What is the Full Form of CVV

25 Jan 2023

Table of Content

-

CVV Full Form

-

What is CVV Number: CVV Meaning & Definition

-

How to Find CVV in Debit Card & Credit Card

-

Different Components in a CVV

-

How Does CVV Number Work & Its Purpose?

-

How Does CVV Protect You from Frauds?

-

How Can You Protect Your CVV?

-

Dos & Don'ts while using CVV Number

-

Why do online stores ask for your CVV instead of your PIN when checking out?

-

Bottom Line

-

CVV FAQs

What is the full form of CVV in Banking?

CVV full form is Card Verification Value is a 3-digit code printed on the back of the credit or debit cards provided by the companies that make the bank cards. This is also known as card security code or the card verification code. A protective and security layer that guards online data when the card is swiped at the POS machine or during online transactions, CVV details cannot be stored by vendors.

What is CVV Number: CVV Meaning & Definition

When completing an online transaction, you must have noticed that after the card number is filled, there is a field that asks for the CVV. What is CVV? Card Verification Value, CVV is a 3-digit code printed on the back of the credit card or debit card. The CVV is an additional security layer of protection for online transactions and when the card is swiped in POS machines. The CVV verifies that the card is physically available when the individual is using it online. The CVV code must be protected and should not be shared with anyone. Merchandise portals are not allowed to save the CVV number as it is against Per Payment Card Industry Data Security Standards (PCIDSS). Though merchants may have card details, they do not have the CVV information making the misuse of the card impossible. If the CVV is copied by anyone who has the other card details, then the card can be misused.

CVV is an external verification feature that assures banks that the rightful cardholder in possession of the card is using it. The CVV debit card codes are generated by issuers, the bank from where you are receiving your credit or debit card.

What does the CVV code reveal?

- The bank numbers

- Service code

- Expiration date

- Unique code. This code is known only to the bank that issues the card. The conversion to a decimal code of three-four digits verifies and authenticates the card.

Amongst the many layers of authentication that banks use, CVV is one such that acts as a protection from hackers who may have procured the card number, but without CVV, the transaction is not authenticated thus protecting the card owner’s interest.

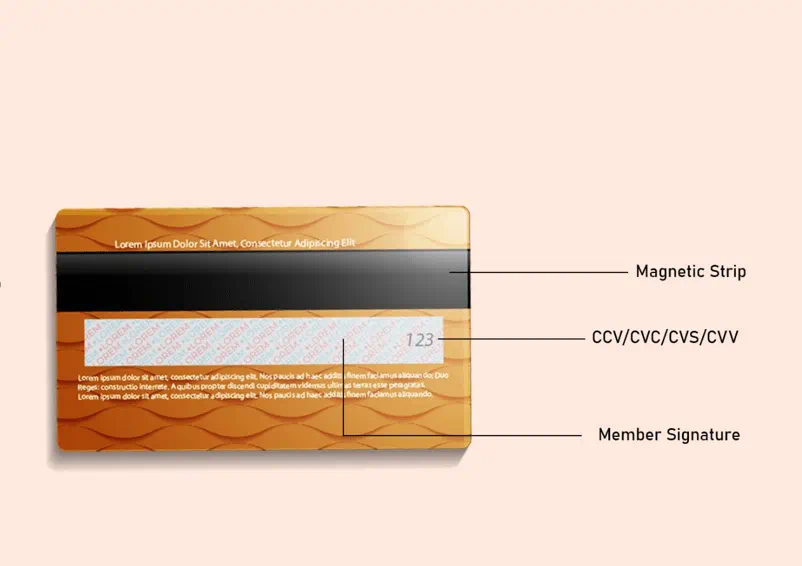

How to Find CVV in Debit Card & Credit Card

As discussed, the card verification value refers to the three-digit code at the back of the card or the magnetic strip. This is found both in credit and debit cards. The decimal representation code is assigned uniquely to the individual to whom the card is issued. The credit card CVV number is called Card Security Code (CSC) or the Card Verification Code (CVC). It is a three-digit number offered by VISA, MasterCard, RuPay and Discover. American Express cards have four-digit numbers.

If you want to know how to find the CVV number on the credit/debit card, it's easy. Finding the CVV on the credit or debit card depends on the card you own. Those owning Visa, Mastercard, RuPay and Discover cards will find the three-digit code on the back either inside or just near the signature strip. American Express card users will find the four-digit CVV on the front, above the Amex logo.

Different Components in a CVV

The Card Verification Value (CVV), Card Security Code (CSC), Card Identification Number (CIN), or CVV2 are different names meaning the CVV. This number is crucial for completing online transactions and must not be shared with anyone. This number is issued by the bank or a financial institute that delivers the card.

The two types of CVVs that the customer must know

- CVV1: The magnetic strip on the card has an encrypted code that is not visible and is automatically read by the POS (Point of Sale) terminal when you swipe the card to make payment. You must have noticed how some merchants do not ask for your PIN and receive payment.

