Understanding the Importance of Retirement Planning

09 May 2024

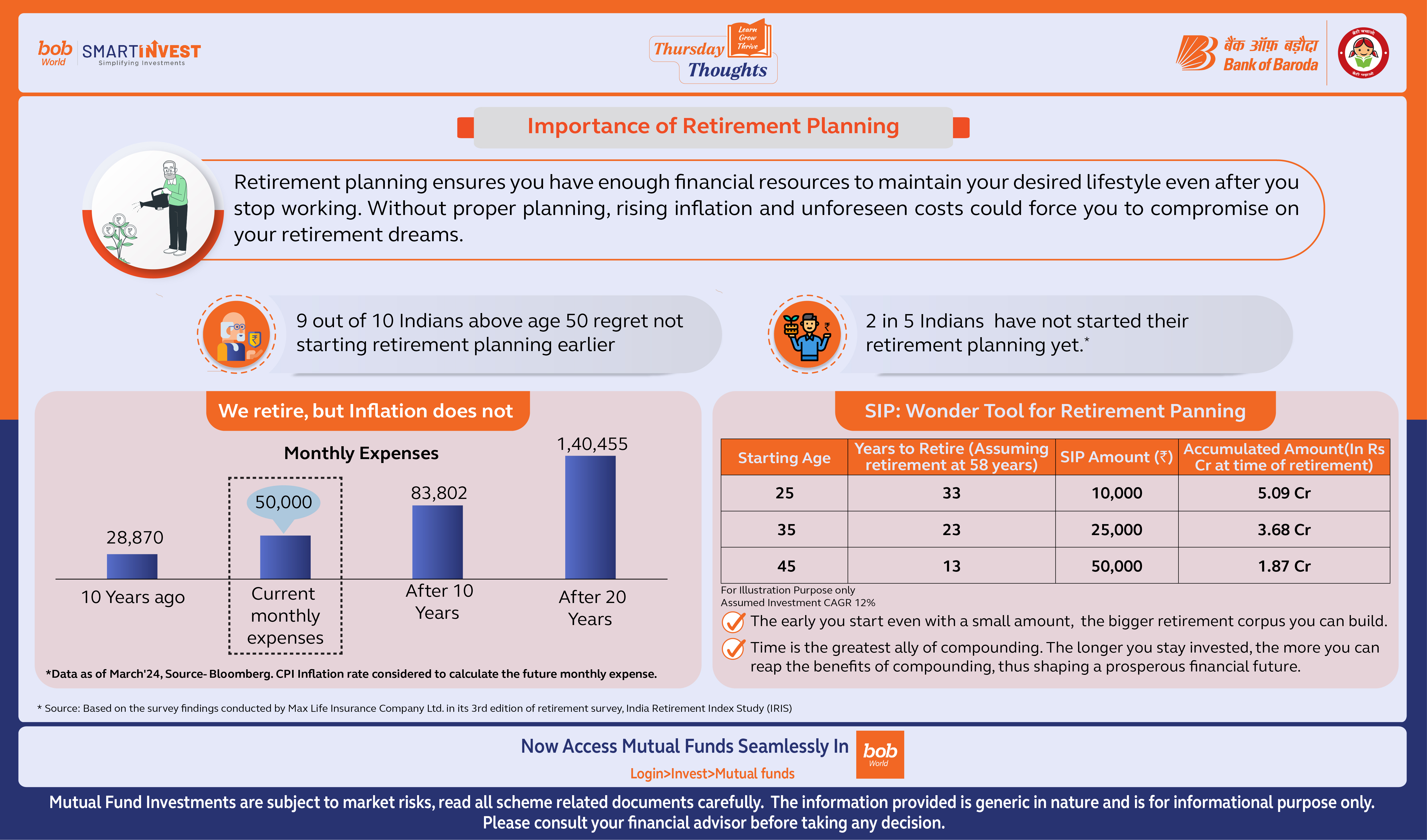

Importance of Retirement Planning

Retirement planning ensures you have enough financial resources to maintain your desired lifestyle even after you stop working. Without proper planning, rising inflation and unforeseen costs could force you to compromise on your retirement dreams.

- 9 out of 10 Indians above age 50 regret not starting retirement planning earlier

- 2 in 5 Indians have not started their retirement planning yet.*

* Source: Based on the survey findings conducted by Max Life Insurance Company Ltd. in its 3rd edition of retirement survey, India Retirement Index Study (IRIS)

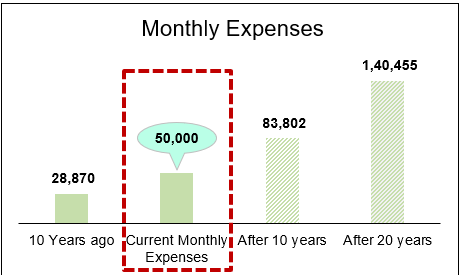

We retire, but Inflation does not

Data as of Mar-24 Source: Bloomberg and Internal Analysis. CPI inflation rate considered to calculate the future monthly expense amount.

SIP the Wonder Tool for Retirement Panning

Insert table

The early you start even with a small amount, the bigger retirement corpus you can build.

Time is the greatest ally of compounding. The longer you stay invested, the more you can reap the benefits of compounding, thus shaping a prosperous financial future.

Mutual Fund Investments are subject to market risks, read all scheme related documents carefully. The information provided is generic in nature and is for informational purpose only. Please consult your financial advisor before taking any decision.

Popular Infographics

Related Infographics

5 Simple Financial Resolutions for 2025: A Guide to Achieving Financial Security

-

Disclaimer

The contents of this article/infographic/picture/video are meant solely for information purposes and do not necessarily reflect the views of Bank of Baroda. The contents are generic in nature and for informational purposes only. It is not a substitute for specific advice in your own circumstances. Bank of Baroda and/ or its Affiliates and its subsidiaries make no representation as to the accuracy; completeness or reliability of any information contained herein or otherwise provided and hereby disclaim any liability with regard to the same. The information is subject to updation, completion, revision, verification and amendment and the same may change materially. The information is not intended for distribution or use by any person in any jurisdiction where such distribution or use would be contrary to law or regulation or would subject Bank of Baroda or its affiliates to any licensing or registration requirements. Bank of Baroda shall not be responsible for any direct/indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information mentioned. Please consult your financial advisor before making any financial decision.