Chhoti SIP – Small Investments for Big Financial Growth

06 Mar 2025

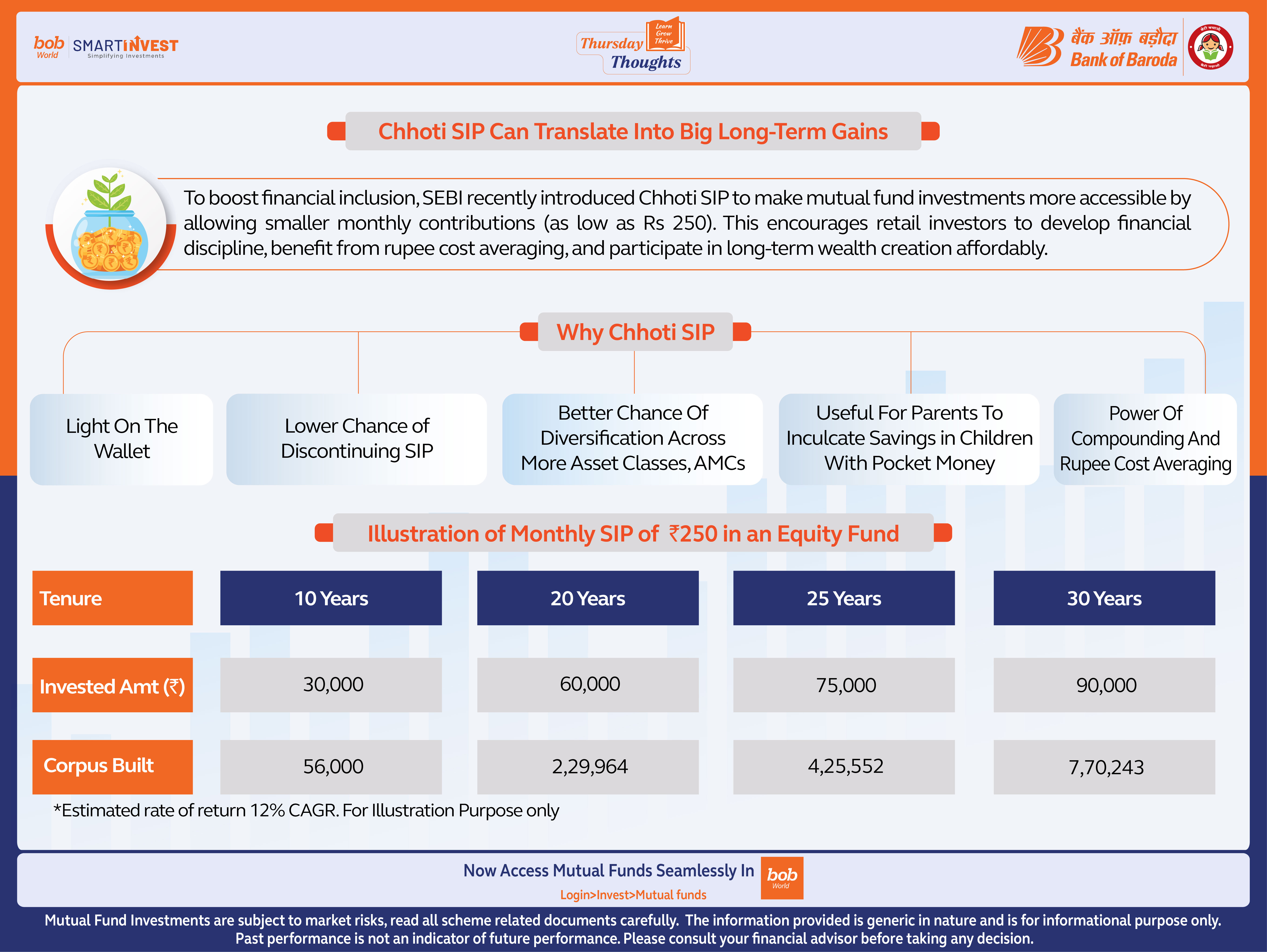

Chhoti SIP Can Translate Into Big Long-Term Gains

To boost financial inclusion, SEBI recently introduced Chhoti SIP to make mutual fund investments more accessible by allowing smaller monthly contributions (as low as Rs 250). This encourages retail investors to develop financial discipline, benefit from rupee cost averaging, and participate in long-term wealth creation affordably.

Why Chhoti SIP

Light On The Wallet

Lower Chance of Discontinuing SIP

Better Chance Of Diversification Across More Asset Classes, AMCs

Useful For Parents To Inculcate Savings in Children With Pocket Money

Power Of Compounding And Rupee Cost Averaging

Illustration of Monthly SIP of ₹250 in an Equity Fund

Mutual Fund Investments are subject to market risks, read all scheme related documents carefully. The information provided is generic in nature and is for informational purpose only. Please consult your financial advisor before taking any decision.

Read morePopular Infographics

Related Infographics

5 Simple Financial Resolutions for 2025: A Guide to Achieving Financial Security

-

Disclaimer

The contents of this article/infographic/picture/video are meant solely for information purposes and do not necessarily reflect the views of Bank of Baroda. The contents are generic in nature and for informational purposes only. It is not a substitute for specific advice in your own circumstances. Bank of Baroda and/ or its Affiliates and its subsidiaries make no representation as to the accuracy; completeness or reliability of any information contained herein or otherwise provided and hereby disclaim any liability with regard to the same. The information is subject to updation, completion, revision, verification and amendment and the same may change materially. The information is not intended for distribution or use by any person in any jurisdiction where such distribution or use would be contrary to law or regulation or would subject Bank of Baroda or its affiliates to any licensing or registration requirements. Bank of Baroda shall not be responsible for any direct/indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information mentioned. Please consult your financial advisor before making any financial decision.