Give Your Home a Festive Makeover with an Instant Personal Loan

31 Mar 2022

Table of Content

-

What are the benefits of opting for a personal loan this festive season?

-

You get to enjoy attractive offers from the lender

-

You get a bigger budget for your festival celebration.

-

Easy and stress-free repayment

-

Home renovation loan vs. personal loan

-

What are the features of a personal loan?

-

It is collateral-free

-

There is flexibility of usage

-

The documentation process is quite simple

-

Wide range of sanctioned amounts

-

Documents required for a personal loan

-

How to get a personal loan?

-

Conclusion

The festive season is the time for celebration, indulging in good food, and exchanging gifts. Festivals are also considered auspicious for making big purchases such as a new vehicle, jewellery, and gadgets. Many people also opt to renovate their homes just before the festive season to add some sparkle and glamour to the celebrations. Now, renovating your home can be quite a costly affair. Fortunately, lenders offer attractive interest rates and even help you get an instant personal loan online during the festive season.

What are the benefits of opting for a personal loan this festive season?

Giving your home a makeover just before a festival can be quite expensive. After all, it’s not just the renovation expenses that you need to worry about. You also must plan for gifting presents to your loved ones, preparing lavish meals, and buying new clothes. Along with your home renovation costs, these additional expenses that accompany the festive season can burn a hole in your pocket or compel you to decrease your overall budget. You can tackle such financial hiccups by procuring a personal loan.

Getting an instant personal loan this festive season can help you afford to turn your home into the palace of your dreams. From new wallpaper to beautiful furniture, you can have it all. Here are some of the major benefits of taking a personal loan during the festive season.

You get to enjoy attractive offers from the lender

Many people wait to make their big purchases during the festive season. This means that there are more customers in the market during this time of the year. Thus, to boost the number of customers, lenders often come up with competitive interest rates and benefits. For example, some lenders even waive loan processing fees during this time of the year. This helps you, the debtor, to procure a personal loan at a significantly lower expense. These opportunities are usually only available to you during the festive season; thus, if you want to save while renovating your house, you should definitely take advantage of such offers while you can.

You get a bigger budget for your festival celebration.

The special offers and competitive interest rates make personal loans more accessible during the festival season. Thus, you can stretch your budget a bit if you need to. You won’t have to compromise on buying that brand new sofa set or new smart refrigerator for your home.

Easy and stress-free repayment

Personal loans usually have a tenure of around 5 years. As you get a longer time for repayment, the EMI amount becomes quite easy to handle. Many lenders do not even charge you a penalty for prepayment of your loan. So, if you think you can clear your debt before the end of 5 years, you can conveniently do so without worrying about the penalties levied for the early clearance of your debt. However, this clause varies among loan providers, and you should check with your lender whether they levy a penalty for paying your loan back before the final due date.

Home renovation loan vs. personal loan

There are typically two types of loans that can help you finance your home renovation - a home renovation loan and a personal loan. While the home renovation loan usually charges a lower interest rate, it can take up to 10 to 15 days to get the loan amount disbursed into your account. On the other hand, you can get personal loan instantly, provided you meet the eligibility criteria.

What are the features of a personal loan?

It is collateral-free

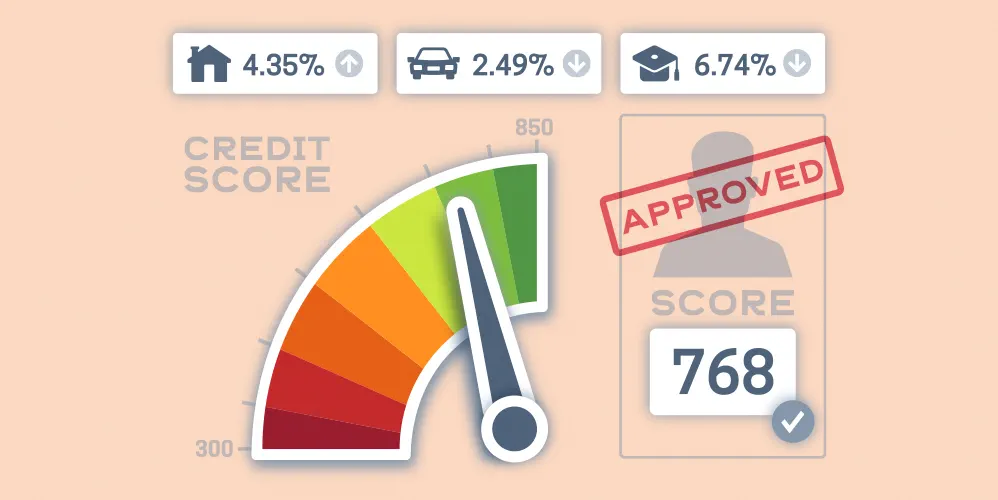

A personal loan does not require you to pledge any collateral or security. Your eligibility for the loan is decided by your CIBIL score and income.

