A Complete Guide to Car Loan

10 Feb 2023

Table of Content

Buying a car is a dream for all. Looking at cars on road is one thing, but owning the car you desire, is a dream come true. Giving you the freedom to move as you want, a car is a social asset that leverages your position in society. Don't spend your savings on purchasing a car. Waiting till retirement to buy a car from your retirement fund is a bad choice. Why wait that long when you have the benefit of car loans? Buy your dream car while you are still young. Make full use of it with your family and pay it off with feasible loan EMIs. Sounds interesting? So let us understand what is a car loan and all that you need to know about loans in greater detail.

What is a Car/Auto loan?

Car/ auto loans are an amount borrowed by an individual to purchase a private car. You can also take a loan for purchasing commercial vehicles. You do not require collateral as the vehicle is hypothecated to the lender as collateral. Individuals can opt for loans on new cars, and used cars, (two-wheeler loans are under a separate category and so are commercial vehicle loans). Banks offer almost 90% of the cost for new vehicles and 75% on second-hand vehicles. The payment is on monthly basis within a term of 12-84 months.

What are the Types of Car Loan?

As we go into the know-how of the types of car loans in detail, as a buyer, you must have decided on the type of car you want. Your loan depends on the type of car you plan to purchase, the amount borrowed, or the principal, the rate of interest that varies from lenders, and the duration of loan repayment. Car loans fall under two types:

• New car loans

this is the loan for those who want to buy a brand-new car from the showroom and pick up their dream model. New car loans come at attractive interest rates. Borrowers can loan from Rs. 2 Lac to Rs. 5 Crore at 8.4 to 11.90% interest rate (as of date i.e 24.01.2023) from the Bank of Baroda and the repayment term is up to 84 months.

• Pre-used car loans :

Cars should not be more than 5 year old and repayment period is upto 96 month of the car age. The loan amount offered is between Rs. 2 Lac to Rs. 50 Lac at an interest rate of 8.4 to 11.90% and the tenure extends up to 60 months.

Documents Required for Car Loan

Once you have decided on the loan amount and the tenure of payback, ensure you have all the documents. What documents required for car loan ?

- Identity proof: PAN card, Aadhar Card, driving license, passport, and voter's identity card fall under valid ID.

- Age proof: The loan applicant's age should be above is 21 years and co applicant age 18 years. This needs to be supported by an age-proof document. A passport, ration card, Aadhar Card, PAN card and birth certificate are considered valid age proof.

- Address proof:Government-issued documents like Aadhar Cards, PAN cards, electricity bills etc. are considered valid documents.

- Income proof:Salaried employees must submit salary slips for the last 3 months and bank statements for 6 Months, Form 16, updated ITR etc. Self-employed individuals should submit bank statements for the past 3 months, their balance sheets, and P&L accounts with ITR.

- Signature verification:Signature verification is necessary to establish the uniqueness of the signature.

- Photographs: Two recent passport-sized photographs of the borrower are required.

Benefits of Car Loan

- Loans are a benefit in today's age. You find it difficult to afford all the material comforts with what you earn; with the benefits of a car loan, you can afford to possess the car you had always wanted.

- Car loans make it possible to own a car at a young age. You no longer need to struggle with public transport. You can travel with your family on short weekend trips.

- With a bit of planning, you can afford the model you always wanted. Payback in comfortable EMIs each month. Very soon, you can own one car and plan for the other.

- Loans offer tax benefits: salaried individuals do not get tax benefits on car loans.

