How to Reduce Your Student Loan Debt

01 Sep 2023

If individuals find themselves overwhelmed by the weight of their student loan debt and actively seek effective ways to reduce it, they need not look any further. This informative blog is dedicated to uncovering the secrets that can help them reduce student loan debt and regain financial freedom.

Whether they have recently graduated, are struggling to manage educational expenses, or are seasoned professionals still grappling with lingering education loan , this blog offers comprehensive coverage.

It's time to bid farewell to the burdensome shackles of loans for students and embrace a transformative experience. Let's dive in together and take the first step towards reducing student loan debt and achieving financial independence.

How to Reduce Student Loan Debt

- Apply for Scholarships

Individuals should actively pursue scholarship opportunities to lessen the weight of student loan debt. There are abundant scholarships available to students, some of which cover the entire cost of education, while others provide partial funding.

Applying for these scholarships can significantly reduce educational expenses and lessen student loan debt.

- Repay More Than the Minimum EMI

One effective strategy to speed up the repayment process and reduce student loan debt is to make payments exceeding the minimum Equated Monthly Installment (EMI) amount. By doing so, borrowers can accelerate the timeline of paying off their loans, leading to a decrease in the total loan amount and duration.

- Consider the Right Education Loan

Individuals should carefully evaluate and choose the most suitable education loan option when seeking ways to reduce student loan debt. It is crucial to understand the restrictions and terms associated with each loan type.

Education loans generally offer lower student loan interest rates, making them a favourable choice for borrowers aiming to minimize their student debt burden.

- Enhance Academic Performance

Many prestigious universities offer grants and scholarship awards to students who excel academically. Individuals are encouraged to strive for academic excellence and qualify for such financial assistance programs to reduce student loan debt.

- Employ Part-Time Work

Working part-time is a different approach to diminish the loan amount and ensure timely repayment. Taking up a part-time job enables individuals to cover their living expenses without resorting to additional borrowing from the sanctioned loan amount.

- Employ Part-Time Work

During the moratorium period, borrowers can pay off the accumulated interest. Opting to pay the interest during this period significantly reduces the overall student loan debt when the repayment begins.

- Utilize Automatic Payment Scheduling

One of the easiest ways to get quick student loan debt relief is by utilizing the automatic payment feature provided by lenders. Enabling automatic monthly payments reduces the chances of missing payments and offers potential interest rate discounts from financial institutions.

- Explore Employer Assistance Programs

Certain companies and employers provide benefits packages that include student loan repayment assistance. Borrowers should inquire with their employers regarding available incentives to support the reduction of their student loan debt.

- Leverage Tax Deductions

Under Section 80E of the Income Tax Act of 1961, borrowers can benefit from tax deductions on the interest paid toward their education loan during the financial year. Taking advantage of this tax benefit helps reduce the overall student loan debt burden.

- Government subsidies

Education Loan Subsidy schemes during moratorium period are modes of financial assistance which help students to repay their education loan with ease. Student loan applicants can avail these subsidies in the form of interest rate subsidies on education loan repayment.

Must Read - Benefits Of Early Education Loan Repayment

What is the Average Student Loan Debt?

According to the report, from September 2018 to March 2019, there was notable growth in India's average student loan debt, rising from ₹7,08,000 to ₹8,95,000. Moreover, within five years, from 2013 to 2018, the volume of loans in the category of ₹20+ lakh experienced a significant sixfold increase.

In India, the student loan segment has experienced an increase in bad debts after the pandemic. The average student loan debt has decreased by around 6% over two years, concluding in January 2022.

Must Read - 6 Best Tips to Repay Your Student Loan Early

Conclusion

In conclusion, the education loan for students’ landscape in India has experienced notable changes and challenges in recent years. Borrowers must know strategies to reduce student loan debt and make informed decisions regarding their education financing.

By exploring options such as scholarships, Moratorium during course period, Subsidy benefits and employer assistance programs, individuals can take steps towards managing their education loans and achieving financial independence.

Popular Articles

Tag Clouds

Related Articles

Guide to Getting Agriculture Loan: Application, Eligibility & Required Documents

-

Disclaimer

The contents of this article/infographic/picture/video are meant solely for information purposes and do not necessarily reflect the views of Bank of Baroda. The contents are generic in nature and for informational purposes only. It is not a substitute for specific advice in your own circumstances. Bank of Baroda and/ or its Affiliates and its subsidiaries make no representation as to the accuracy; completeness or reliability of any information contained herein or otherwise provided and hereby disclaim any liability with regard to the same. The information is subject to updation, completion, revision, verification and amendment and the same may change materially. The information is not intended for distribution or use by any person in any jurisdiction where such distribution or use would be contrary to law or regulation or would subject Bank of Baroda or its affiliates to any licensing or registration requirements. Bank of Baroda shall not be responsible for any direct/indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information mentioned. Please consult your financial advisor before making any financial decision.

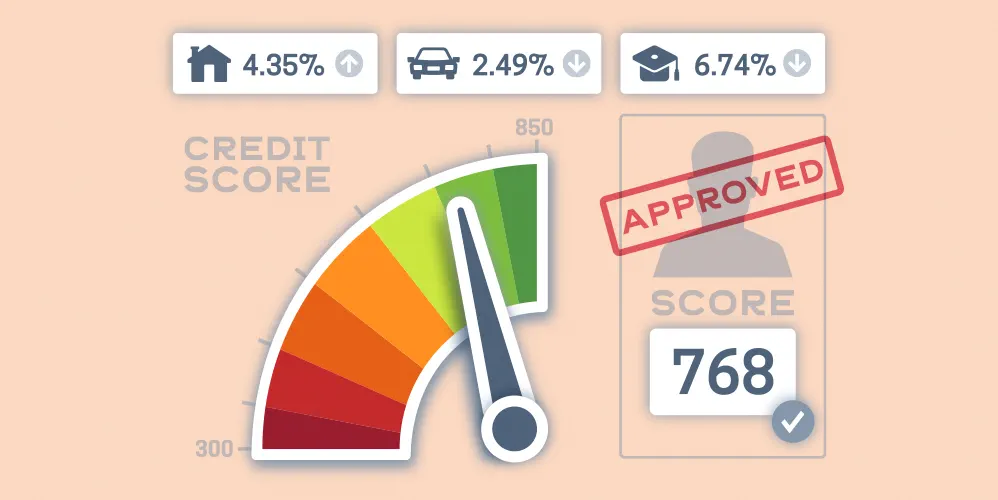

Understanding CIBIL Score Requirements for Education Loans

Learn the CIBIL score requirements for education loan and guidelines to secure funding. Ensure loan approval with a good CIBIL score for education loans.

Understanding Personal Loan Part Prepayment and Closure

Personal loans are unsecured loans offered by banks and financial institutions to meet the financial needs of individuals. These loans may be used for buying a vehicle or a home, paying off a debt or funding an emergency; the list goes on. Personal loans are easy to obtain and come with a flexible repayment tenor. Nonetheless, these loans are often extended at high-interest rates and rigid terms and conditions. At times, a borrower may be instances where a borrower may want to close the loan before the due date. There are standard procedures for this, which can vary from one lender to another.