Maximize Long-Term Growth with Consistent SIPs

29 Aug 2024

Why Investors Can Consider Large and Mid Cap Funds

Large and mid-cap funds are an attractive investment option for investors seeking long-term capital appreciation and diversification. These funds combine the stability of established companies with the growth potential of mid-sized firms, offering a well-rounded approach to investing.

Role of Large and Mid Market Caps

As the name suggests, Large and Mid Cap companies are the cornerstones of this fund category. Collectively, these two market caps offer a combination of stability and growth opportunities in a single fund.

Large Cap Stocks

Large-cap stocks are primariliy the top 100 companeis my market capitalization. These are market leaders and form a foundation stone for a well-diversified portfolio. They tend to exhibit lower volatility during market correction thus making them an optimal option for investors.

Mid Cap Stocks

Mid-caps stocks are companies that are ranked 101-250 by market capitalization. They tend to offer a balance of risk and reward. While they may exhibit higher volatility compared to large-caps, they often possess significant growth potential thereby having a potential to generate a better alpha.

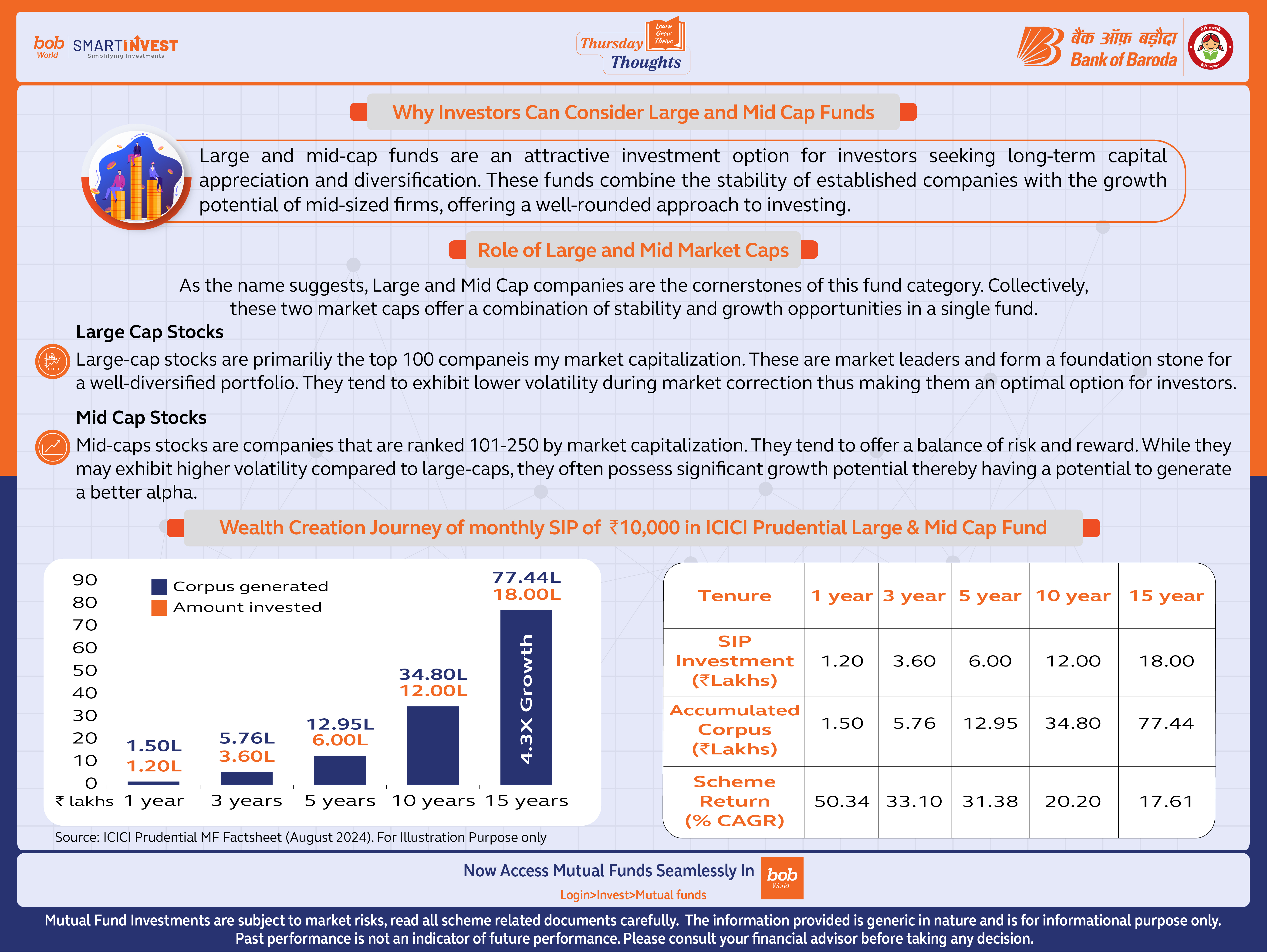

Wealth Creation Journey of monthly SIP of Rs.10,000 in ICICI Prudential Large & Mid Cap Fund

Mutual Fund Investments are subject to market risks, read all scheme related documents carefully. The information provided is generic in nature and is for informational purpose only. Please consult your financial advisor before taking any decision.

Popular Infographics

Related Infographics

5 Simple Financial Resolutions for 2025: A Guide to Achieving Financial Security

-

Disclaimer

The contents of this article/infographic/picture/video are meant solely for information purposes and do not necessarily reflect the views of Bank of Baroda. The contents are generic in nature and for informational purposes only. It is not a substitute for specific advice in your own circumstances. Bank of Baroda and/ or its Affiliates and its subsidiaries make no representation as to the accuracy; completeness or reliability of any information contained herein or otherwise provided and hereby disclaim any liability with regard to the same. The information is subject to updation, completion, revision, verification and amendment and the same may change materially. The information is not intended for distribution or use by any person in any jurisdiction where such distribution or use would be contrary to law or regulation or would subject Bank of Baroda or its affiliates to any licensing or registration requirements. Bank of Baroda shall not be responsible for any direct/indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information mentioned. Please consult your financial advisor before making any financial decision.