What Is Loan Against Securities – A Complete Guide

05 May 2022

Table of Content

When you need cash, especially a lump sum amount urgently, a loan is one of the best facilities at your disposal. The loan allows you to attend to your expenses, while you can return the funds borrowed from the bank in pocket-friendly instalments over a stipulated tenure. Today, you can mortgage more than your home or any property you may have to procure a loan; you can take out a loan against securities. Let us attempt to understand the meaning, features, benefits and application process for a LAS loan.

What is loan against security?

A loan against securities is a type of loan that empowers you to avail of a loan from a bank or a non-banking financial institution by merely pledging your investment securities to the lender. It is the simple alternative that prevents you from selling your investment instruments such as shares, mutual funds, bonds, etc., in a haste, especially during an emergency when you need funds urgently. Instead, you can pledge these instruments as collateral with the lender and get the funds you need. The lender considers the total value of the securities pledged and determines the principal amount you can acquire. The principal amount loaned is typically a specific percentile of the securities pledged, applying the same rules as applicable with a loan against property. Also, the loan against securities' interest rate depends on your chosen loan repayment tenure.

How does a loan against securities work?

Having explained what is loan against securities let us understand how it works.

Typically, the lender opens an OD account in your name and calculates the rate of interest based on the amount you withdraw from it during the period of utilisation.

You do not have to pay interest on the entire amount. The lender gives you steady cash when you most require it, and you only need to pledge that particular security against which you want the loan. This way, you can continue accruing the benefits

from your investment, such as the bonus shares and dividend payments, if any.

What securities can you pledge to acquire a LAS loan?

Most lenders typically accept the following when you apply for a loan against securities.

- Mutual fund units

- DEMAT shares

- UTI bonds

- NABARD bonds

- Non-convertible debentures

Most lenders accept one or more of the securities mentioned above when you apply for a LAS loan.

Features and benefits

The following are the primary features and benefits of loan against shares and securities:

• Higher loan amounts

The minimum amount for a LAS loan is INR 100,000, whereas the maximum limit differs per individual and the securities pledged. Here's a table explaining the same:

|

Securities |

Amount |

|---|---|

|

Shares/ Equity Oriented MF in Demat Form/ Debentures and Bonds in Demat Form |

Rs. 20 Lacs |

|

Equity Oriented MF in Unit Form |

Rs. 10 Lacs |

|

Debt Oriented MF in Unit/ Demat Form |

Rs. 5 Crore |

Overdraft and interest

The loan against securities is akin to an overdraft loan, and you only have to pay interest on the funds you utilise from your current account, not the actual funds borrowed.

Doubles as a personal loan

One of the most significant attributes of the LAS loan is that you can use the loan amount to fund any personal expenses you may have. However, the interest rate on this loan is significantly lower than that applicable on a personal loan. Also, while there is no specific end-use restriction on utilising the loan amount as you deem necessary, you may not use the sums borrowed to fund any speculative activities linked to capital market investments.

Transparent transaction process

You can rest assured about the transactions associated with the loan. As mentioned earlier, the borrower provides a separate overdraft account for you to track all your transactions. Any payments you make will be reflected in the account. Lenders also mention all the charges associated with the loan, including loan against securities' interest rates, processing fees, etc., upfront.

24x7 account access

You can access your loan account at any given time, from any corner of the world. You can also reach out to your lender's customer care network if you need any assistance or information pertaining to the loan.

Basic eligibility criteria

Individuals who have a DEMAT account with any recognised depository participant can apply for a loan against shares and securities. For loan against Mutual Funds Demat account is not required, if units are in non-Demat form. The applicant can be a Resident or Non-Resident Indian and apply for the loan jointly with another applicant. They should, however, be gainfully employed and provide proof of a regular income source.

Documents required for loan against securities

The list of documents required for loan against securities is as under

Identity proof documents

All applicants (individual or joint) must submit a copy of their identity proof documents. Lenders typically accept PAN, Aadhaar, driver's license, passport, voter's ID, Employer ID card, and ID cards issued by government entities as valid ID proof documents.

Address proof documents

All applicants must submit a copy of their current and permanent address proof documents. Lenders generally accept Aadhaar, driver's license, passport, voter's ID, latest utility bills (electricity/landline/gas/water), leave and license agreements, etc., as valid address proof documents.

Income proof documents

Whether you apply for the loan individually or jointly, you must provide copies of your income proof documents such as

- Your salary slips for the last 3-6 months (as applicable)

- Your bank statements of the previous 3-6 months (as applicable)

- Your duly filed Income Tax Returns of the last 2 years

You may also provide proof of your other income sources like variable pay from employers, proof of passive income from other sources, and so on.

