Asset Allocation and Its Strategies: A Comprehensive Guide

17 Oct 2024

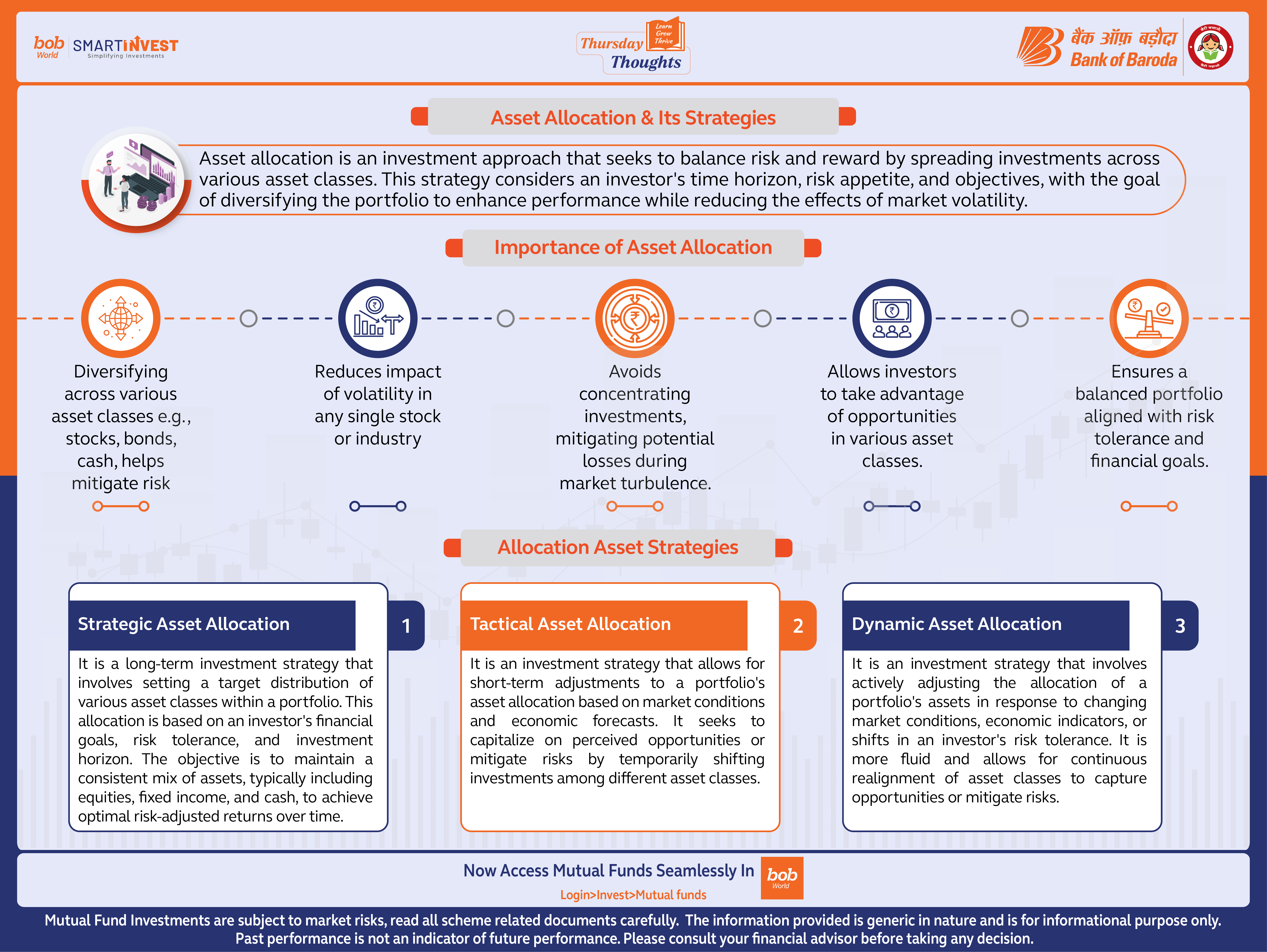

Asset Allocation & Its Strategies

Asset allocation is an investment approach that seeks to balance risk and reward by spreading investments across various asset classes. This strategy considers an investor's time horizon, risk appetite, and objectives, with the goal of diversifying the portfolio to enhance performance while reducing the effects of market volatility.

Importance of Asset Allocation

- Diversifying across various asset classes e.g., stocks, bonds, cash, helps mitigate risk

- Reduces impact of volatility in any single stock or industry

- Avoids concentrating investments, mitigating potential losses during market turbulence.

- Allows investors to take advantage of opportunities in various asset classes.

- Ensures a balanced portfolio aligned with risk tolerance and financial goals.

Allocation Asset Strategies

1. Strategic Asset Allocation: It is a long-term investment strategy that involves setting a target distribution of various asset classes within a portfolio. This allocation is based on an investor's financial goals, risk tolerance, and investment horizon. The objective is to maintain a consistent mix of assets, typically including equities, fixed income, and cash, to achieve optimal risk-adjusted returns over time.

2. Tactical Asset Allocation: It is an investment strategy that allows for short-term adjustments to a portfolio's asset allocation based on market conditions and economic forecasts. It seeks to capitalize on perceived opportunities or mitigate risks by temporarily shifting investments among different asset classes.

3. Dynamic Asset Allocation: It is an investment strategy that involves actively adjusting the allocation of a portfolio's assets in response to changing market conditions, economic indicators, or shifts in an investor's risk tolerance. It is more fluid and allows for continuous realignment of asset classes to capture opportunities or mitigate risks.

Popular Infographics

Related Infographics

5 Simple Financial Resolutions for 2025: A Guide to Achieving Financial Security

-

Disclaimer

The contents of this article/infographic/picture/video are meant solely for information purposes and do not necessarily reflect the views of Bank of Baroda. The contents are generic in nature and for informational purposes only. It is not a substitute for specific advice in your own circumstances. Bank of Baroda and/ or its Affiliates and its subsidiaries make no representation as to the accuracy; completeness or reliability of any information contained herein or otherwise provided and hereby disclaim any liability with regard to the same. The information is subject to updation, completion, revision, verification and amendment and the same may change materially. The information is not intended for distribution or use by any person in any jurisdiction where such distribution or use would be contrary to law or regulation or would subject Bank of Baroda or its affiliates to any licensing or registration requirements. Bank of Baroda shall not be responsible for any direct/indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information mentioned. Please consult your financial advisor before making any financial decision.