6 Effective Ways To Improve Your CIBIL Scores

01 Nov 2019

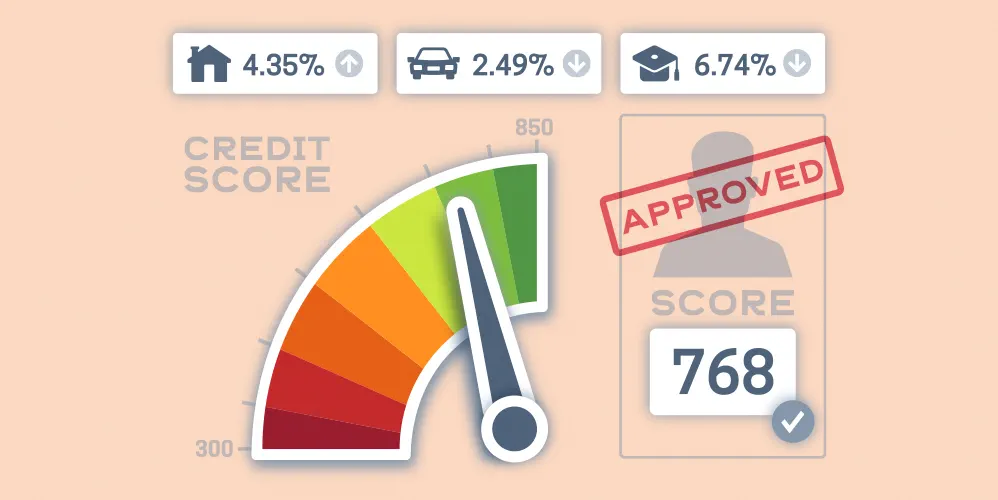

One of the most important prerequisites for taking on any kind of loan today, is your CIBIL score. Whether it is a home loan, a vehicle loan, a personal loan or any other kind of loan

Applicant, banks always check one’s CIBIL scores. Also known as credit score; this is a document containing information about the borrower’s credit behaviour. Banks use potential borrowers’ credit scores to check whether or not they have been repaying their loans on time. Through the CIBIL scores they can check if a borrower has defaulted on any loan payments, missed paying any EMI and even get an idea regarding one’s financial conditions. If your credit scores are below 750 most lenders reject loan applications. So it is imperative to have good credit scores. Find out how to improve CIBIL score here.

Repay your debts on time

Whether it is your credit card bills or your loan EMIs, it is imperative that you repay your debts well in time. Missing out on repaying any outstanding debt can impact your credit rating. You especially need to be careful when it comes to paying loan EMIs because failure to do so, not only attracts penalties, but also affects your credit scores negatively. One easy way to pay your debt on time is to set reminders so that you don’t forget the loan repayment dates and never miss out on making timely payments. You can also set up automatic payments so that the loan amount is directly debited from your savings account every month.

Don’t take on multiple loans

A great way to improve CIBIL score is to ensure you do not take on multiple loans at the same time. Ensure that you’ve paid off your current loan before taking on another one. This prevents your credit scores from reducing. When you take on several loans at the same time, it shows your lender that you may not have sufficient funds to repay all of them. If you have only one loan to repay, the lender can feel confident in giving you the loan and your credit scores also remain unaffected.

Try to maintain a healthy mix of credit

Most people have to take on a variety of loans to fund the various life necessities. But when you take the loan, it is better to ensure that there is a healthy mix of secured and unsecured loans. While the home loan and car loan count for a secured loan, your credit card debt or personal loans are regarded as unsecured loans. It is necessary to maintain a balance since taking any loan in access can affect your credit rating.

Don’t utilize your entire credit limit

Another important point that pops up when we talk about how to improve credit score is credit limit utilization. One of the quickest and the easiest ways to improve credit scores is not utilizing your credit card to the extreme limit provided by lenders. Try to spend only 30% of the credit limit provided on your card per month. For instance, if you have a credit limit of ₹200,000 per month, you should try to restrict your monthly credit spends to only ₹60,000. When you exceed the 30% limit, your potential lender may get the idea that your spending habits are impulsive, which can also reduce your credit scores.

Increase the credit limit

If you demonstrate good credit repayment behaviour, your bank can reach out to you to increase the credit limit on your credit card. It is better not to turn down this increased credit limit. Increasing the credit limit doesn’t necessarily mean that you are going to increase your credit card spends. The idea is to have a higher credit limit but limiting your credit utilisation, and thereby improve CIBIL score. Doing this leaves a positive impact on your credit scores.

Ensure that your credit report is error free

While you may believe that your credit report is free of errors, there may be several unknown errors that may be reducing your credit score. For instance, you may have paid off your personal loan in full, but you may see that it is still unpaid owing to administrative errors. It is therefore important to check your credit score and ensure it is error-free before you apply for a loan so that your loan request is not rejected, thus further impacting your credit scores.