Eligibility Criteria for Car Loan

Car loan eligibility works on different factors. While applying for a car loan, ensure that you fulfil the following criteria so that your application meets with hassle-free approval:

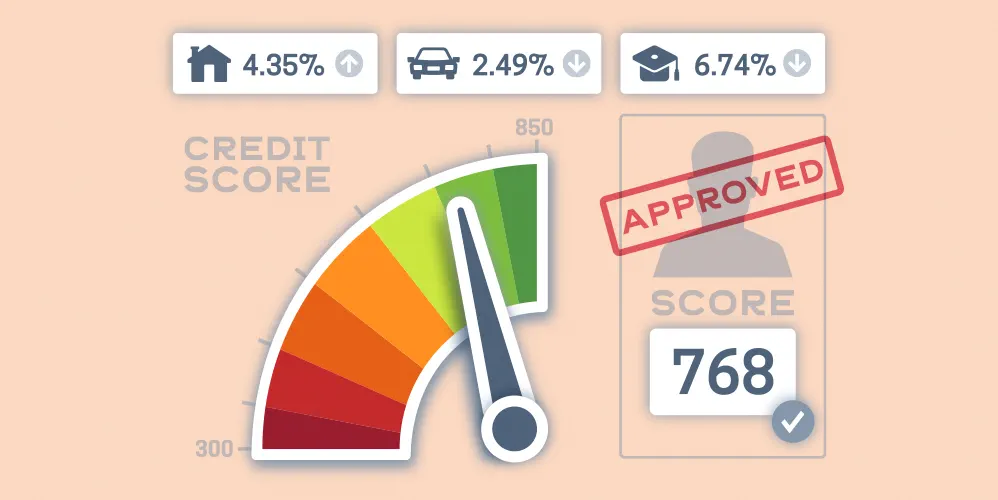

- Credit score:This is an important aspect when you seek car loans. Try maintaining a good score with your bank.

- Application form: Fill out the mandatory fields and supply all authentic documents.

- Verification: Once the bank verifies your profile, credit score and eligibility, your loan application is approved.

- Approval time:Car loans take around 1-5 days to be approved by banks. However, factors like the candidate’s eligibility decide the approval time.

Apart from these, the other mandatory eligibility criteria are:

- You should be an Indian resident.

- The age limit is between 21 years, repayment age should not exceed 70 years.

- In the case of preowned cars, the repayment period plus the age of the vehicle should not exceed 96 months.

- If the applicants is salaried than with a minimum of 3 months to 2 years and self-employed applicants with a minimum of 2-3 years of experience.

Visit the Bank of Baroda portal to tick the factors that work for you.

CIBIL Score for Car Loan

Just like any other loan application, CIBIL score for car loan is an important factor for loan approval. The bank considers this to be a qualifier when it comes to a loan sanction. Though the CIBIL alone is not the only criterion considered by the bank, it is an important factor. A higher CIBIL score makes your loan approval journey smooth. If your score is 701, you have an advantage.

Car Loan Interest Rates

Your car loan interest can be fixed or floating. Fixed car loan interest rates remain the same all through the loan tenure. It is a preferred option as the level of uncertainty in this type of loan is nil and enables better loan return management.

*BOB is not offering fixed rate auto loan as date

| Fixed car loan interest rate | Floating car loan interest rate |

| Interest rate is higher | Interest rate is lower |

| EMIs will remain constant | EMIs will change according to MCLR changes |

| Comes with lower risk | Comes with higher risk |

| Easy to prepare budgets with these rates | Tough to maintain budgets as rates keep changing |

| Offers security to borrowers | Offers savings to borrowers |

| Good for a short loan tenure (3 to 10 years) | Good for a long loan tenure (20 to 30 years) |

The floating interest rate of car are cheaper than fixed interest rates. They are dependent on the current market trends. The MCLR changes and the floating interest loan rate is impacted. If the rate soars, then the car loan EMI will go high. If the rates fall, your repayment rate fall. While there is an advantage attached to this type of loan, there is immense unpredictability that does not allow you to stay within a budget.

Car Loans Prepayment

Car loan prepayment works just like any other loan prepayment. Making a prepayment on the bank loan gives you a chance to repay a part of the principal. The lender, therefore, offers a lower rate of interest. Prepayment reduces the overall amount. However, banks have standard charges on the processing of a loan that include foreclosure penalties and processing fees. A foreclosure penalty is applicable when the borrower repays part or full loan amount before the maturity date. The processing fee is applied when the bank approves the loan. If you are taking a car loan from the Bank of Baroda, you can make a prepayment after paying 1 EMI. No penalty is applied to the prepaid amount.

