ौदा जिम्मेदार नहीं होगा । कोई भी वित्तीय निर्णय लेने से पहले अपने वित्तीय सलाहकार से सलाह जरूर लें।

What to Do When You Forget Your ATM PIN

Your ATM Personal Identification Number (PIN) is like the key to your bank account. It’s a vital piece of information that safeguards your funds and ensures that only you can access them. Memorizing your PIN is crucial for security reasons, but we all know that memory lapses can occur, which is why it is important to make sure that your ATM pin is simple and can be easily recalled by you.

डेबिट कार्ड को सक्रिय कैसे करें

बधाई ! आपको अपना नया डेबिट कार्ड मिल गया है और अब आप इसका उपयोग करने के लिए इंतजार नहीं कर सकते! चाहे यह पुराने कार्ड का प्रतिस्थापन (रिप्लेश्मेंट) हो या आपका पहला कार्ड हो। अब आप अपनी धनराशि को सुचारू रूप से प्रबंधित करते हुए त्वरित और आसान लेनदेन के लिए तैयार है। तथापि, इससे पहले कि आप ऑनलाइन खरीदारी के लिए अपने कार्ड को स्वाइप करना, टैप करना या उपयोग करना शुरू करें, आपको एक महत्वपूर्ण प्रक्रिया का पालन करना होगा। इसका उपयोग करने के लिए आपको अपने डेबिट कार्ड को सक्रिय करना होगा। इस ब्लॉग में, हम आपको अपने डेबिट कार्ड को सक्रिय करने की प्रक्रिया से अवगत कराएंगे और आपको एक सहज अनुभव सुनिश्चित करने के लिए कुछ महत्वपूर्ण सुझाव प्रदान करेंगे।