The Smart Way to Repay Your Home Loan

20 Jun 2024

The Smart Way to Repay Your Home Loan

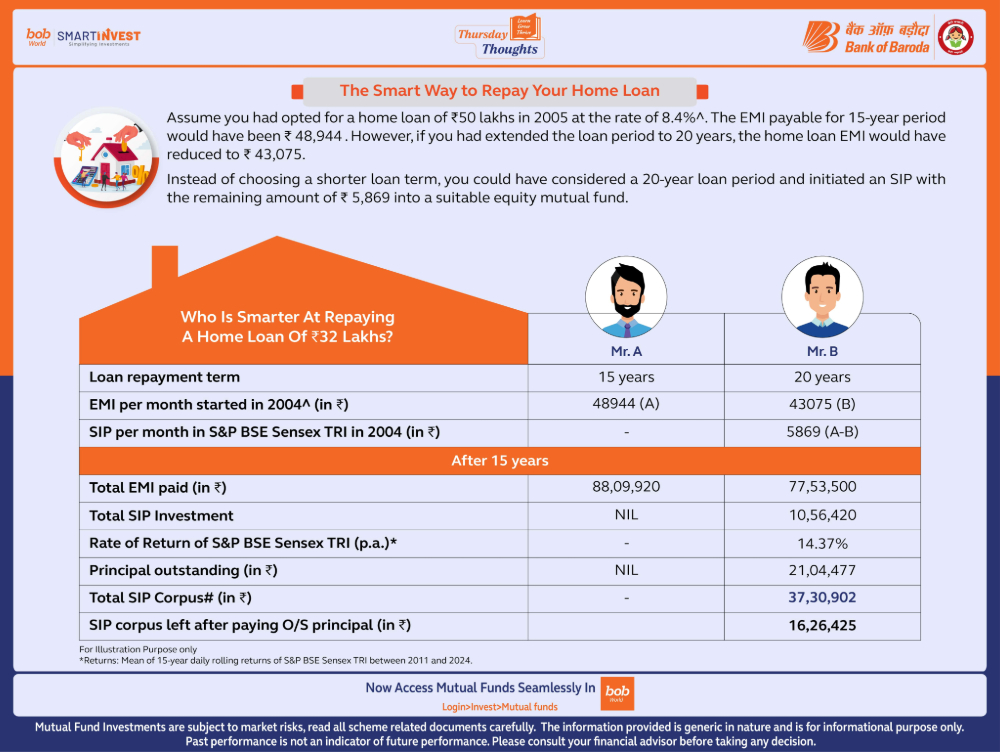

Assume you had opted for a home loan of ₹50 lakhs in 2005 at the rate of 8.4%^. The EMI payable for 15-year period would have been ₹ 48,944 . However, if you had extended the loan period to 20 years, the home loan EMI would have reduced to ₹ 43,075.

Instead of choosing a shorter loan term, you could have considered a 20-year loan period and initiated an SIP with the remaining amount of ₹ 5,869 into a suitable equity mutual fund.

| Who Is Smarter At Repaying A Home Loan Of ₹32 Lakhs? | Mr. A | Mr. B |

|---|---|---|

| Loan repayment term | 15 years | 20 years |

| EMI per month started in 2004 (in ₹) | 48944 (A) | 43075 (B) |

| SIP per month in S&P BSE Sensex TRI in 2004 (in ₹) | - | 5869 (A-B) |

| After 15 years | ||

| Total EMI paid (in ₹) | 88,09,920 | 77,53,500 |

| Total SIP Investment | NIL | 10,56,420 |

| Rate of Return of S&P BSE Sensex TRI (p.a.)* | - | 14.37% |

| Principal outstanding (in ₹) | NIL | 21,04,477 |

| Total SIP Corpus# (in ₹) | - | 37,30,902 |

| SIP corpus left after paying O/S principal (in ₹) | 16,26,425 |

For Illustration Purpose only

*Returns: Mean of 15 year daily rolling returns of S&P BSE Sensex TRI between 2011 and 2024.

Mutual Fund Investments are subject to market risks, read all scheme related documents carefully. The information provided is generic in nature and is for informational purpose only. Please consult your financial advisor before taking any decision.

Popular Infographics

Related Infographics

5 Simple Financial Resolutions for 2025: A Guide to Achieving Financial Security

-

Disclaimer

The contents of this article/infographic/picture/video are meant solely for information purposes and do not necessarily reflect the views of Bank of Baroda. The contents are generic in nature and for informational purposes only. It is not a substitute for specific advice in your own circumstances. Bank of Baroda and/ or its Affiliates and its subsidiaries make no representation as to the accuracy; completeness or reliability of any information contained herein or otherwise provided and hereby disclaim any liability with regard to the same. The information is subject to updation, completion, revision, verification and amendment and the same may change materially. The information is not intended for distribution or use by any person in any jurisdiction where such distribution or use would be contrary to law or regulation or would subject Bank of Baroda or its affiliates to any licensing or registration requirements. Bank of Baroda shall not be responsible for any direct/indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information mentioned. Please consult your financial advisor before making any financial decision.