Repayment of Gold Loan: Everything You Need to Know

23 Nov 2022

Table of Content

Gold loans have always been one of the popular ways to borrow funds due to ease in the process, less documentation, rapid availability of funding, and a variety of repayment options. Between personal loan and gold loan, a personal loan takes days or even weeks to avail, whereas a gold loan can be approved within hours as borrowers keep a sufficient quantity of gold as collateral against the loan amount. Moreover, gold loans' interest rate is lower than personal loans. Owning physical gold can act as an investment or a backup during an unexpected financial crisis. Banks and financial institutions offer different gold loan repayment methods. From regular EMIs to bullet repayments, borrowers can repay gold loans as per their suitability and financial situation. Below is detailed information regarding various aspects of gold loan repayment, including process, period, and best ways to repay.

How does the gold loan repayment work?

Borrowers can pledge their gold as collateral and borrow the principal amount based on the gold's purity, weight, and current market rate. The interest rate and the tenure vary from lender to lender. Borrowers can opt for a repayment method that best suits their circumstances. The different ways to repay the gold loan include paying the principal amount and interest amount equally in monthly instalments, paying the interest amount as EMIs and paying the principal amount at the end of tenure, making partial repayments based on fund availability throughout the tenure, and bullet repayment. Borrowers must follow the processes involved in the repayment method they choose. They can then take the pledged gold back from the lender at the end of the loan term.

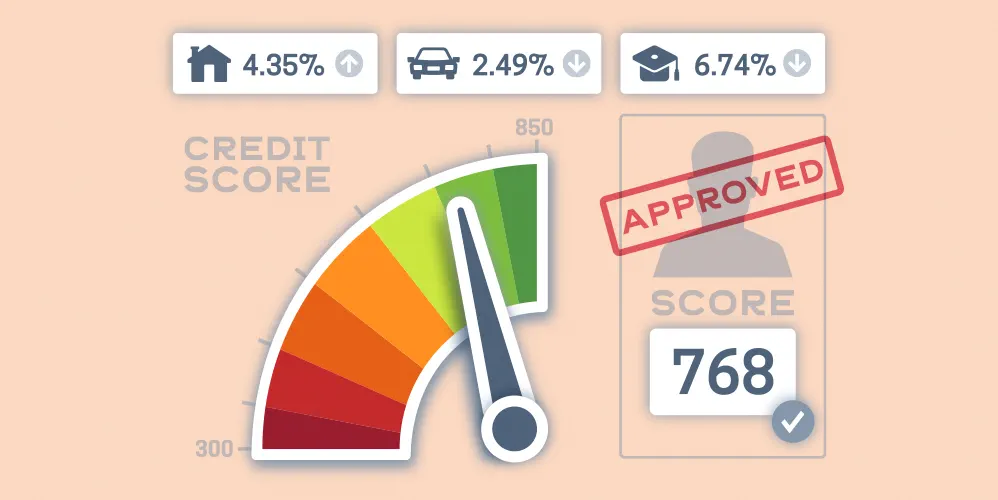

Also Read: Does Gold Loan Affect CIBIL Score

What is the gold loan repayment procedure?

Different procedures through which gold loan repayment can be carried out involve EMIs, bullet repayment, and partial repayments & foreclosure. Through the EMI option, you can repay the gold loan by paying EMIs to the lender for the predetermined tenure, you can also check your EMI using our gold loan EMI calculator. In the bullet repayment option, you can submit the principal and interest amount at once at the end of the loan tenure. You can also make partial repayments as per the availability of funds and pay the entire principal and interest amount before the end of the tenure. In this case, you can foreclose the loan and take back the pledged gold before the loan tenure ends.

Know your gold loan repayment period

The gold loan repayment period is usually short term. Maximum period is up to 12 months and 36 months for EMI scheme. Selecting the repayment period is important, as the interest amount increases with a longer tenure.

What are the best ways to repay your gold loan?

Following are the best ways for gold loan repayment:

1. Pay interest amount as EMI and principal amount at the end

In this option, you can pay the interest amount through the schedule of EMI provided by the lender. The principal amount can be paid in a single payment at the end of the loan tenure. Borrowers prefer this option as they do not need to worry about paying the principal throughout the tenure.

2. Pay principal and interest amount as regular EMI during the tenure

This option works best for people with fixed monthly incomes. The EMI includes the principal and interest amount. This option works like most home or car loans in which borrowers pay a part of the total principal and interest amount every month as EMI throughout the tenure.

3. Bullet repayment

In this gold loan repayment option, a borrower needs to pay the entire principal and interest amount at the end of the loan tenure. Borrowers do not need to worry about following an EMI schedule or making partial payments throughout the tenure. Though the gold loan interest rate is calculated for each month of the entire tenure, the total principal and interest amount are payable at the end of the tenure in a single payment. So, it is known as bullet repayment.

4. Partial payments and foreclosure

Making partial payments and paying the entire principal and interest amount before the tenure is favorable for borrowers in two ways. They can repay the gold loan as per the availability of funds. Having no fixed EMI schedule gives borrowers some flexibility. Moreover, if the entire loan is paid off before the end of the tenure, borrowers can save considerably as the interest amount for the remaining tenure will be waived off. Paying the entire principal and interest amount before the end of the tenure and closing the loan is known as foreclosure. This option is suitable if borrowers wish to save the interest amount and claim the pledged gold at the earliest.

Also Check: Gold Loan Eligibility

Key Takeaways

A gold loan will always remain one of the most preferred ways to borrow owing to fast loan approval, minimal documentation, multiple repayment options, and other gold loan benefits. Borrowers should compare interest rates and tenure options before deciding on a loan type. They also need to study various repayment methods and their financial situations to determine the best way of loan repayment.

The regular EMI option will not help save the interest amount, but foreclosure through partial repayments can. With the bullet repayment method, the borrower need not worry about repaying the loan amount throughout the tenure. Weighing these pros and cons and determining the future possibilities of funds becoming available, borrowers should choose the appropriate gold loan repayment option.

Popular Articles

Tag Clouds

Related Articles

Guide to Getting Agriculture Loan: Application, Eligibility & Required Documents

-

Disclaimer

The contents of this article/infographic/picture/video are meant solely for information purposes and do not necessarily reflect the views of Bank of Baroda. The contents are generic in nature and for informational purposes only. It is not a substitute for specific advice in your own circumstances. Bank of Baroda and/ or its Affiliates and its subsidiaries make no representation as to the accuracy; completeness or reliability of any information contained herein or otherwise provided and hereby disclaim any liability with regard to the same. The information is subject to updation, completion, revision, verification and amendment and the same may change materially. The information is not intended for distribution or use by any person in any jurisdiction where such distribution or use would be contrary to law or regulation or would subject Bank of Baroda or its affiliates to any licensing or registration requirements. Bank of Baroda shall not be responsible for any direct/indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information mentioned. Please consult your financial advisor before making any financial decision.

How Does Gold Loan Affect Your CIBIL Score?

Gold is one of the most common options for secured loans among Indians. With a gold loan, you can borrow money at a reasonable interest rate in exchange for the gold you provide.

What Are the Gold Loan Eligibility Criteria?

Data revealed by the World Gold Council showed that Indian gold consumption increased by 78% in 2021 to 797.3 tonnes. In India, gold’s financial value is accompanied by a deep sentimental connection as Indians purchase gold on numerous auspicious occasions.