How to Choose the Right Mutual Fund

02 May 2024

There Is More to Mutual Funds Than Returns

Selecting mutual funds based on parameters beyond returns is a wise approach, as it gives a more comprehensive view of the fund’s performance, risk, and suitability to your investment goals and risk tolerance.

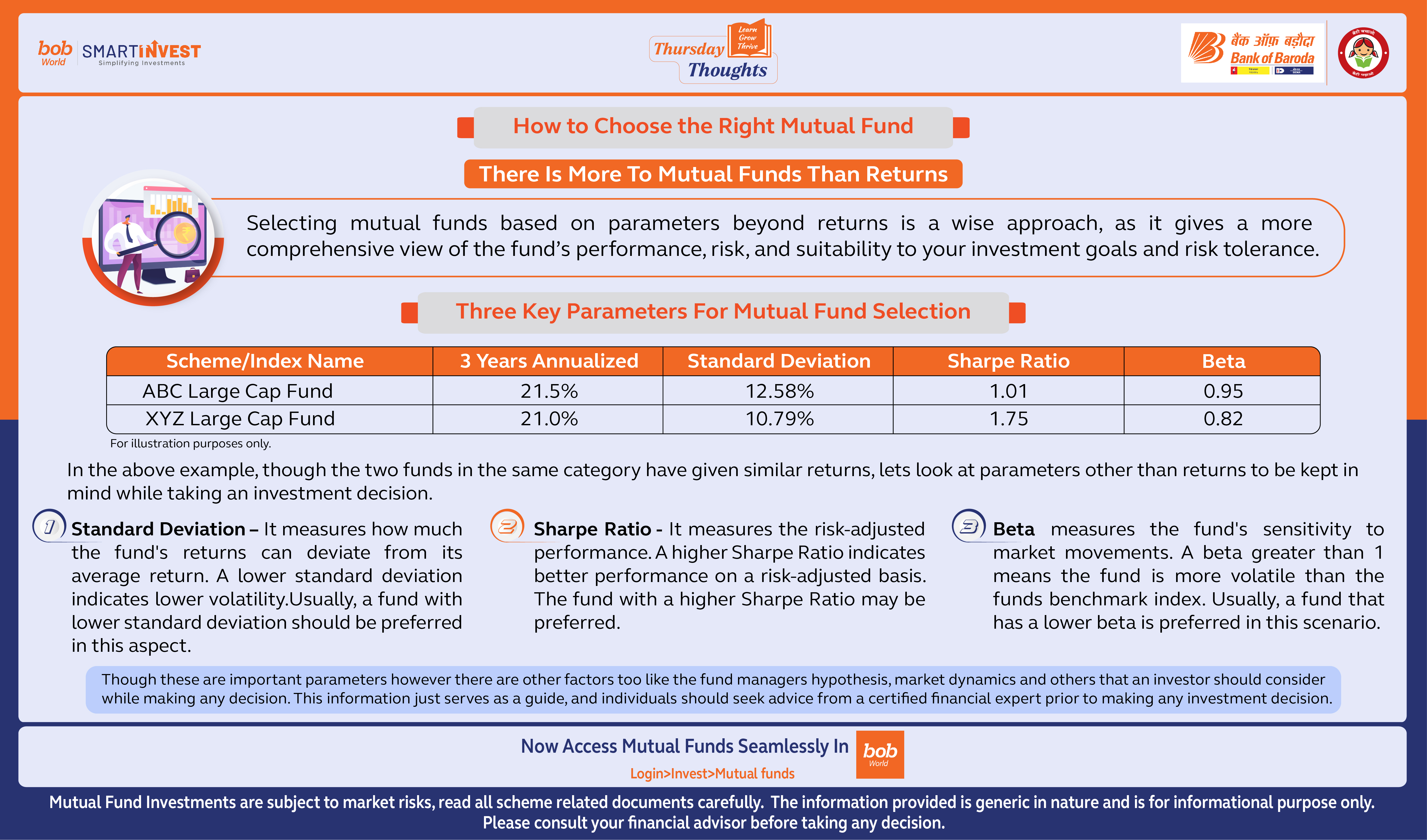

Three Key Parameters for Mutual Fund Selection

INESERT TABLE

In the above example, though the two funds in the same category have given similar returns, lets look at parameters other than returns to be kept in mind while taking an investment decision.

- Standard Deviation – It measures how much the fund's returns can deviate from its average return. A lower standard deviation indicates lower volatility.Usually, a fund with lower standard deviation should be preferred in this aspect.

- Sharpe Ratio- It measures the risk-adjusted performance. A higher Sharpe Ratio indicates better performance on a risk-adjusted basis. The fund with a higher Sharpe Ratio may be preferred.

- Beta measures the fund's sensitivity to market movements. A beta greater than 1 means the fund is more volatile than the funds benchmark index. Usually, a fund that has a lower beta is preferred in this scenario.

Though these are important parameters however there are other factors too like the fund managers hypothesis, market dynamics and others that an investor should consider while making any decision. This information just serves as a guide, and individuals should seek advice from a certified financial expert prior to making any investment decision.

Mutual Fund Investments are subject to market risks, read all scheme related documents carefully. The information provided is generic in nature and is for informational purpose only. Please consult your financial advisor before taking any decision.

Popular Infographics

Related Infographics

5 Simple Financial Resolutions for 2025: A Guide to Achieving Financial Security

-

Disclaimer

The contents of this article/infographic/picture/video are meant solely for information purposes and do not necessarily reflect the views of Bank of Baroda. The contents are generic in nature and for informational purposes only. It is not a substitute for specific advice in your own circumstances. Bank of Baroda and/ or its Affiliates and its subsidiaries make no representation as to the accuracy; completeness or reliability of any information contained herein or otherwise provided and hereby disclaim any liability with regard to the same. The information is subject to updation, completion, revision, verification and amendment and the same may change materially. The information is not intended for distribution or use by any person in any jurisdiction where such distribution or use would be contrary to law or regulation or would subject Bank of Baroda or its affiliates to any licensing or registration requirements. Bank of Baroda shall not be responsible for any direct/indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information mentioned. Please consult your financial advisor before making any financial decision.