5 Simple Financial Resolutions for 2025: A Guide to Achieving Financial Security

02 Jan 2025

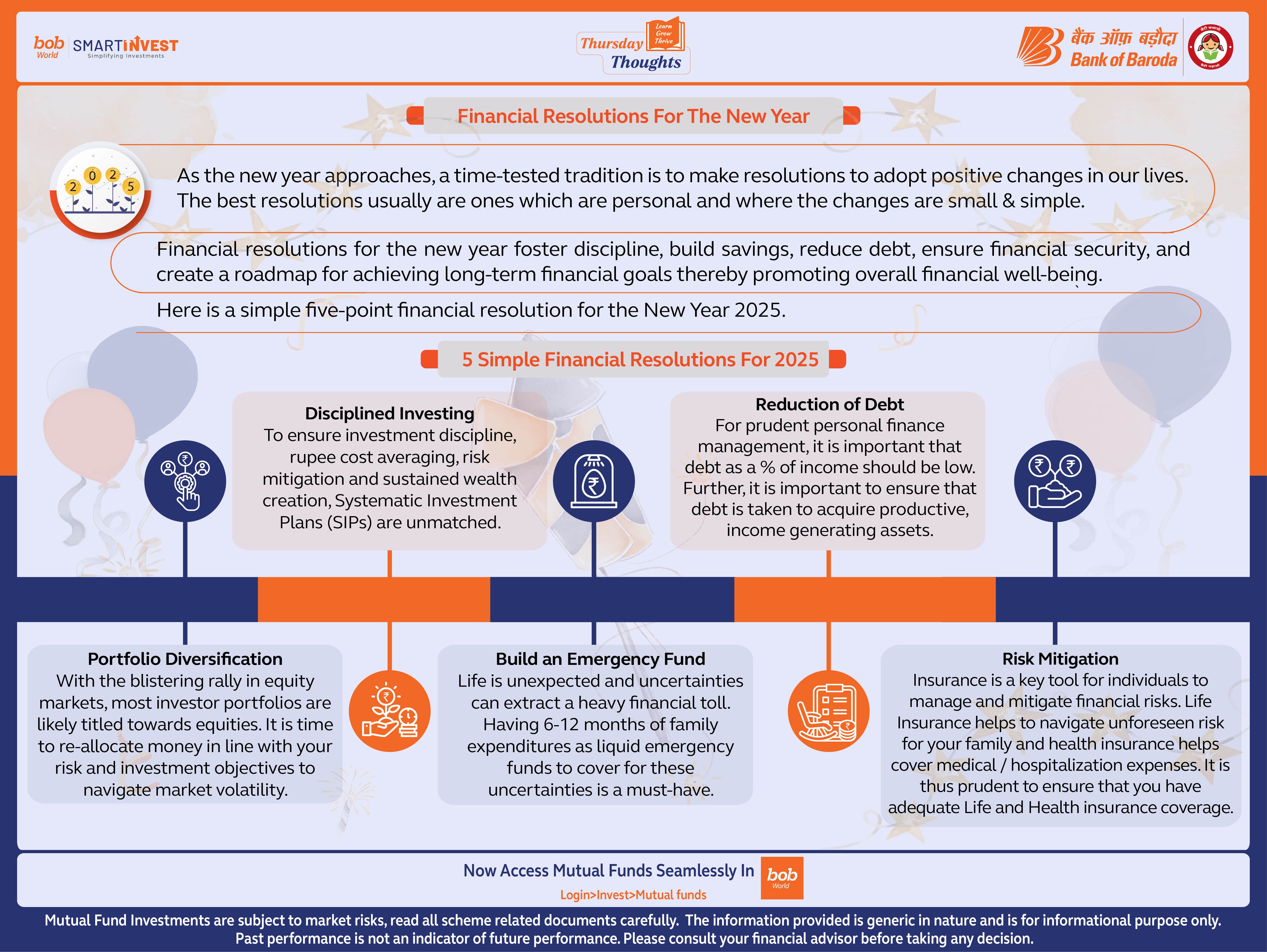

Financial resolutions for the New Year

As the new year approaches, a time-tested tradition is to make resolutions to adopt positive changes in our lives. The best resolutions usually are ones which are personal and where the changes are small & simple.

Financial resolutions for the new year foster discipline, build savings, reduce debt, ensure financial security, and create a roadmap for achieving long-term financial goals thereby promoting overall financial well-being.

Here is a simple five-point financial resolution for the New Year 2025.

5 simple financial resolutions for 2025

Portfolio Diversification

With the blistering rally in equity markets, most investor portfolios are likely titled towards equities. It is time to re-allocate money in line with your risk and investment objectives to navigate market volatility.

Disciplined Investing

To ensure investment discipline, rupee cost averaging, risk mitigation and sustained wealth creation, Systematic Investment Plans (SIPs) are unmatched.

Build an Emergency Fund

Life is unexpected and uncertainties can extract a heavy financial toll. Having 6-12 months of family expenditures as liquid emergency funds to cover for these uncertainties is a must-have.

Reduction of Debt

For prudent personal finance management, it is important that debt as a % of income should be low. Further, it is important to ensure that debt is taken to acquire productive, income generating assets.

Risk Mitigation

Insurance is a key tool for individuals to manage and mitigate financial risks. Life Insurance helps to navigate unforeseen risk for your family and health insurance helps cover medical / hospitalization expenses. It is thus prudent to ensure that you have adequate Life and Health insurance coverage.

Mutual Fund Investments are subject to market risks, read all scheme related documents carefully. The information provided is generic in nature and is for informational purpose only. Please consult your financial advisor before taking any decision.

Read morePopular Infographics

Related Infographics

-

Disclaimer

The contents of this article/infographic/picture/video are meant solely for information purposes and do not necessarily reflect the views of Bank of Baroda. The contents are generic in nature and for informational purposes only. It is not a substitute for specific advice in your own circumstances. Bank of Baroda and/ or its Affiliates and its subsidiaries make no representation as to the accuracy; completeness or reliability of any information contained herein or otherwise provided and hereby disclaim any liability with regard to the same. The information is subject to updation, completion, revision, verification and amendment and the same may change materially. The information is not intended for distribution or use by any person in any jurisdiction where such distribution or use would be contrary to law or regulation or would subject Bank of Baroda or its affiliates to any licensing or registration requirements. Bank of Baroda shall not be responsible for any direct/indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information mentioned. Please consult your financial advisor before making any financial decision.