Security details

Applicants must provide a detailed list of the securities they wish to provide as collateral to avail the loan against shares and securities. You must name every security along with the number of units owned (as applicable) while applying for the LAS loan.

Remember to consult your lender about the interest rates and tenures associated with the loan. Loan against Securities is initially given for the period of 12 months subject to renewal.

Opt for a Bank of Baroda loan against securities

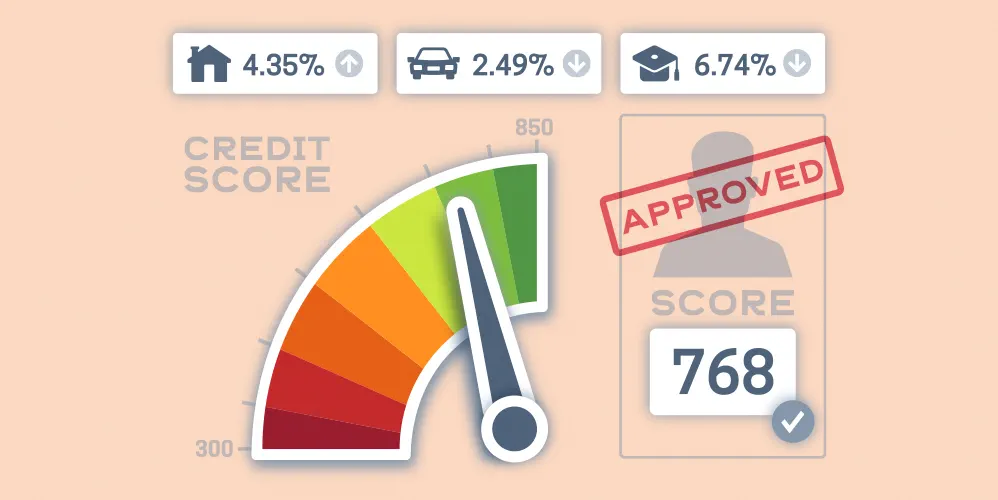

With Bank of Baroda's loan against securities, you can rest assured that you can obtain one of the lowest interest rates and a high loan amount to finance your various needs. The interest rate is directly proportional to your CIBIL or credit scores – the higher the CIBIL score, the lower the loan against securities interest rate. You can effortlessly mortgage securities like shares, mutual funds, bonds, etc., in DEMAT form and get LAS loans. Limit of 5Crs is only for Debt Mutual Funds. Our simple application and documentation process ensures you get the required sums in your account within the shortest timeframe. We levy a nominal 0.35% loan processing fee for new accounts, whereas the maximum fee for Baroda e-trade account holders is as low as INR 1000. You can also renew and enhance your account at any time by paying a minuscule loan processing fee as an existing or new Bank of Baroda e-trade account holder. If you need any further assistance with the LAS loan application process, you can reach out to us on our toll-free numbers - 1800 5700 or visit your nearest Bank of Baroda branch.

Popular Articles

Tag Clouds

Related Articles

Guide to Getting Agriculture Loan: Application, Eligibility & Required Documents

-

Disclaimer

The contents of this article/infographic/picture/video are meant solely for information purposes and do not necessarily reflect the views of Bank of Baroda. The contents are generic in nature and for informational purposes only. It is not a substitute for specific advice in your own circumstances. Bank of Baroda and/ or its Affiliates and its subsidiaries make no representation as to the accuracy; completeness or reliability of any information contained herein or otherwise provided and hereby disclaim any liability with regard to the same. The information is subject to updation, completion, revision, verification and amendment and the same may change materially. The information is not intended for distribution or use by any person in any jurisdiction where such distribution or use would be contrary to law or regulation or would subject Bank of Baroda or its affiliates to any licensing or registration requirements. Bank of Baroda shall not be responsible for any direct/indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information mentioned. Please consult your financial advisor before making any financial decision.

Types of Mortgage Loans: Which Is Best for You

Emergencies are unpredictable, especially financial ones. Sometimes these expenses can be too high to seek financial aid from friends and family. In such times, you can make your idle assets work for you. If you own assets like properties, you can get a loan against them. You can mortgage them as collateral with your lender and avail loan. Read on to understand what a mortgage loan is and the various types of Mortgage Loans.

What's the Difference Between a Gold Loan and a Loan Against Property?

Loans are one of the best ways to access funds in an emergency or to pursue your goals. There are broadly two types of loans that you can procure - a secured loan and an unsecured loan. If you offer collateral to the lender in exchange for the loan, you

are said to have taken a secured loan. Many people prefer to take a secured loan as it helps them receive funds on suitable loan terms and conditions such as lower interest rates and higher loan amounts. When offering a secured loan, lenders usually

accept gold, securities, property, and other similar assets as collateral. Out of all these types, a loan against gold and a loan against property are the two most common types of secured loans.