How to Save & Invest for Your Child's Education Aboard

25 Sep 2023

Table of Content

Quality education is one of the most important investments in your child's future. It equips them with the knowledge, skills, and opportunities necessary to thrive in today's globalised world.

If your child dreams of pursuing higher education abroad, it opens up even more personal and academic growth possibilities. However, the costs associated with international education can be substantial, making it essential to start planning and saving early.

Education abroad offers numerous benefits, including exposure to diverse cultures, global perspectives, and top-notch academic institutions. Students gain valuable life experiences and a broader understanding of the world by immersing themselves in a new environment.

However, the financial aspect can be a significant hurdle for many families. That's why it's crucial to be proactive and implement effective strategies to save and invest in your child's foreign education.

Whether your child is interested in studying in renowned universities in the United States, the United Kingdom, Australia, or any other country, the principles of saving and investing for their education remain the same. Adopting a proactive and disciplined approach can alleviate the financial burden and ensure your child receives a world-class education.

So, let's dive into the strategies and insights that will empower you to save and invest in your child's foreign education.

Tips to Save and Invest for Your Child's Foreign Education Goals

Here are a few saving tips for a child's foreign education goals:

Creating a Budget and Saving Strategy

Start by assessing your current financial situation and creating a budget. Determine how much you can save each month for your child's education. Cut back on unnecessary expenses and allocate those savings towards an education fund. Consider setting up an automatic monthly transfer to a separate savings account to ensure consistent contributions.

Setting a Goal and Estimating Costs

Research and estimate the costs associated with your child's desired foreign education. Consider tuition fees, living expenses, travel, and other related expenses. Setting a clear savings goal will help you stay motivated and track your progress. Remember to account for inflation and currency exchange rate fluctuations when estimating long-term costs.

Also Read: Important Education Loan: Student Loan Terms You Should Know

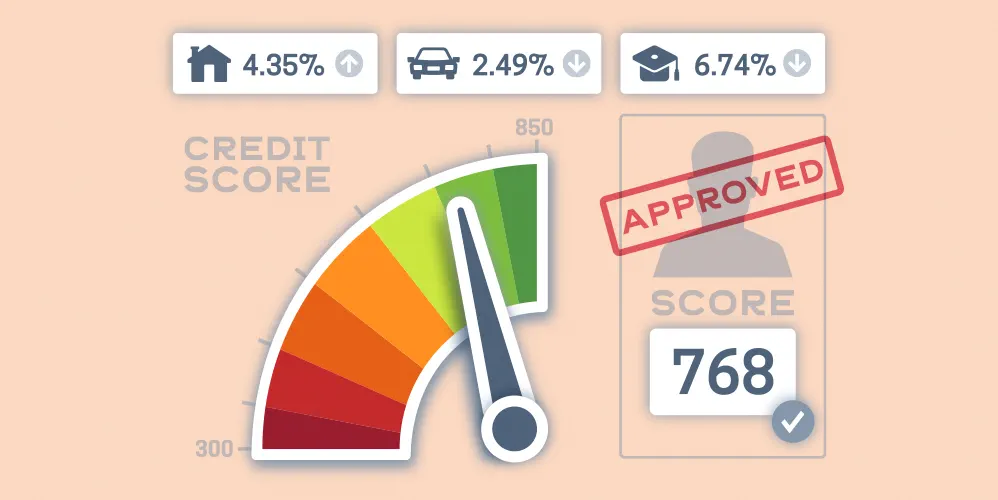

Exploring Education Loan Options

While saving is crucial, it may not cover the entire cost of your child's education abroad. Familiarise yourself with different education loan options specifically designed for higher education overseas. Look for loans that offer competitive interest rates, flexible repayment terms, and beneficial features such as moratorium periods.

Seeking Professional Financial Advice

Consult a financial advisor specialising in education planning. They can guide you on the most effective investment strategies based on your financial goals and risk tolerance. A professional can help you explore investment options such as mutual funds, fixed deposits, or other suitable investment vehicles that align with your objectives.

Government Schemes and Scholarships

The Indian government has implemented various policies and schemes to support parents and students in achieving their child's foreign education goals. These initiatives aim to provide financial assistance, guidance, and opportunities for Indian students to pursue higher education abroad. Here are some prominent policies and schemes:

• Pradhan Mantri Vidya Lakshmi Karyakram (PMVLK):

This scheme is a government portal that provides a single window for students to access information about various education loan schemes banks offer. It simplifies the loan application process by providing a platform to compare different loan options, apply online, and track the status of applications.

• Study in India (SII) Programme:

Launched by the Ministry of Education, the Study in India program promotes India as a destination for international students while offering opportunities for Indian students to pursue higher education there. The program includes scholarships, fee waivers, and other incentives for deserving students.

• National Overseas Scholarship Scheme (NOSS):

The Ministry of Social Justice and Empowerment offers the NOSS to support students from economically weaker sections of society, including SC, scheduled tribes, and other backward classes. The scheme provides financial assistance to eligible students pursuing higher education abroad.

• Indian Council for Cultural Relations (ICCR) Scholarships:

The ICCR, under the Ministry of External Affairs, provides scholarships to international students to study in India. It enhances cultural exchange and provides opportunities for Indian students to interact with international peers and gain a global perspective.

Explore these initiatives' respective websites and portals for detailed information on eligibility criteria, application processes, and deadlines.

Also Read: Common Problems with Overseas Education Loans: Solutions and Techniques

Conclusion

Saving and investing in your child's overseas education requires careful planning, discipline, and a long-term financial strategy. By creating a budget, estimating costs, exploring education loans abroad and seeking professional advice, you can ensure that you are on the right track.

Bank of Baroda's Education Loan can be a reliable and beneficial financial solution to help you achieve your objective.

Popular Articles

Tag Clouds

Related Articles

Guide to Getting Agriculture Loan: Application, Eligibility & Required Documents

-

Disclaimer

The contents of this article/infographic/picture/video are meant solely for information purposes and do not necessarily reflect the views of Bank of Baroda. The contents are generic in nature and for informational purposes only. It is not a substitute for specific advice in your own circumstances. Bank of Baroda and/ or its Affiliates and its subsidiaries make no representation as to the accuracy; completeness or reliability of any information contained herein or otherwise provided and hereby disclaim any liability with regard to the same. The information is subject to updation, completion, revision, verification and amendment and the same may change materially. The information is not intended for distribution or use by any person in any jurisdiction where such distribution or use would be contrary to law or regulation or would subject Bank of Baroda or its affiliates to any licensing or registration requirements. Bank of Baroda shall not be responsible for any direct/indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information mentioned. Please consult your financial advisor before making any financial decision.

Education Loans vs. Self-Finance to Study Abroad

Studying abroad is a dream for many students. It allows them to receive a quality education besides exploring new cultures and gaining global exposure; however, financing an international education can be a significant challenge for most students.

Important Education Loan: Student Loan Terms You Should Know

Pursuing higher education is a dream for many individuals, but the rising education costs can often be a major hurdle. In such situations, education or student loans come to the rescue by providing the necessary financial support.