Why Equity Savings Funds Are a Smart Investment Choice

13 Feb 2025

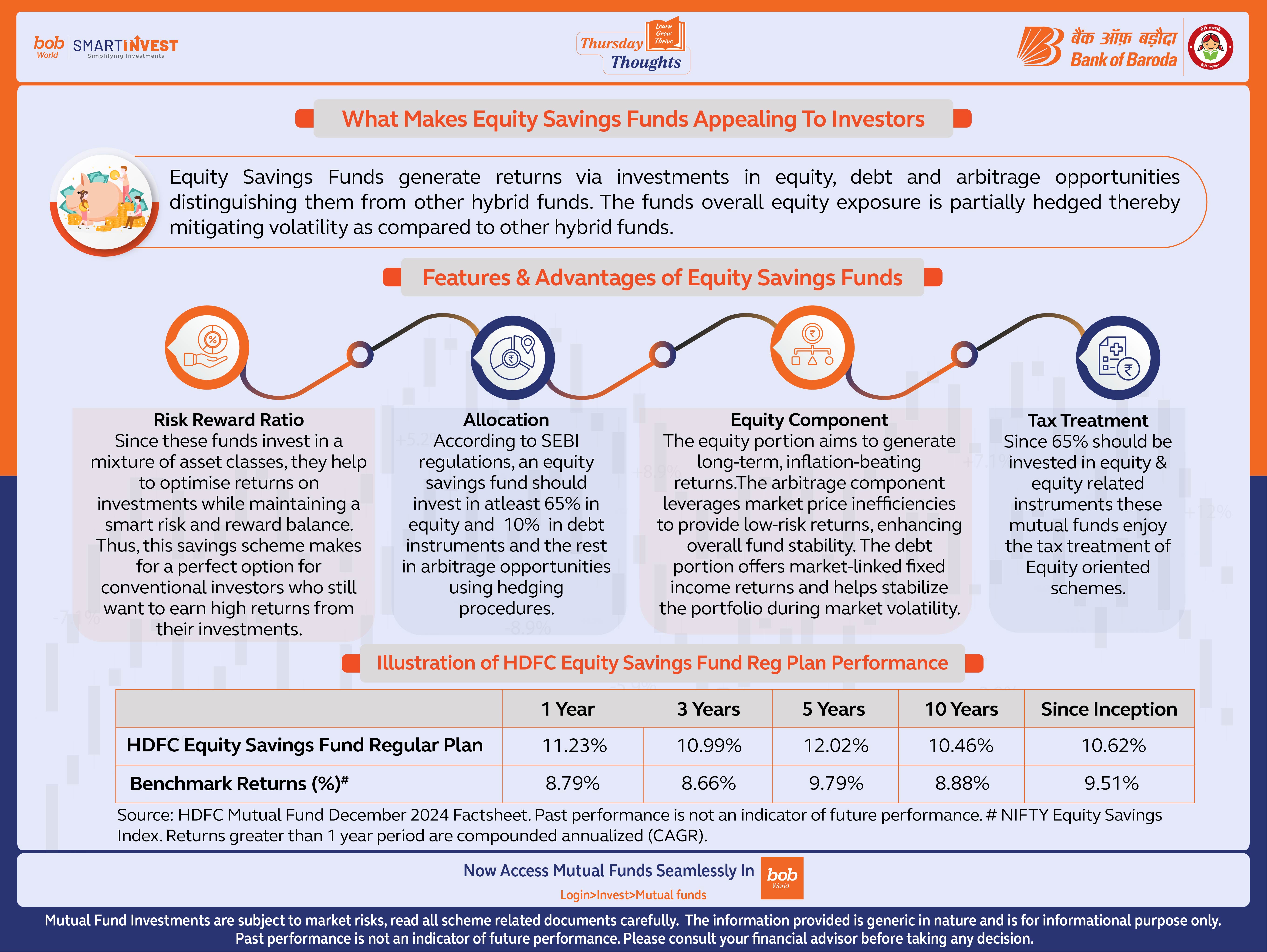

What Makes Equity Savings Funds Appealing To Investors

Equity Savings Funds generate returns via investments in equity, debt and arbitrage opportunities distinguishing them from other hybrid funds. The funds overall equity exposure is partially hedged thereby mitigating volatility as compared to other hybrid funds.

Features & Advantages of Equity Savings Funds

Risk Reward Ratio :

Since these funds invest in a mixture of asset classes, they help to optimise returns on investments while maintaining a smart risk and reward balance. Thus, this savings scheme makes for a perfect option for conventional investors who still want to earn high returns from their investments.

Allocation :

According to SEBI regulations, an equity savings fund should invest in atleast 65% in equity and 10% in debt instruments and the rest in arbitrage opportunities using hedging procedures.

Equity Component :

The equity portion aims to generate long-term, inflation-beating returns.The arbitrage component leverages market price inefficiencies to provide low-risk returns, enhancing overall fund stability. The debt portion offers market-linked fixed income returns and helps stabilize the portfolio during market volatility.

Tax Treatment :

Since 65% should be invested in equity & equity related instruments these mutual funds enjoy the tax treatment of Equity oriented schemes.

Illustration of HDFC Equity Savings Fund Reg Plan Performance

# NIFTY Equity Savings Index. Returns greater than 1 year period are compounded annualized (CAGR).

Mutual Fund Investments are subject to market risks, read all scheme related documents carefully. The information provided is generic in nature and is for informational purpose only. Please consult your financial advisor before taking any decision.

Read morePopular Infographics

Related Infographics

5 Simple Financial Resolutions for 2025: A Guide to Achieving Financial Security

-

Disclaimer

The contents of this article/infographic/picture/video are meant solely for information purposes and do not necessarily reflect the views of Bank of Baroda. The contents are generic in nature and for informational purposes only. It is not a substitute for specific advice in your own circumstances. Bank of Baroda and/ or its Affiliates and its subsidiaries make no representation as to the accuracy; completeness or reliability of any information contained herein or otherwise provided and hereby disclaim any liability with regard to the same. The information is subject to updation, completion, revision, verification and amendment and the same may change materially. The information is not intended for distribution or use by any person in any jurisdiction where such distribution or use would be contrary to law or regulation or would subject Bank of Baroda or its affiliates to any licensing or registration requirements. Bank of Baroda shall not be responsible for any direct/indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information mentioned. Please consult your financial advisor before making any financial decision.