There is flexibility of usage

Unlike a home loan that can only be used to finance the purchase of your dream house or a car loan that can only be used to buy a car, a personal loan can be used for various purposes. You can procure a personal loan to renovate your house, overcome financial emergencies or pursue your goals. The lender does not place restrictions on how you can use the loan amount.

The documentation process is quite simple

You can easily get an instant personal loan online. You do not need to maintain a complicated paper trail to procure a personal loan. By providing the lender a proof of income, a proof of your identity and a proof of your address, you can easily get your funding sanctioned almost instantly. The loan amount will be disbursed to your account in about three to four working days, if not sooner.

Wide range of sanctioned amounts

A personal loan offers a loan amount of anywhere between Rs. 10,000 and Rs. 40 lakhs. So, you can be sure of covering even costly home renovations that involve construction work. The sanctioned loan amount depends upon your CIBIL score, monthly income, age, employer reputation and other such factors.

Documents required for a personal loan

Here is a quick look at the documents required for a personal loan -

- A document proving your identity, such as your Aadhaar card, driving license or passport

- A document that acts as your proof of residence, such as your driving license, utility bills that are not more than three months old, or property purchase agreement

- Documents that act as proof of your income, such as, salary slip, bank account statements and ITR or form 16

- Proof of business such as certificate of practice, GST registration and filing documents, and shop act license for business owners

How to get a personal loan?

You can easily for a personal loan in 5 simple steps.

Step 1

The first step is to understand your purpose of procuring the loan. Then, you need to determine the total loan amount you need. This planning will save you from exceeding your budget.

Step 2

Once you have decided on the total loan amount required, you must calculate your EMI payments and formulate a strategy for the repayment of the debt. You can simply use an online personal loan EMI calculator for this purpose. The personal loan EMI calculator can be easily found on the lender’s website.

Step 3

Now, check your eligibility for the personal loan. The loan amount that you are eligible for depends on your CIBIL score, age, and income. It is important to check if you are eligible for the loan amount required by you before starting the application process. You can check the eligibility online too.

Step 4

Once you know whether you are eligible for the loan amount, approach the lender and start your application process. Submit all the required documents and provide your details to the loan provider with complete transparency.

Step 5

Wait for your loan to get approved and disbursed. The disbursal of the loan amount typically takes three to four days. Once the money has been credited into your account, you are free to use it however you wish to.

Conclusion

A personal loan can truly help you meet all your expenses during the festive season. After all, we don’t want to compromise on making such moments count. Bank of Baroda offers a wide range of loans for all your needs, so you can turn your dreams into reality. Apply for a personal loan today!

Popular Articles

Tag Clouds

Related Articles

Guide to Getting Agriculture Loan: Application, Eligibility & Required Documents

-

Disclaimer

The contents of this article/infographic/picture/video are meant solely for information purposes and do not necessarily reflect the views of Bank of Baroda. The contents are generic in nature and for informational purposes only. It is not a substitute for specific advice in your own circumstances. Bank of Baroda and/ or its Affiliates and its subsidiaries make no representation as to the accuracy; completeness or reliability of any information contained herein or otherwise provided and hereby disclaim any liability with regard to the same. The information is subject to updation, completion, revision, verification and amendment and the same may change materially. The information is not intended for distribution or use by any person in any jurisdiction where such distribution or use would be contrary to law or regulation or would subject Bank of Baroda or its affiliates to any licensing or registration requirements. Bank of Baroda shall not be responsible for any direct/indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information mentioned. Please consult your financial advisor before making any financial decision.

6 Easy Ways to Choose the Best Personal Loan in 2022

There are multiple personal loan providers present in the market today; thus, you get a plethora of personal loans options to choose from. However, it is important to ensure that you get the best personal loan for yourself by choosing the right creditor.

This will ensure that you can clear off your debt easily without taking on any unnecessary stress.

How to Get a Personal Loan Without a Salary Slip in India?

Personal loans can prove helpful in consolidating your existing debts and helping you meet financial emergencies. You can even procure a personal loan to finance special occasions such as a marriage ceremony or an anniversary holiday. It is one of the

most popular types of loans available in the market today.