How to Get a Car Loan?

01 Nov 2019

How to Get a Car Loan?

Now that you have zeroed in on your dream car after test driving a few of them, you probably cannot wait any longer to buy it. Now the next obvious question is, what are your financial options for buying the dream car? For many of us, a car loans seems like a comfortable financial option to consider, given that it leaves cash liquidity intact and you can get a car loans in easy EMI options at affordable interest rates, so it does not pinch your pocket much. Here’s a guide on what to do next!

First things first. Check if you are eligible for a car loans . Once you know you meet the eligibility criteria, it speeds up the process of getting a loan approved.

Am I eligible for a car loan?

Each bank has its own criteria for . It could be minimum annual income or minimum years of employment among others.

For example, Bank of Baroda provides up to 90% financing for the said category of borrowers-

- Salaried Employees

- Businessmen, professionals and farmers

- Directors of Private and Public Limited companies, Proprietor of Proprietorship Firms, partners of Partnership Firms.

- Corporates (Partnership, private Limited, Public limited and Trust)

- NRIs/PIOs

What are the documents required for a car loan?

Though documents required may vary from bank to bank, but most commonly, banks ask for the documents mentioned below along with the loan application form-

For Proof of identity, one of these documents van be produced:

- Passport

- Driving license

- Latest three months old credit card statement.

- Salary slip

- Income tax assessment order

- Utilities like electricity bill, landline bills-not older than 6 months.

- Bank statement

- Letter from employer/public authority (should be validated by bank)

- iVoter ID card

- Retired government employees can produce pension payment orders

- Registered leave and license agreement or sale deed or lease agreement.

Please note, every time there is a change of address or change in any other detail furnished to the bank, the applicant will need to immediately notify it to the bank along with updated document proofs.

Proof of income:

- Bank statement of the last three to six months

- Salary slip and form 16 (for salaried persons)

- Income tax returns (for self-employed persons)

Margin

Lenders require you to pay a portion of the price of the car, also called the margin, as the lender pays the rest, which becomes your loan value. In case of Bank of Baroda, the margin is 10% on the ‘on the road’ price of the car.

Popular Articles

Related Articles

Guide to Getting Agriculture Loan: Application, Eligibility & Required Documents

-

Disclaimer

The contents of this article/infographic/picture/video are meant solely for information purposes and do not necessarily reflect the views of Bank of Baroda. The contents are generic in nature and for informational purposes only. It is not a substitute for specific advice in your own circumstances. Bank of Baroda and/ or its Affiliates and its subsidiaries make no representation as to the accuracy; completeness or reliability of any information contained herein or otherwise provided and hereby disclaim any liability with regard to the same. The information is subject to updation, completion, revision, verification and amendment and the same may change materially. The information is not intended for distribution or use by any person in any jurisdiction where such distribution or use would be contrary to law or regulation or would subject Bank of Baroda or its affiliates to any licensing or registration requirements. Bank of Baroda shall not be responsible for any direct/indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information mentioned. Please consult your financial advisor before making any financial decision.

How to Claim Car Loan Tax Exemption ? | Bank of Baroda

Introduction:

Cars are considered a luxury product in India and many people avail loans to purchase their dream cars. But did you know that you can avail car loan tax benefit?

Yes, you read that right. Much like the education and home loan, car loan benefits in income tax. While cars purchased for personal use may not have car loan tax exemption, if you are a self-employed professional or business owner using the car for business purposes, you can claim exemptions. Loans on personal use cars are not eligible for tax exemption as cars are considered luxury products.

However, if you are a businessman/ woman and have taken a loan to buy a car for your business, you can claim the interest you pay as business expenses. The interest you pay in a year towards your car loan can be deducted from your taxable income. Apart from the interest deduction from taxable income, you are also eligible to claim tax benefits on the depreciation of your vehicle.

How to claim car loan benefits in income tax

In simple terms, if you are a business or are self-employed and you take a loan to buy a car for your business, you are eligible for tax deductions. How does tax rebate on car loan work?

For example, you own a business and have taken a loan for a car for your business. For this, you take a loan of Rs15 lakh at 12% for a year. Now let us assume your total taxable income, from your business, is Rs 25 lakh. You can then deduct 12% of Rs 15 lakh (Rs1.8 lakh) from your taxable income while filing your tax returns.

So when you are claiming tax rebate on car loan, deduct the interest you have paid towards your car loan in that year from your taxable income. The interest paid can be added as a business expenditure.

