The Role of Gold Investments in a Diversified Portfolio

27 Feb 2025

How Gold Can Be Useful For Portfolio Diversification

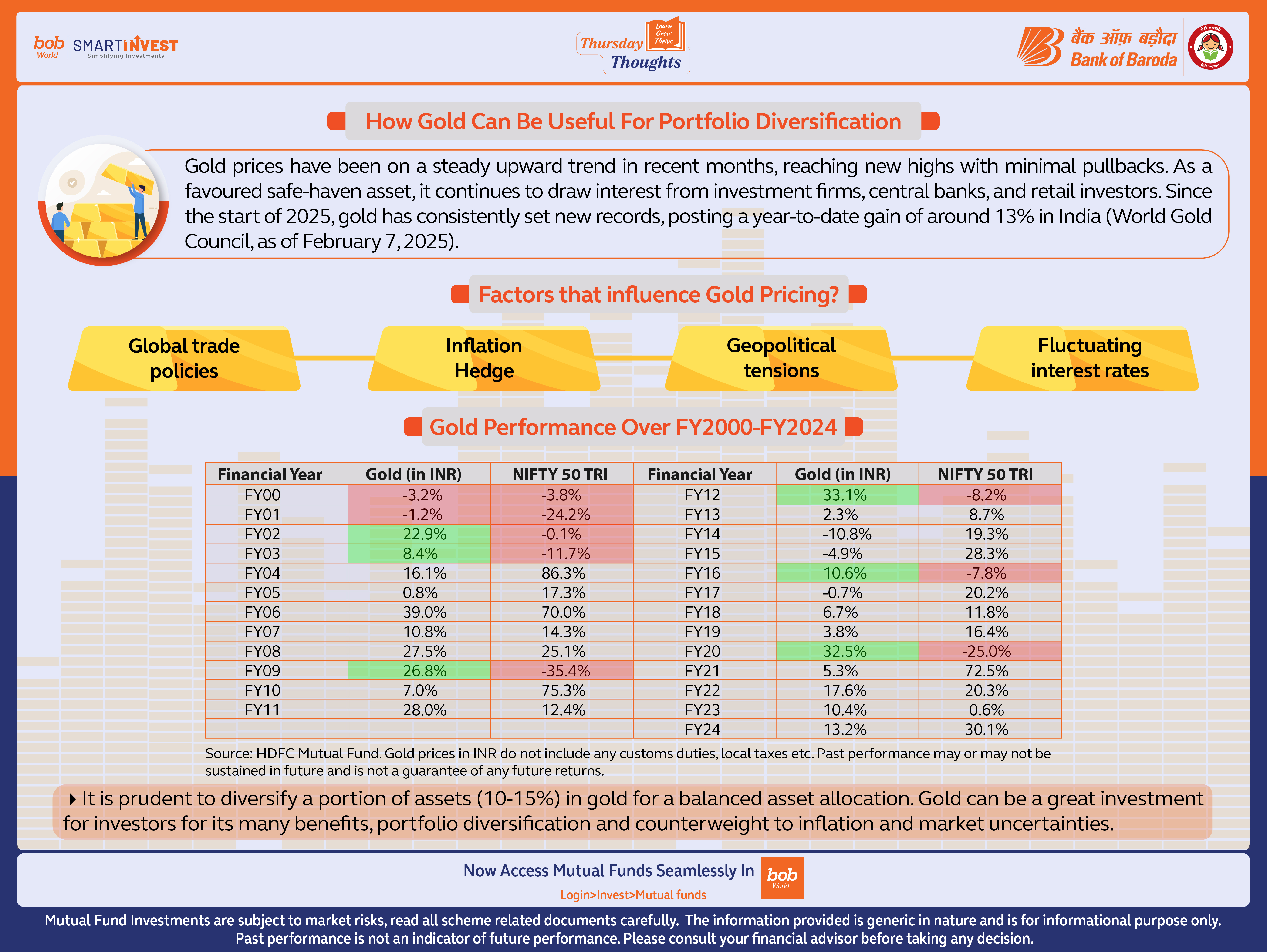

Gold prices have been on a steady upward trend in recent months, reaching new highs with minimal pullbacks. As a favored safe-haven asset, it continues to draw interest from investment firms, central banks, and retail investors. Since the start of 2025, gold has consistently set new records, posting a year-to-date gain of around 13% in India (World Gold Council, as of February 7, 2025).

Why Gold Prices Are Rising?

Global trade policies Inflation Hedge Geopolitical tensions, Fluctuating interest rates

Gold Performance Over FY2000-FY2024

It is prudent to diversify a portion of assets (10-15%) in gold for a balanced asset allocation. Gold can be a great investment for investors for its many benefits, portfolio diversification and counterweight to inflation and market uncertainties.

Mutual Fund Investments are subject to market risks, read all scheme related documents carefully. The information provided is generic in nature and is for informational purpose only. Please consult your financial advisor before taking any decision.

Read morePopular Infographics

Related Infographics

5 Simple Financial Resolutions for 2025: A Guide to Achieving Financial Security

-

Disclaimer

The contents of this article/infographic/picture/video are meant solely for information purposes and do not necessarily reflect the views of Bank of Baroda. The contents are generic in nature and for informational purposes only. It is not a substitute for specific advice in your own circumstances. Bank of Baroda and/ or its Affiliates and its subsidiaries make no representation as to the accuracy; completeness or reliability of any information contained herein or otherwise provided and hereby disclaim any liability with regard to the same. The information is subject to updation, completion, revision, verification and amendment and the same may change materially. The information is not intended for distribution or use by any person in any jurisdiction where such distribution or use would be contrary to law or regulation or would subject Bank of Baroda or its affiliates to any licensing or registration requirements. Bank of Baroda shall not be responsible for any direct/indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information mentioned. Please consult your financial advisor before making any financial decision.