Car Loan Tenure

When you are planning for a car loan, how do you decide which tenure to choose? Car loans offer no tax reduction, however, if you are opting for a high-priced model, then a shorter tenure will increase the EMI payment. Before moving forward with the loan application make sure you use the Bank of Baroda car loan EMI calculator to check the maximum suitability.

The car loan tenure should depend on the following factors:

- Surplus:Your monthly surplus which is your net income minus the surplus cash. Ensure that you keep your other investment obligations in mind like recurring deposits, SIP mutual funds, insurance premiums, or EMIs on other loans, credit card repayments etc.

- Plan a prepayment:Start reducing your loan with a pre-payment and check the prepayment foreclosure charges. This will help you decide on either a long-tenure repayment or short-term repayment. The interest rate will be reduced owing to prepayment. However, with the Bank of Baroda, no extra foreclosure charges are applied if you make a prepayment after paying the 1st EMI.

Why You Should Choose Bank of Baroda’s Car Loan

Bank of Baroda offers one of the lowest interest rates on car loans. You can enjoy low monthly EMIs on vehicle loans up to a tenure of 7 years. Bank of Baroda charges low processing fees, and prepayment charges are nil. Car loan borrowers can avail of a concession of 0.5% on the interest rate for those who offer 50% liquid security collateral. If the applicant is repaying a home loan with the Bank of Baroda and maintains a healthy repayment track record, the individual gets a discount from the bank on the car loan interest rate. Apply for Bank of Baroda car loans online directly by calling, SMS, or through their website, https://bit.ly/3tRMXoK. Existing Bank of Baroda customers can apply using Mobile Banking (bob World).

Popular Articles

Related Articles

Guide to Getting Agriculture Loan: Application, Eligibility & Required Documents

-

Disclaimer

The contents of this article/infographic/picture/video are meant solely for information purposes and do not necessarily reflect the views of Bank of Baroda. The contents are generic in nature and for informational purposes only. It is not a substitute for specific advice in your own circumstances. Bank of Baroda and/ or its Affiliates and its subsidiaries make no representation as to the accuracy; completeness or reliability of any information contained herein or otherwise provided and hereby disclaim any liability with regard to the same. The information is subject to updation, completion, revision, verification and amendment and the same may change materially. The information is not intended for distribution or use by any person in any jurisdiction where such distribution or use would be contrary to law or regulation or would subject Bank of Baroda or its affiliates to any licensing or registration requirements. Bank of Baroda shall not be responsible for any direct/indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information mentioned. Please consult your financial advisor before making any financial decision.

Car Loan Process in India - A Complete Guide

That expensive car you have your eyes on is now a possibility more than ever. You can get a loan from banks and other financial institutions to fund it. Not long ago, having a home of your own or a family car used to be considered luxurious most people found themselves unable to afford. But with the variety of loan products on offer these days, one does not have to have unfulfilled dreams anymore.

Car Loan Foreclosure & Prepayment Process

While car loans are a great way of purchasing high-end new or used cars, repaying the loan is a responsibility that keeps borrowers on their toes. A good plan of repayment will help lenders systematically manage their EMI without delaying or defaulting. Once you calculate your EMI, based on the types of car loan , new or pre-used, ensure you have a well-researched repayment plan ready. No matter what the size of your loan, a properly researched repayment plan will increase the loan sanction eligibility from banks. Following the EMI repayment tenure that the bank has set, is one way to pay back a major part of the full loan through prepayment or foreclosure, closing the loan can ease a bit of the borrower’s pressure. Banks and financial institutes annually allocate large funding towards loans . Thus, repayment and foreclosure are attached to certain terms and conditions as lenders incur losses through foreclosure or part payment. The loan process rests upon an agreement where the borrower agrees to pay regular EMI to the bank or the lender, so borrowers may have to pay car loan closure charges when they choose these repayment options. Banks offer borrowers the flexibility to pay off the entire or part of the loan balance ahead of the term reducing the interest liability. In this article let us explore these repayment processes that lenders offer to borrowers.