There are other ways to save taxes on car purchase, even if you have not sought a loan to buy the car. You can do so by showing your car as a depreciating asset for your business. You can add the depreciation as a business expense, too. The upper limit for depreciation is set at 15 % in a year.

Conclusion

For salaried individuals buying car for personal use, there is no car loan tax benefit. However, self-employed individuals or businesses can claim tax deductions for loan on car used for business purposes. While availing these tax benefits be sure that the car is being used for legitimate business purposes.

How to Get Personal Loan with Low CIBIL Score

With a number of lenders proliferating across the country borrowing money is no longer difficult. The number of phone calls we get on a daily basis selling personal loans is an indication of how the lenders are now chasing people to borrow.

However, it may be easy to borrow money as far as you are able to repay it. The moment you start defaulting on the loans, trouble starts. Even a delay in payment would mean trouble for the borrower.

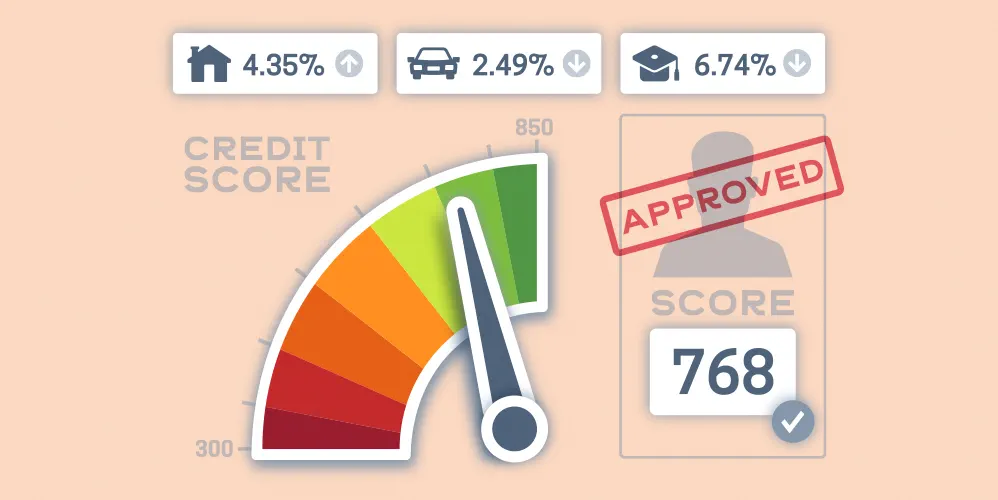

A delay or default in repaying a loan affects what is called a bad credit score measured in India as CIBIL score. This score is very important for a personal loans as compared to any other form of a loan.

A personal loan is an unsecured loan which means the lender is taking a higher risk based on certain financial track record of the borrower.

The CIBIL score measures your credit worth. The range of the score is usually between 300 and 900. The closer the score is to 900 the better it is for the borrower while a score closer to 300 would mean that getting money from the official route will be difficult. Lenders are generally comfortable lending money to people with a CIBIL score of over 725.

Your CIBIL score depends on various factors concerning your borrowing track record. It does not depend on your salary. How you have financially behaved after taking a loan is the main -basis of CIBIL score. Defaults and delay, - can bring your CIBIL score down. More than any other loan CIBIL score is paramount in personal loans.

So does it mean that a person with a low CIBIL score has no option of getting a loan?

This may not always be the case. However, chronic defaulters would have trouble raising money from the official channel. But occasional delays or defaults can be managed.

Here are some of the ways in which one can raise money through personal loans despite a low CIBIL score.

Improve your income stream

In order to get incremental personal loans, the lender has to be satisfied that you have the ability to repay the loan. A new source of funds or a salary increment will go a long way in convincing the lender that there is enough cash flow to support a new loan repayment. One will have to convince the lender that the new income stream is a regular one and not a one-time income. Any documentary proof like a contract with the vendor from where the borrower is getting money will help in building up the case.

Even if the lender may see merit in the story they may agree to lend on a higher interest rate than the market rate along with some additional charges.

Go in for a smaller loan

Asking for a bigger loan after having a low CIBIL score will scare away any lender. A smaller loan with an adequate income stream may convince him to risk a small amount. Taking a small loan and repaying it regularly will not only convince the lender but also help improve your CIBIL score.

Collateral loans

While personal loans may be difficult, but not impossible despite a low CIBIL score, one can go in for a Collateral loan.

Loan against shares, gold loans, - Term deposits is easier to get despite a lower CIBIL score. The lender is comfortable that they have collateral as a guarantee against any defaults. In such cases, the CIBIL score does not matter. On the other hand, a regular payment on these loans can help in improving your CIBIL score.