How to Invest in Gold for Maximum Returns in the Upcoming Budget 2024-25

08 Aug 2024

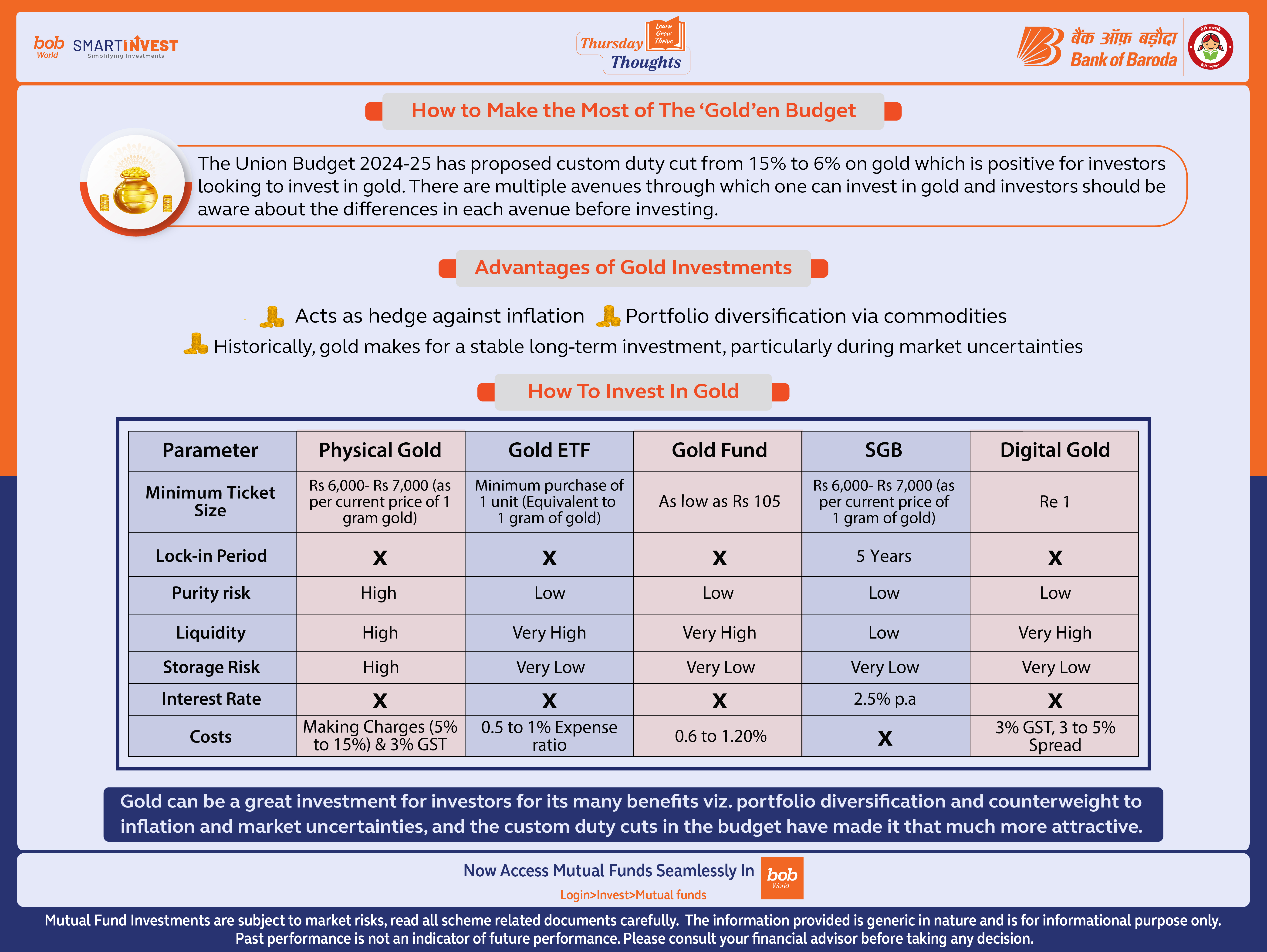

How to Make the Most of The ‘Gold’en Budget

The Union Budget 2024-25 has proposed custom duty cut from 15% to 6% on gold which is positive for investors looking to invest in gold. There are multiple avenues through which one can invest in gold and investors should be aware about the differences in each avenue before investing.

Advantages of Gold Investments

Acts as hedge against inflation

Portfolio diversification via commodities

Historically, gold makes for a stable long-term investment, particularly during market uncertainties

Gold can be a great investment for investors for its many benefits viz. portfolio diversification and counterweight to inflation and market uncertainties, and the custom duty cuts in the budget have made it that much more attractive.

Read more

Popular Infographics

Related Infographics

5 Simple Financial Resolutions for 2025: A Guide to Achieving Financial Security

-

Disclaimer

The contents of this article/infographic/picture/video are meant solely for information purposes and do not necessarily reflect the views of Bank of Baroda. The contents are generic in nature and for informational purposes only. It is not a substitute for specific advice in your own circumstances. Bank of Baroda and/ or its Affiliates and its subsidiaries make no representation as to the accuracy; completeness or reliability of any information contained herein or otherwise provided and hereby disclaim any liability with regard to the same. The information is subject to updation, completion, revision, verification and amendment and the same may change materially. The information is not intended for distribution or use by any person in any jurisdiction where such distribution or use would be contrary to law or regulation or would subject Bank of Baroda or its affiliates to any licensing or registration requirements. Bank of Baroda shall not be responsible for any direct/indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information mentioned. Please consult your financial advisor before making any financial decision.