Popular Articles

Related Articles

Guide to Getting Agriculture Loan: Application, Eligibility & Required Documents

-

Disclaimer

The contents of this article/infographic/picture/video are meant solely for information purposes and do not necessarily reflect the views of Bank of Baroda. The contents are generic in nature and for informational purposes only. It is not a substitute for specific advice in your own circumstances. Bank of Baroda and/ or its Affiliates and its subsidiaries make no representation as to the accuracy; completeness or reliability of any information contained herein or otherwise provided and hereby disclaim any liability with regard to the same. The information is subject to updation, completion, revision, verification and amendment and the same may change materially. The information is not intended for distribution or use by any person in any jurisdiction where such distribution or use would be contrary to law or regulation or would subject Bank of Baroda or its affiliates to any licensing or registration requirements. Bank of Baroda shall not be responsible for any direct/indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information mentioned. Please consult your financial advisor before making any financial decision.

5 Steps to Apply for a Home Loan

5 Steps to Apply for a Home Loan

You may have heard people say that real estate is the best kind of investment. Its value appreciates over time, and you also get several tax benefits under various Sections of the Income Tax Act of India, 1961. But with ever-escalating property rates, you may not have sufficient savings to buy a property on your own. Thankfully, you can approach Bank of Baroda for a Home Loan. The bank offers a wide variety of Home Loans at affordable interest rates. You can get financing of up to 90% of the property's value and repay the loan in affordable Equated Monthly Instalments (EMIs) over tenures lasting up to 30 years. To get you started, we have outlined the bank's Home Loan application process here.

5 Steps on How to Apply for a Home Loan

Eligibility

Before you begin the Home Loan application process, you need to ensure that you are indeed eligible for the loan. The bank determines whether you qualify for a Housing Loan after considering several factors such as your age, employment status, income, and monthly expenses. You have to input these details in the Bank of Baroda Home Loan Eligibility Calculator. The calculator instantly computes whether or not you are eligible for the loan. If you qualify, it calculates the maximum loan amount you can get. Note that the calculator only computes a rough estimate of the loan amount. The bank determines the actual loan amount you can get, after assessing the loan application form.

Document Submission

After getting a rough estimate of the loan amount you can get, you can move to the next step in the Home Loan application process. You need to fill the loan application form. You can fill the form online, directly through the bank's website. You have to provide your personal and financial details, based on which the bank confirms the maximum loan amount for which you are eligible. You also have to provide your necessary documents such as your ID, age, and income proof documents etc. You have to also submit property documents like sale or title deeds, NOC or the allotment letter etc. You need these documents irrespective of whether it's a new or existing property.

Property Evaluation

Since a Home Loan is a high-value investment for the bank, the bank does its bit in evaluating the property. A surveyor appointed by the bank visits the property's site and checks the market value of the property. While the bank surveys the property, it would help to have free and clear titles. Bank also appoint a lawyer to check that the title deed and other documents are clear from leagal angle

Documentation

The bank provides a format for you to draw up the loan agreement. All costs and charges relating to the Home Loan, including the loan processing fees, stamp duty charges, loan administration charges, etc., should be borne by you. You may factor in these charges as part of your loan amount as well. The Home Loan agreement document comprises details such as the bank's loan amount, the levied interest rate, the EMI payable, and the loan tenure. It also includes other essential terms and conditions regarding prepayment, default, collateral, etc., which you must read carefully.

Home Loan Disbursal

In the final step of the Home Loan application process, the bank disburses the loan amount. Based on the type of Home Loan you have applied for, the money will be disbursed either to you or the builder. The bank also determines whether the loan amount should be disbursed in partial instalments or as a lump sum. Once the loan amount is disbursed, your Home Loan is officially underway. It begins when you pay your first EMI and ends when you pay the last.

Types of Home Loan

Having explained how to apply for a Home Loan, let us look at the different types of Home Loans offered by Bank of Baroda. These are of 9 types:

The Standard Home Loan that enables you to buy a new, existing pre-owned, or under-construction property.

A Home Construction Loan enables you to construct a house on a piece of land owned by you.

A Home Loan to buy a plot of land, on which you will construct a property in the future (within 36 months).

A Home Extension Loan allows you to enlarge the size of your existing house, build extra floors, etc.

A Home Improvement Loan helps to finance the costs associated with renovating your existing house.

A Top-up Home Loan can get you additional financing on your existing Home Loan.

A Balance Transfer Home Loan allows you to transfer your loan from another lender to Bank of Baroda and benefit from a reduced interest rate.

A Pradhan Mantri Awas Yojana (PMAY) Home Loan allows you to get subsidised interest rates on your Home Loan. This funding type is useful if you belong to the economically weaker section, a light-income group or a medium-income group per PMAY policies.