- CVV2: This is a three-digit code printed behind the card and required, when you make an online purchase. The payment gateway can store all your other card details but not the CVV number. Each time you purchase, this number needs to be filled in no matter how frequently you use the service of the same merchant.

The card is based on the following components

- The credit/ debit card number

- Service code

- Card expiry Date

- Issuer's unique code

It is easy to locate the CVV number while making an online transaction as it is a three-digit code mostly located at the back, just below the magnetic bar. It can either be within the signature area of the card or outside in another smaller box.

How Does CVV Number Work & Its Purpose?

When moving into the payment gateway of an online merchant site, after filling in the card detail and the card expiry date, the CVV is an important field that needs to be filled, without which a payment is not processed. By doing so, the user shows that the card is in his/her possession. This is a simple layer of security that banks maintain to reduce fraud. A person may acquire your card details, as hackers can find details of cards that may be recorded by merchants during an online transaction. However, CVV numbers are prohibited from storage by Industry Data Security Standards. Therefore, this number is difficult to guess unless one has access to the card. The number cannot be copied when the card is swiped or during offline payment. If the data in the magnetic chip has changed, the card will be declined by the POS machines. The multiple ways of guarding the CVV are protection provided by banks against fraudulent activities in the bank account.

Though CVV in cards provides excellent security, credit cards are not immune to phishing and other forms of cybercrime as many merchants do not ask for CVV codes to complete transactions. The vulnerability of credit cards increases as hackers can carry out unauthorized transactions with just the card details.

While using credit cards, do not move ahead with transactions that do not have multiple verification layers safeguarding the owner's interest. Also, when applying for credit cards, choose reliable lenders over popular ones.

CVV is generated by banks based on the following information:

- Primary account number

- Four-digit expiration date

- Pair of DES (Data Encryption Standard) keys and a three-digit service code

- The proper algorithms are not disclosed by banks for obvious reasons.

How Does CVV Protect You from Frauds?

Both debit and credit cards are used for online transactions for payment on online virtual gateways. If you are a regular customer of a particular merchant, you enjoy the personalization that the merchant offers whenever you are taken to the payment gateway. Your card number is stored, and all that is required is to fill out the CVV. You may have wondered why the merchant site forgot to store the CVV. The CVV is the protection code that saves your account from hackers. Portals from where you transact are prohibited from saving the CVV number of cardholders as part of Per Payment Card Industry Data Security Standards. This security standard is a layer of protection that guards the account holder against misuse of the card information. Hackers may duplicate the credit card with the magnetic strip and can access the CVV debit card code for misusing the card.

However, chip-enabled card technology has effectively stopped physical card fraud. Cards are provided with two protective layers of CVV, the encoded magnetic strip for in-person transactions. This is a non-visible CVV encrypted by magnetic decimal codes. The other is the visible code on the card. This is a CVV that needs to be given when making online transactions. While online hackers can get hold of credit card numbers and expiration dates, it is impossible to track CVVs. So, each time you are paying for an online transaction that requires you to fill your CVV, remember you are adding a layer of security to your transaction with this facility.

CVVs are static digits that do not change. When the card is not present with the hacker, the CVV is a useful filter. However, if you lose the card in public and do not realize it, someone with nefarious intentions can start misusing your card before you block it. With the new technology of dynamic CVV, temporary numbers will expire as they are sent to the cardholder via text messages or email. Without verification, even if the card is stolen, the person cannot go ahead with transactions. These are all risk-reducing practices to safeguard the interest of the cardholder. In the end, every individual should be aware and keep their security active. Being watchful and vigilant will protect the cardholder from falling into the hands of fraudsters.

How Can You Protect Your CVV?

- If you are transacting from your computer, ensure to have an antivirus installed

- Ensure that you do banking or payment transactions from a protected Wi-Fi network

- Use trusted websites for entering credit card information

- When you are browsing away from home using a VPN

- Do not share photos of your credit card on social media or with friends

- If you receive unsolicited requests, asking for personal information, ignore them

- Keep a vigilant eye on account activities

Dos & Don'ts while using CVV Number

| Dos for protecting CVV | Don’ts for protecting CVV |

|---|---|

| Sign in the backside of the card, on receipt from the bank | Do not share your Credit / Debit Card numbers, or CVV number with anyone, not even with the bank officials |

| Erase and memorize the 3-digit CVV number on the backside of the card | Do not share your OTP (One Time Password) with anyone over the phone or by mail |

| Memorize the card PIN and do not write it down anywhere. | Do not carry out financial transactions while using public networks, i.e., Internet café, free Wi-Fi, etc., |

| When swiping cards Ensure that merchants swipe your card Point of Sale (POS) terminals, insist it is done in your presence. Shield the POS PIN pad while entering your PIN. | Avoid ATMs located in isolated or dimly lit places without security. |

| Do change your PINs as often as convenient. | Do not crumple and throw away the ATM transaction slips. The information printed on the slip can be misused. Ensure you destroy the transaction slips into small pieces and dispose of them. |

| Register for SMS and Email alerts, whenever your account is accessed or debited. | Do not use ATMs that look tampered with, i.e., broken, scratched, damaged, sticky with glue, has extra wiring or loose parts around the slot, difficulty in inserting the card, etc., Look for any camera/blinking light in the close vicinity. |

| Verify the transactions in your bank statement regularly to identify suspicious transactions. | Do not delay reporting a lost Debit / Credit Card to avoid the worst consequences. |

| Beware of unsolicited calls, texts, or emails asking for sensitive financial information like Debit card/Credit card/ ATM pin/CVV/Expiry date or Password. |

Why do online stores ask for your CVV instead of your PIN when checking out?

