Why Investing in India’s Manufacturing Sector is a Smart Move

06 Jun 2024

Making The Most of India’s Manufacturing Sector Potential

India’s manufacturing sector is on the cusp of a holistic surge, driven by a potent combination of government initiatives and expanding domestic market. One way to capitalize on this exciting opportunity is by investing in a dedicated fund which further invests in various avenues in the manufacturing theme.

Why Invest in Manufacturing Sector

Government Support:

The government has launched initiatives like Skill India, Atmanirbhar Bharat, and PLI schemes, providing technical and financial support for local manufacturing. Reforms like GST promote transparency and enhance the business environment.

Focus on Infrastructure:

The government’s emphasis on improving overall infrastructure by constructing massive expressways and highways, increasing the railway network, adding more airports and ports is an advantage for the sector.

Demographic Dividend:

India benefits from having a sizable, youthful, educated, and tech-savvy population, which gives the manufacturing sector a competitive edge in terms of pricing.

Though these are important parameters however there are other factors too like the fund managers hypothesis, market dynamics and others that an investor should consider while making any decision. This information just serves as a guide, and individuals should seek advice from a certified financial expert prior to making any investment decision.

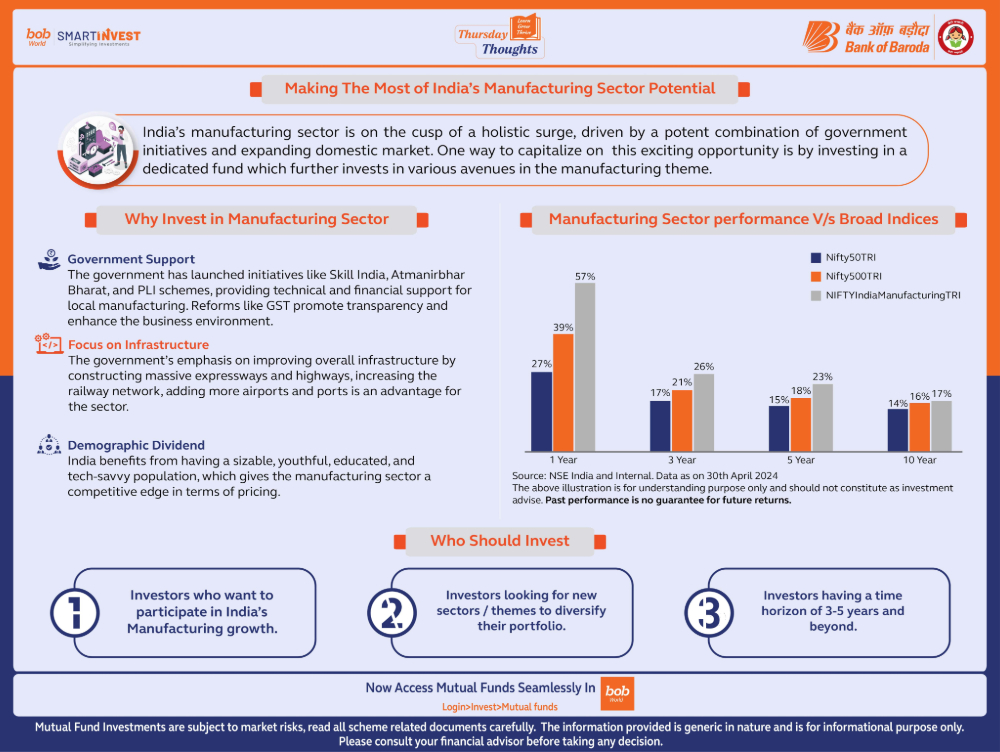

Manufacturing Sector performance V/s Board Indices

| Index | 1 Year | 3 Year | 5 Year | 10 Year |

|---|---|---|---|---|

| Nifty50TRI | 27% | 17% | 15% | 14% |

| Nifty500TRI | 39% | 21% | 18% | 16% |

| NiftyIndiaManufacturingTRI | 57% | 26% | 23% | 17% |

The Above illustration is for understanding purpose only and should not constitute as investment advise.

Past performance is on guarantee for future returns.

Who Should Invest

Investors who want to participate in India’s Manufacturing growth.

Investors looking for new sectors / themes to diversify their portfolio.

Investors having a time horizon of 3-5 years and beyond.

Mutual Fund Investments are subject to market risks, read all scheme related documents carefully. The information provided is generic in nature and is for informational purpose only. Please consult your financial advisor before taking any decision.

Popular Infographics

Related Infographics

5 Simple Financial Resolutions for 2025: A Guide to Achieving Financial Security

-

Disclaimer

The contents of this article/infographic/picture/video are meant solely for information purposes and do not necessarily reflect the views of Bank of Baroda. The contents are generic in nature and for informational purposes only. It is not a substitute for specific advice in your own circumstances. Bank of Baroda and/ or its Affiliates and its subsidiaries make no representation as to the accuracy; completeness or reliability of any information contained herein or otherwise provided and hereby disclaim any liability with regard to the same. The information is subject to updation, completion, revision, verification and amendment and the same may change materially. The information is not intended for distribution or use by any person in any jurisdiction where such distribution or use would be contrary to law or regulation or would subject Bank of Baroda or its affiliates to any licensing or registration requirements. Bank of Baroda shall not be responsible for any direct/indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information mentioned. Please consult your financial advisor before making any financial decision.