What Makes Arbitrage Funds a Smart Investment Choice?

16 Jan 2025

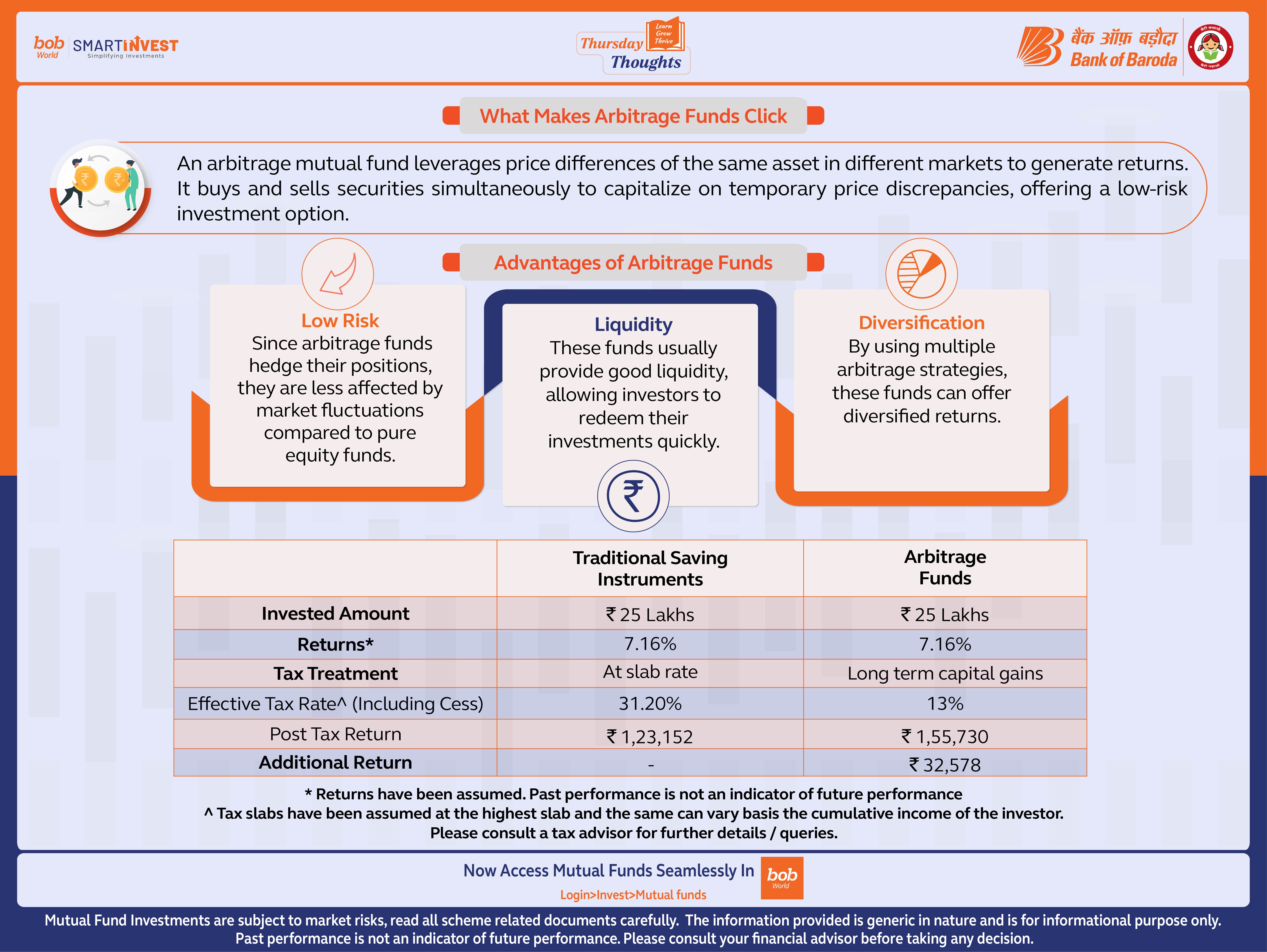

What Makes Arbitrage Funds Click

An arbitrage mutual fund leverages price differences of the same asset in different markets to generate returns. It buys and sells securities simultaneously to capitalize on temporary price discrepancies, offering a low-risk investment option.

Advantages of Arbitrage Funds:

• Low Risk :

Since arbitrage funds hedge their positions, they are less affected by market fluctuations compared to pure equity funds.

• Liquidity :

These funds usually provide good liquidity, allowing investors to redeem their investments quickly.

• Diversification :

By using multiple arbitrage strategies, these funds can offer diversified returns

| Illustration |

Traditional Saving Instruments |

Arbitrage Funds |

|---|---|---|

| Invested Amount | Rs 25 Lakhs | Rs 25 Lakhs |

| Returns* | 7.16% | 7.16% |

| Tax Treatment | At slab rate | Long term capital gains |

| Effective Tax Rate^ (Including Cess) | 31.20% | 13% |

| Post Tax Return | 1,23,152 | 1,55,730 |

| Additional Return | 32,578 |

* Returns have been assumed. Past performance is not an indicator of future performance

^ Tax slabs have been assumed at the highest slab and the same can vary basis the cumulative income of the investor. Please consult a tax advisor for further details / queries.

Mutual Fund Investments are subject to market risks, read all scheme related documents carefully. The information provided is generic in nature and is for informational purpose only. Please consult your financial advisor before taking any decision.

Read morePopular Infographics

Related Infographics

5 Simple Financial Resolutions for 2025: A Guide to Achieving Financial Security

-

Disclaimer

The contents of this article/infographic/picture/video are meant solely for information purposes and do not necessarily reflect the views of Bank of Baroda. The contents are generic in nature and for informational purposes only. It is not a substitute for specific advice in your own circumstances. Bank of Baroda and/ or its Affiliates and its subsidiaries make no representation as to the accuracy; completeness or reliability of any information contained herein or otherwise provided and hereby disclaim any liability with regard to the same. The information is subject to updation, completion, revision, verification and amendment and the same may change materially. The information is not intended for distribution or use by any person in any jurisdiction where such distribution or use would be contrary to law or regulation or would subject Bank of Baroda or its affiliates to any licensing or registration requirements. Bank of Baroda shall not be responsible for any direct/indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information mentioned. Please consult your financial advisor before making any financial decision.