Six Reasons to Start a Systematic Investment Plan (SIP) Today

30 May 2024

Six Reasons for Starting an SIP

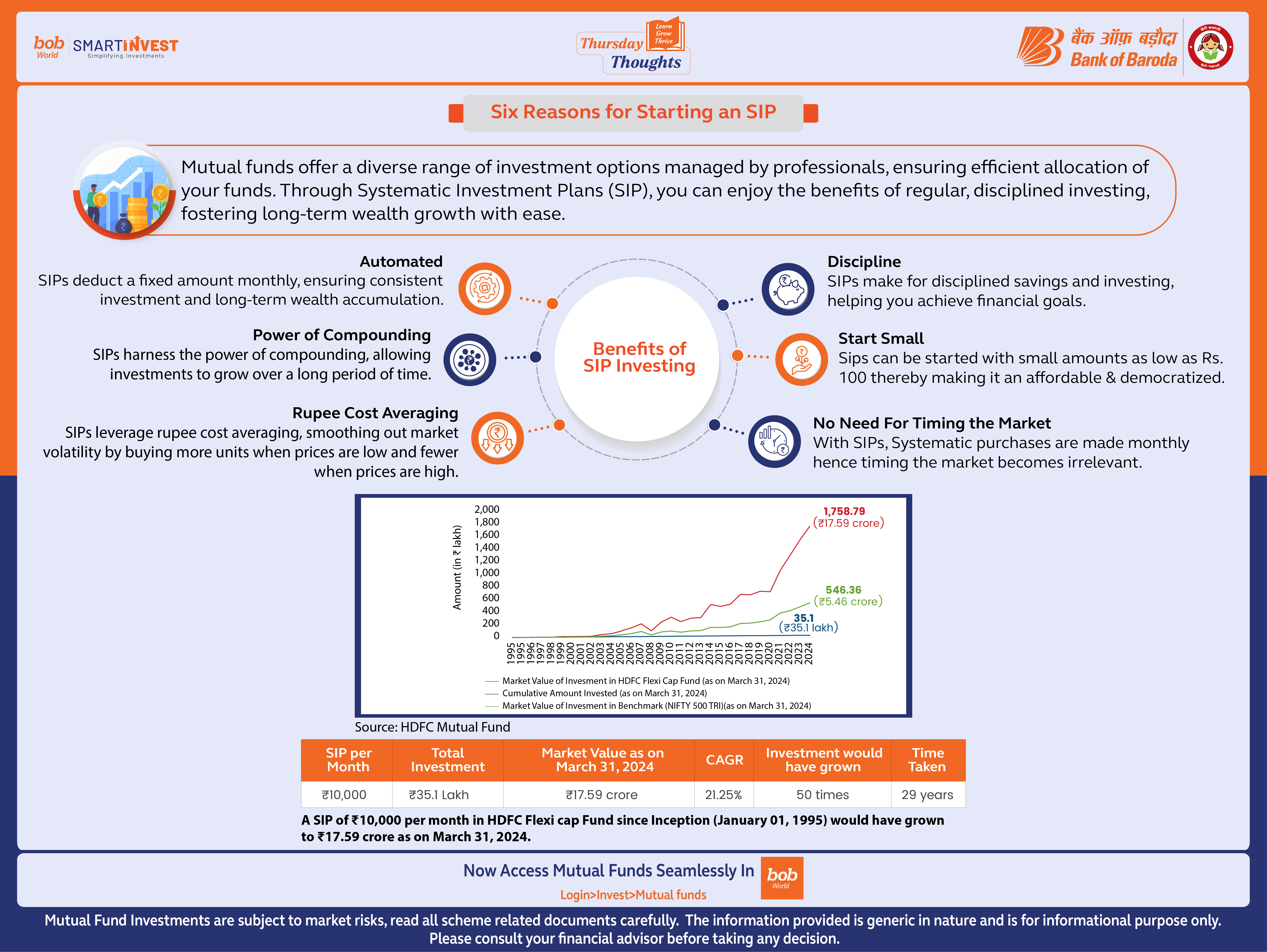

Mutual funds o¬er a diverse range of investment options managed by professionals, ensuring e cient allocation of your funds. Through Systematic Investment Plans (SIP), you can enjoy the benefits of regular, disciplined investing, fostering long-term wealth growth with ease.

Benefits of SIP Investing

Automated

SIPs deduct a fixed amount monthly, ensuring consistent investment and long-term wealth accumulation.

Power of Compounding

SIPs harness the power of compounding, allowing investments to grow over a long period of time.

Start Small

Sips can be started with small amounts as low as Rs. 100 thereby making it an adorable & democratized.

No Need for Timing the Market

With SIPs, Systematic purchases are made monthly hence timing the market becomes irrelevant.

Rupee Cost Averaging

SIPs leverage rupee cost averaging, smoothing out market, volatility by buying more units when prices are low and fewer when prices are high.

Discipline

SIPs make for disciplined savings and investing, helping you achieve financial goals.

Though these are important parameters however there are other factors too like the fund managers hypothesis, market dynamics and others that an investor should consider while making any decision. This information just serves as a guide, and individuals should seek advice from a certified financial expert prior to making any investment decision.

Mutual Fund Investments are subject to market risks, read all scheme related documents carefully. The information provided is generic in nature and is for informational purpose only. Please consult your financial advisor before taking any decision.

Popular Infographics

Related Infographics

5 Simple Financial Resolutions for 2025: A Guide to Achieving Financial Security

-

Disclaimer

The contents of this article/infographic/picture/video are meant solely for information purposes and do not necessarily reflect the views of Bank of Baroda. The contents are generic in nature and for informational purposes only. It is not a substitute for specific advice in your own circumstances. Bank of Baroda and/ or its Affiliates and its subsidiaries make no representation as to the accuracy; completeness or reliability of any information contained herein or otherwise provided and hereby disclaim any liability with regard to the same. The information is subject to updation, completion, revision, verification and amendment and the same may change materially. The information is not intended for distribution or use by any person in any jurisdiction where such distribution or use would be contrary to law or regulation or would subject Bank of Baroda or its affiliates to any licensing or registration requirements. Bank of Baroda shall not be responsible for any direct/indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information mentioned. Please consult your financial advisor before making any financial decision.