A Step-by-Step Guide to Apply For an Education Loan

10 Nov 2022

Table of Content

We have all heard the age old saying that the path to a great career and successful life is paved through a quality education. Holding a higher education degree opens up many career avenues and helps you secure your financial future. But with the ever-rising cost of college and university fees, students and parents have no choice but to take on an education loan to fund higher studies. Education loans cover a host of expenses related to higher education such as the tuition and examination fees, hostel fees (if applicable) cost of books and apparatus, conveyance charges and so on.

Education Loan Application Process – Easy Steps to follow

Here’s the education loan procedure you need to follow.

Step 1 - Do your research and choose the lender

Before you begin with the loan application procedure, you need to get the admission offer letter from the school you wish to attend, finalise the lender and then visit them online or in person. Let’s say you choose Bank of Baroda as your preferred lender.

Step 2 - Fill the loan application form

If you apply for the education loan online, you can find the loan application form on the lender’s website. As per the instructions of the Department of Financial Services, Ministry of Finance, Government of India, all education loan applications (including applications received by Bank in physical format) are to be applied through Vidya Lakshmi portal

Step 3 - Appear for the interview round

The procedure to take education loan continues with the interview round. Whether you apply for the loan offline or online, the bank may call you to appear for a personal discussion. The student wishing to study further is considered as the principal loan applicant, which is why he/she must be present for this discussion. The bank generally asks student applicants some basic questions regarding their overall academic performance, the degree they wish to pursue and the school they wish to attend and so on. They also ask questions regarding the possible income that can be generated from their chosen field. Based on the information provided by the applicant, the bank decides whether to proceed with the loan.

Step 4 - Provide the documents

The bank also asks you to provide some documents as part of the Bank’s education loan procedure. You need to submit the admission offer letter provided by your chosen university. The bank will also do its due diligence and verify your enrolment.

Step 5 - The bank approves the loan

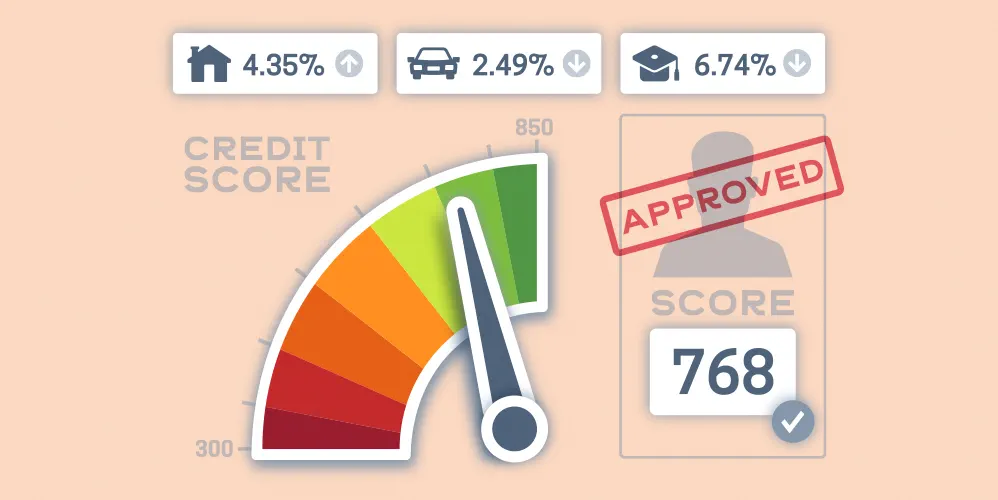

After verifying your credentials, your student loan may be approved. The student’s one of the parents/guardians are listed as co-borrower or guarantors and the bank also checks the guarantor’s /co-borrower’s credit scores before approving the loan. Additionally, the applicant must also sign a promissory note and other prescribed loan documents, assuring the bank that the loan will be repaid within the stipulated tenure.

Step 6 - Loan disbursal

The last step in the education loan procedure is loan disbursal. After all formalities are completed, the bank disburses the loan amount directly into the bank account of the university the student wishes to attend. Disbursement can be done partially (–semester wise) or fully, at one go.

Popular Articles

Related Articles

Guide to Getting Agriculture Loan: Application, Eligibility & Required Documents

-

Disclaimer

The contents of this article/infographic/picture/video are meant solely for information purposes and do not necessarily reflect the views of Bank of Baroda. The contents are generic in nature and for informational purposes only. It is not a substitute for specific advice in your own circumstances. Bank of Baroda and/ or its Affiliates and its subsidiaries make no representation as to the accuracy; completeness or reliability of any information contained herein or otherwise provided and hereby disclaim any liability with regard to the same. The information is subject to updation, completion, revision, verification and amendment and the same may change materially. The information is not intended for distribution or use by any person in any jurisdiction where such distribution or use would be contrary to law or regulation or would subject Bank of Baroda or its affiliates to any licensing or registration requirements. Bank of Baroda shall not be responsible for any direct/indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information mentioned. Please consult your financial advisor before making any financial decision.

6 Best Tips to Repay Your Student Loan Early

An education loan is truly a boon for students who want to pursue higher studies but cannot afford to do so on their own. Many people end up selling family assets - such as gold – in order to pursue their higher studies. With the help of an education loan, you can protect these valuable assets and still not miss out on studying further.

Benefits of Education Loan To Raise Funds

As the cost of education continues to sky-rocket, students have little choice but to take out an education loan. Thankfully, the government offers some respite on education loans in the form of education loan tax benefits. Here’s all you need to know about education loan tax benefits under Section 80E of the Income Tax Act: