The Importance of Time Value of Money: Why It Matters for Your Finances

19 Sep 2024

Importance of Time Value of Money

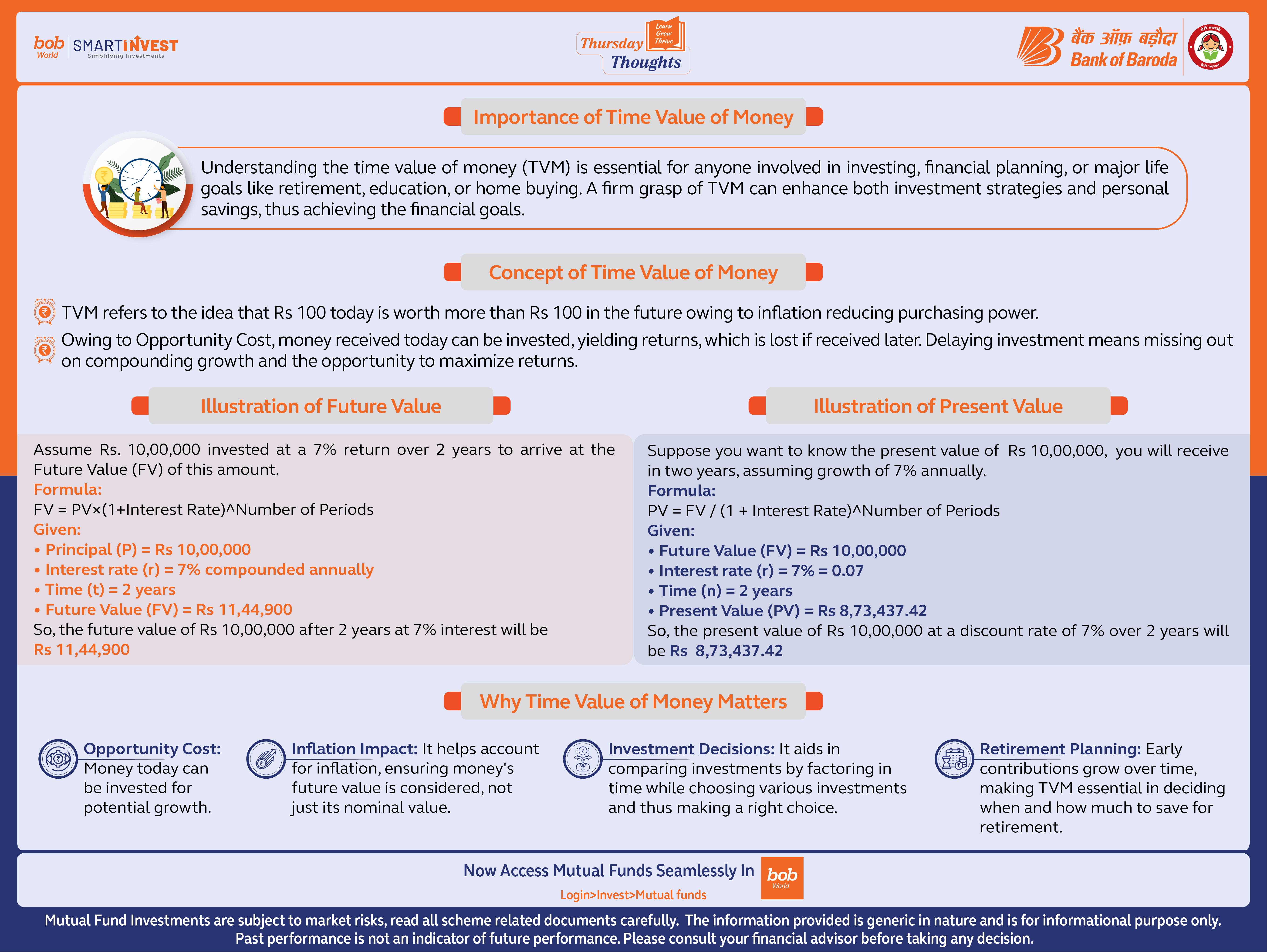

Understanding the time value of money (TVM) is essential for anyone involved in investing, financial planning, or major life goals like retirement, education, or home buying. A firm grasp of TVM can enhance both investment strategies and personal savings, thus achieving the financial goals.

Concept of Time Value of Money

- TVM refers to the idea that Rs 100 today is worth more than Rs 100 in the future owing to inflation reducing purchasing power.

- Owing to Opportunity Cost, money received today can be invested, yielding returns, which is lost if received later. Delaying investment means missing out on compounding growth and the opportunity to maximize returns.

Illustration of Future Value

Assume Rs. 10,00,000 invested at a 7% return over 2 years to arrive at the

Future Value (FV) of this amount.

Formula:

FV = PV×(1+Interest Rate)^Number of Periods

Given:

- Principal (P) = Rs 10,00,000

- Interest rate (r) = 7% compounded annually

- Time (t) = 2 years

- Future Value (FV) = Rs 11,44,900

So, the future value of Rs 10,00,000 after 2 years at 7% interest will be

Rs 11,44,900

Illustration of Present Value

Suppose you want to know the present value of Rs 10,00,000, you will receive

in two years, assuming growth of 7% annually.

Formula:

PV = FV / (1 + Interest Rate)^Number of Periods

Given:

- Future Value (FV) = Rs 10,00,000

- Interest rate (r) = 7% = 0.07

- Time (n) = 2 years

- Present Value (PV) = Rs 8,73,437.42

So, the present value of Rs 10,00,000 at a discount rate of 7% over 2 years will

be Rs 8,73,437.42

Why Time Value of Money Matters

• Opportunity Cost :

Money today can be invested for potential growth.

• Inflation Impact :

It helps account for inflation, ensuring money's future value is considered, not just its nominal value.

• Investment Decisions :

It aids in comparing investments by factoring in time while choosing various investments and thus making a right choice

• Retirement Planning :

Early contributions grow over time, making TVM essential in deciding when and how much to save for retirement.

Popular Infographics

Related Infographics

-

Disclaimer

The contents of this article/infographic/picture/video are meant solely for information purposes and do not necessarily reflect the views of Bank of Baroda. The contents are generic in nature and for informational purposes only. It is not a substitute for specific advice in your own circumstances. Bank of Baroda and/ or its Affiliates and its subsidiaries make no representation as to the accuracy; completeness or reliability of any information contained herein or otherwise provided and hereby disclaim any liability with regard to the same. The information is subject to updation, completion, revision, verification and amendment and the same may change materially. The information is not intended for distribution or use by any person in any jurisdiction where such distribution or use would be contrary to law or regulation or would subject Bank of Baroda or its affiliates to any licensing or registration requirements. Bank of Baroda shall not be responsible for any direct/indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information mentioned. Please consult your financial advisor before making any financial decision.