ELSS: The Best Tax-Saving Investment with High Returns

13 Mar 2025

Boost Your Tax savings with ELSS

Equity-Linked Savings Schemes (ELSS) are mutual funds that provide tax benefits under Section 80C of the Income Tax Act. They invest primarily in equities, offering market-linked returns. ELSS has a mandatory three-year lock-in period, making it the shortest among tax-saving instruments. Investors benefit from capital appreciation and tax savings.

Optimize Tax-saving The ELSS way

- Dual advantage of tax savings and wealth generation through stockmarkets

- Shorter lock-in period of 3 years, in contrast to other tax-saving options

- Can invest upto Rs 1.5 Lakhs to avail tax benefits under Section 80C

- Invest across sectors and market caps for a diversified investment approach

- Begin tax-saving journey with as low as Rs 500 / month

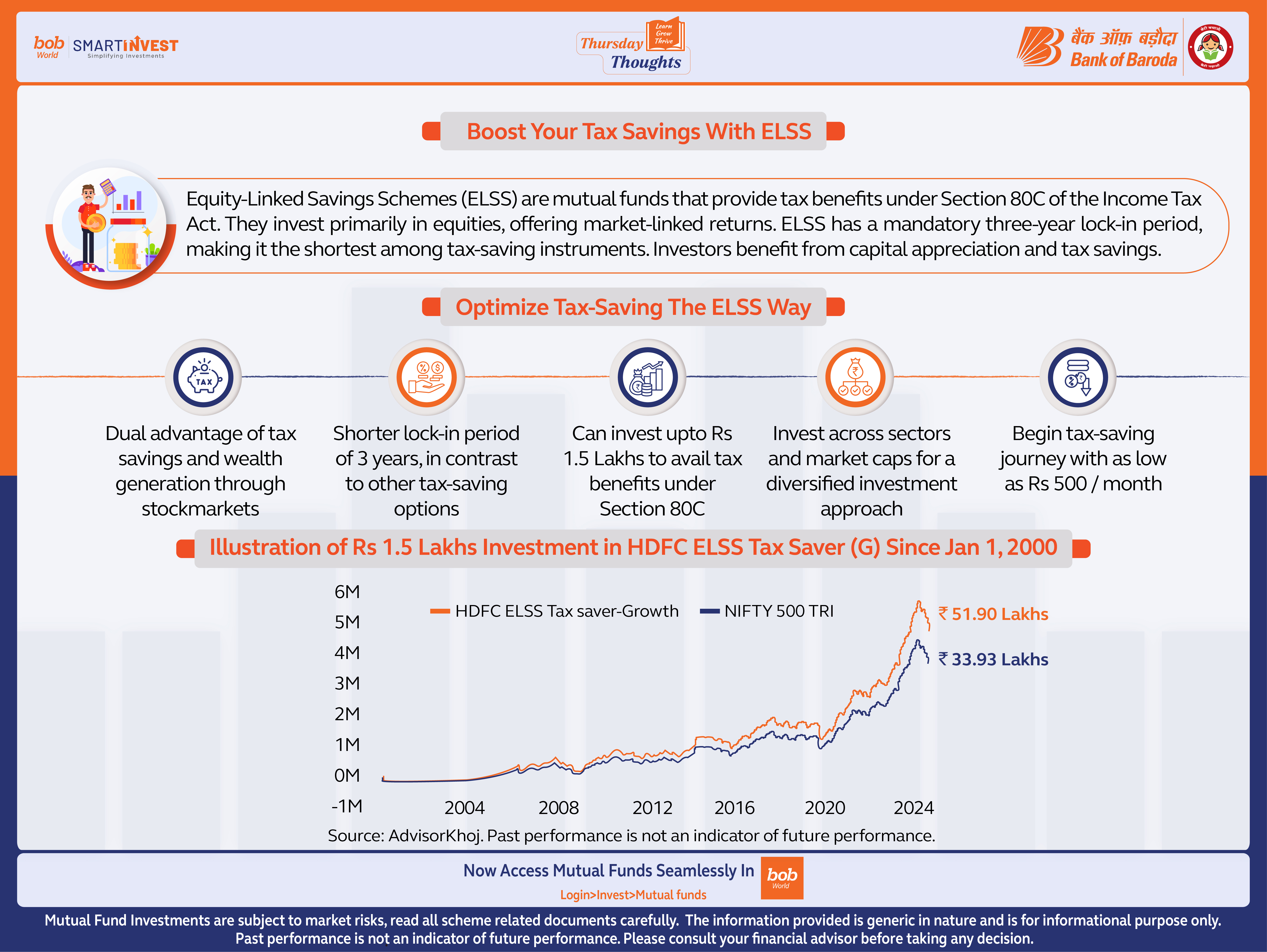

Illustration of Rs 1.5 Lakhs Investment in HDFC ELSS Tax Saver (G) Since Jan 1, 2000

Mutual Fund Investments are subject to market risks, read all scheme related documents carefully. The information provided is generic in nature and is for informational purpose only. Please consult your financial advisor before taking any decision.

Read morePopular Infographics

Related Infographics

5 Simple Financial Resolutions for 2025: A Guide to Achieving Financial Security

-

Disclaimer

The contents of this article/infographic/picture/video are meant solely for information purposes and do not necessarily reflect the views of Bank of Baroda. The contents are generic in nature and for informational purposes only. It is not a substitute for specific advice in your own circumstances. Bank of Baroda and/ or its Affiliates and its subsidiaries make no representation as to the accuracy; completeness or reliability of any information contained herein or otherwise provided and hereby disclaim any liability with regard to the same. The information is subject to updation, completion, revision, verification and amendment and the same may change materially. The information is not intended for distribution or use by any person in any jurisdiction where such distribution or use would be contrary to law or regulation or would subject Bank of Baroda or its affiliates to any licensing or registration requirements. Bank of Baroda shall not be responsible for any direct/indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information mentioned. Please consult your financial advisor before making any financial decision.