PINs are different from CVVs. PINs are user-created four or more numbers used for personal identification. In credit cards, PINs are used for cash advances, withdrawing cash, or initiating a POS purchase. CVV is generated by the card issuer and is printed on the card. Banks also provide PINs for credit and debit cards, which are temporary and encourage individuals to change them as soon as possible. A CVV has nothing to do with the card expiry date. CVV is a security code that adds extra protection when you are purchasing items from the internet. When the CVV is entered into the payment gateway, the bank authenticates the payment, as each debit card and the credit card have a unique code peculiar to the card. A PIN is just a password to help the card owner complete their transaction.

Bottom Line

A reliable bank provides debit cards and credit cards when you have an account with them. Ensure that you maintain all the cautions suggested for protecting your CVV debit card code. Apply for credit cards from banks you can trust and those that are augmented with a variety of options and features. Bank of Baroda credit and debit cards are an asset for any customer. With a Bank of Baroda Debit card, you can explore dining, entertainment shopping, and travel benefits. Debit cards can be chosen from a variety of offerings depending on the spending pattern and repayment capacity of the individual. Customers can choose from eight different debit card types from BoB, Baroda BPCL Debit Card, MasterCard Platinum DI Debit Card, RuPay Classic Debit Card, RuPay Platinum DI Debit Card, RuPay Select DI Debit Card, Visa Classic DI Debit Card, Visa Platinum DI Debit Card.

BoB credit cards offer a variety of options that can be used anywhere in the world and is compatable to more than a million ATMs around the world. The list includes, BOB Prime Credit Card, BOB ICAI Exclusive Credit Card, BOB ICSI Diamond Credit Card, BOB CMA One Credit Card, BOB Assure Credit Card, BOB Titanium Master Credit Card, BOBCARD Easy Credit Card, Co-Branded Card (BOBCARD Bombay Bullion), BOB Elite Platinum Visa Credit Card, BOB Signature Visa Credit Card, BOB SELECT Credit Card, BOB Premier Credit Card, BOB Paytm Credit Card, and BOB ETERNA Credit Card. A 24/7 customer service supports the cardholders. Cardholders can win loyalty points; cards are facilitated with free add-ons and a lot more perks. Most distinguishingly, BoB provides the most secure banking services and customers can enjoy safe and fearless transactions with Bank of Baroda credit and debit cards.

What is CVV FAQs

- What is full form of CVV?

- Can I share my CVV number?

- Is CVV 3 or 4 digits?

- How to find the CVV number on a debit card?

- Can someone use my credit card without CVV?

- How can I find my CVV number online?

- Can I pay online without CVV?

The CVV full form is Card Verification Value.

Never, only in verified merchant gateways while initiating payment.

Most CVVs have 3-digits.

VISA, RuPay and Mastercard credit cards and debit cards have 3-digit security codes

American Express, issues 4-digit CVV credit cards

CVV codes in debit cards are typically printed on the back of the card to the right of the white signature strip.

Some merchants allow the use of credit cards without asking for the CVV code. This is highly risky. Ensure using sites that work with CVV codes. This layer of risk management is only for maintaining secure transactions and benefits customers. Banks try to protect customers from fraudulent activities. While banks take full measures, it is also the responsibility of the customer to protect their interest.

CVV numbers are not available online. They are found only on the backside of the customer’s credit/debit card. No online gateway has permission to store an individual’s CVV.

No financial transaction online is permitted without CVV. Those performing transactions without CVV are unsecured and unauthorized transactions that must be avoided. Always transact from reliable merchant sites that ask for CVVs.

Popular Articles

Tag Clouds

-

Disclaimer

The contents of this article/infographic/picture/video are meant solely for information purposes and do not necessarily reflect the views of Bank of Baroda. The contents are generic in nature and for informational purposes only. It is not a substitute for specific advice in your own circumstances. Bank of Baroda and/ or its Affiliates and its subsidiaries make no representation as to the accuracy; completeness or reliability of any information contained herein or otherwise provided and hereby disclaim any liability with regard to the same. The information is subject to updation, completion, revision, verification and amendment and the same may change materially. The information is not intended for distribution or use by any person in any jurisdiction where such distribution or use would be contrary to law or regulation or would subject Bank of Baroda or its affiliates to any licensing or registration requirements. Bank of Baroda shall not be responsible for any direct/indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information mentioned. Please consult your financial advisor before making any financial decision.