Union Budget 2024: Updated Mutual Fund Taxation Rates

25 Jul 2024

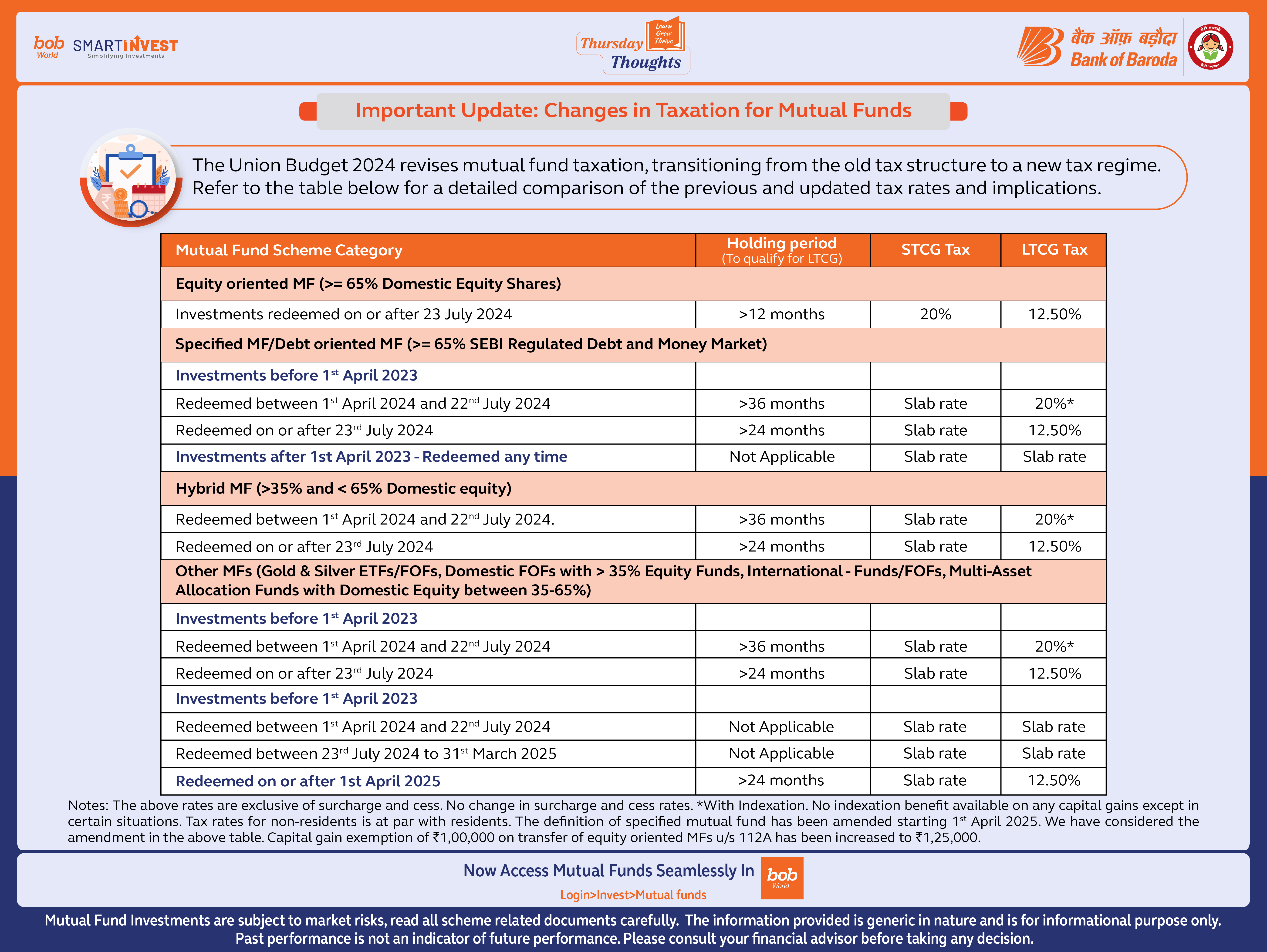

Important Update: Changes in Taxation for Mutual Funds

The Union Budget 2024 revises mutual fund taxation, transitioning from the old tax structure to a new tax regime. Refer to the table below for a detailed comparison of the previous and updated tax rates and implications.

Table

Notes: The above rates are exclusive of surcharge and cess. No change in surcharge and cess rates. *With Indexation. No indexation benefit available on any capital gains except in certain situations. Tax rates for non-residents is at par with residents. The definition of specified mutual fund has been amended starting 1st April 2025. We have considered the amendment in the above table. Capital gain exemption of `S1,00,000 on transfer of equity oriented MFs u/s 112A has been increased to `1,25,000.

Mutual Fund Investments are subject to market risks, read all scheme related documents carefully. The information provided is generic in nature and is for informational purpose only. Please consult your financial advisor before taking any decision.

Read morePopular Infographics

Related Infographics

5 Simple Financial Resolutions for 2025: A Guide to Achieving Financial Security

-

Disclaimer

The contents of this article/infographic/picture/video are meant solely for information purposes and do not necessarily reflect the views of Bank of Baroda. The contents are generic in nature and for informational purposes only. It is not a substitute for specific advice in your own circumstances. Bank of Baroda and/ or its Affiliates and its subsidiaries make no representation as to the accuracy; completeness or reliability of any information contained herein or otherwise provided and hereby disclaim any liability with regard to the same. The information is subject to updation, completion, revision, verification and amendment and the same may change materially. The information is not intended for distribution or use by any person in any jurisdiction where such distribution or use would be contrary to law or regulation or would subject Bank of Baroda or its affiliates to any licensing or registration requirements. Bank of Baroda shall not be responsible for any direct/indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information mentioned. Please consult your financial advisor before making any financial decision.