A Pre-approved Home Loan wherein you can first get approval for a loan and then finalise the property based on your eligibility.

Documents for Home Loan Application Process

Besides knowing how to apply for a Home Loan online, you should also be aware of the documents you need to submit while applying for a Home Loan. These include:

Your age proof documents

You need to provide any government-approved document with your date of birth mentioned on it. Age proof documents help banks assess if you are in the 21-65 years age group (at the time of repaying the final EMI) to be eligible for the loan. This document could be a PAN Card, Aadhaar Card, Passport, Driving License, etc.

Your identity proof documents

Any Government-approved document featuring your photograph is accepted as a valid identity proof document. It could be your PAN Card, Aadhaar Card, Passport, Driving License, Voter ID Card, etc.

Your address proof documents

Any Government-approved document featuring your current/permanent address is accepted as a valid address proof document. It could be your Aadhaar Card, Passport, Driving License, Voter ID Card, Ration Card, Utility bills, etc.

Your income and employment proof documents

You need to provide documents validating your employment, such as your offer letter and designation, salary slips, increment letters, etc. If you are self-employed or a business owner, you need to provide your bank statement, profit and loss statements, proof of business documents, etc. All applicants must also provide their income tax returns for the last three years.

Property-specific documents

Finally, you must provide all documents related to the property you intend to buy such as the No Objection Certificate supplied by the society or builder, the original sale deed, letter of allotment, bank statements and receipts showing advance payments, etc. If you are taking a Home Construction Loan, you must also provide a document on estimating the costs associated with property construction, approved map etc.

Factors to Consider Before Applying Online for Home Loan

Now that you know how to apply for a Home Loan online, you should consider the factors mentioned below before beginning the Home Loan application process.

Consider the bank's lending rate and the maximum loan amount you can get based on your income.

Consider your credit scores and ensure they are above 701 points to get an affordable Home Loan interest rate along with the repayment tenure of your choice.

Consider repaying any existing loans and credit card bills to enhance your credit score, and by extension, your eligibility.

Consider opting for a longer-tenure loan to reduce the monthly instalment amount significantly.

As is apparent, the Home Loan application process is quite simple and straightforward. Now that you know how easy it is to apply for A Bank of Baroda Home Loan visit the Home Loan Section of our website to get started.

How to Calculate Car Loan EMI: A Step-by-Step Guide

Every individual’s journey to buy a car is unique. It begins with where the individual is in his/her career, and the choice of vehicle they want, which is mainly based on why they want the car. During the process, they also focus on how they can get a car loan that suits their requirement.

When you, as an individual are considering a car loan, you are likely to do your due homework in checking for affordability and the loan tenure among other factors. While it is essential to go for a car loan from a lender who has banking expertise in the sector of car or auto loans, so you get the best rate and comfortable repayment options, you can also use the EMI calculator like the Bank of Baroda’s Car Loan EMI calculator that will help you make a well-informed choice in picking your car loan.

In using a car loan EMI calculator, you need to key in three basic variables- the loan amount you are likely to need, the tenure or the repayment period that suits your finances and the rate of interest. Now, the rate of interest is what you get from the bank, while the other two are the ones you can play around with on the calculator. Here is why using a car loan EMI calculator works.

If EMI is more:

You can pick a longer loan term or

You can make the loan amount smaller

If you find the EMI is coming out to be lower, then you can plan for a larger loan value or a shorter loan term.

You can also use the PMT formula on Microsoft Excel to calculate the EMI (Equated Monthly Instalments), where PMT is your EMI, Rate is the rate of interest, Nper or number of periods is the total number of payments for the loan and Pv is the loan value or the principal. The formula is PMT (Rate, Nper, Pv).

You can keep trying the formula for various combinations and then choose the one with the lowest EMI, though this is a roundabout approach prone to human error.

Bank of Baroda offers car loans and has a wide range of benefits, irrespective of your loan amount or type of vehicle.

With a BoB car loans, you can ride home your dream car in a short period of time. Our loans are designed for those who may be unable to purchase a private vehicle due to paucity of funds.

You can benefit from quick processing, minimal documentation and speedy fund disbursal. Additionally, our loan borrowers are not required to pay foreclosure charges or pre-payment penalty, nor do they need to pay advance EMIs.

With higher limits on the car loan amount, you can avail loans for new cars based on your eligibility. So, if you have always had your eye on a luxury car, our loan can take you one step closer to your dream.

Also, say goodbye to down payment worries, as you can get up to 90% financing on the car’s on-road price with Bank of Baroda’s auto loan.

Bank of Baroda offer attractive interest rates on loans to all our customers based on their credit scores. Additionally, existing home loan borrowers with a good credit history enjoy a concession on their car loan interest rate.