Smart Ways to Calculate EMI on Personal Loan

31 Oct 2022

Table of Content

Before you apply for a Personal Loan, you may want to get down to the basics, to shop for the best offers on personal loans in the market and also know the ways to calculate the EMI on your loan. Among the most popular ones is the Bank of Baroda Personal loan which apart from having the pedigree of belonging to one of the oldest and largest Indian banks, comes replete with some amazing features like flexible repayment options, affordable EMIs (Equated Monthly Instalments) that sit easy on your pocket and sizable loan amount among others in the category of personal loans.

What is an EMI?

EMI is the monthly installment paid by the borrower towards the loan at a specified interest rate over a specified loan tenure.

Calculating The EMI On Personal Loans

The EMI calculations mainly rely on three variables-

- The Loan Term or The Tenure of The Loan

- The Loan Value

- Rate of Interest

*The rate of interest is one of the aspects that comes determined by the bank.

Calculating EMI Using The PMT Formula

This is a longer, tedious and round about approach to calculating the EMI on your personal loan. Here, you can run the PMT formula on Microsoft Excel to calculate EMI on personal loan, where

- PMT is your EMI

- NPER or number of periods is the total number of payments for the loan

- PV is the loan value or the principal

- Rate is the rate of interest/12

- The formula is

- PMT (Rate, NPER, pv)

You can keep trying the formula for various combinations and then choose the one with the lowest EMI, though this is a roundabout approach that could be prone to human error.

Online Personal Loan EMI Calculator

Or a far easier option to calculate the affordable EMI, is using, for example, Bank of Baroda’s online personal loan EMI calculator.

Here, you will find a slider on the range of each of the three basic variables on your screen- the loan amount you are likely to need, the tenure or the repayment period of the loan that suits your finances and the rate of interest.

Now, the rate of interest is what you get from the bank, while the other two aspects, i.e., the loan amount and the tenure of the personal loan are the ones you can play around with here.

When you place the cursor on a particular value of the loan term, rate of interest and loan amount, the calculator throws up a monthly payment value, which is your EMI. You can move the cursor horizontally along the range provided to pick the various values.

How To Calculate Emi For Personal Loan With Example

The formula used to calculate EMI for personal loans is:

EMI = [P x R x (1+R) ^n] / [(1+R) ^ n-1]

Where P= Principal loan amount

R= Rate of interest &

n= Number of monthly installments.

For example:

Let us assume, P= Rs. 3 lakh, R= 15 percent per annum= 15/12= 1.250 per month, N= 60 months then,

EMI = [300000*1.250/100*(1+1.250/100) ^60]/ [(1+1.250/100) ^60-1] = Rs. 7,137

Here’s How a Bank of Baroda Personal Loan EMI Calculator can Help You-

If EMI is too high

- You can pick a longer loan term or

- You can make the loan amount smaller.

If you find the EMI is affordable or even lower than ideal, then you can plan to repay faster by either

- Taking a larger loan value or

- A shorter loan term.

Popular Articles

Related Articles

Guide to Getting Agriculture Loan: Application, Eligibility & Required Documents

-

Disclaimer

The contents of this article/infographic/picture/video are meant solely for information purposes and do not necessarily reflect the views of Bank of Baroda. The contents are generic in nature and for informational purposes only. It is not a substitute for specific advice in your own circumstances. Bank of Baroda and/ or its Affiliates and its subsidiaries make no representation as to the accuracy; completeness or reliability of any information contained herein or otherwise provided and hereby disclaim any liability with regard to the same. The information is subject to updation, completion, revision, verification and amendment and the same may change materially. The information is not intended for distribution or use by any person in any jurisdiction where such distribution or use would be contrary to law or regulation or would subject Bank of Baroda or its affiliates to any licensing or registration requirements. Bank of Baroda shall not be responsible for any direct/indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information mentioned. Please consult your financial advisor before making any financial decision.

A Complete Guide to Personal Loan

A personal loan does not require the borrower to provide collateral and so it is an unsecured loan. The purpose or intention of a personal loan is to fund immediate financial contingencies. It could be for business capital, marriage, medical expenses or even foreign trips, though the end use of the capital really depends on the borrower, as long as it is for a legitimate financial need.

Eligibility for a personal loan?

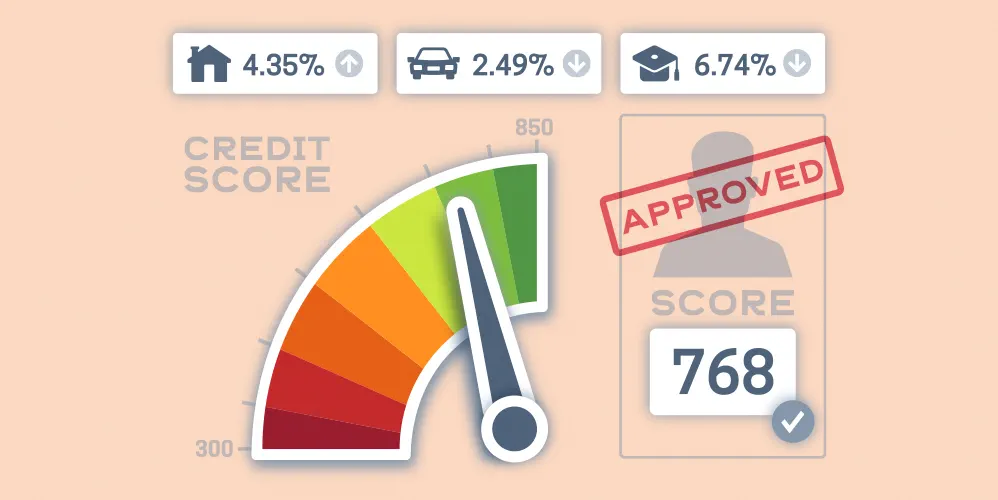

Since these loans are unsecured- at what rate of interest you will get the loan and how much, whether or not you will get the loan-depend on the credit quality of the borrower. If you have good creditworthiness, you are likely to get the loan at an attractive rate of interest. If you have been a long time customer with the bank, with sound track record of financial discipline, you may also get a pre-approved personal loan sanction.

Bank of Baroda lists the following types of employees/self-employed individuals who are eligible for personal loans.

Employees of Central / State Govt. / Autonomous Bodies/ Public / Joint Sector Undertakings, Public Limited Co. / MNCs & Educational Institutions – with minimum continuous service for 1 year

Employees of Proprietorship, Partnership firms, Private Limited companies, Trust - with minimum continuous service for 1 year

Insurance Agents- doing business for minimum last -2- years

Self Employed Professionals (Doctor, Engineer, Architect, Interior Designers, Tech. and Management Consultants, Practicing Company secretaries etc) -- with minimum 1 year stable business.

Self Employed Business persons - with minimum 1 year stable business.

Some of the benefits of a personal loan are

Urgent financial requirement

If there is an immediate need for money, personal loans are the best option. They are considered better than credit cards or loans from family members or unorganized lenders, since the rate of interest is reasonable and the lender is a credible organization. Credit cards come with strict credit limits, which is not the case with personal loans. Funds taken from the bank as personal loan also resolve the issue of certain vendors not accepting payment through credit cards.

Breathing time for repayment

Also, the credit card bills need to be paid off by the due date which generally falls in the next month whereas you get some breather in repaying a personal loan EMI over a period of time, generally ranging from 3-4 years.

Flexibility of use

Funds from a personal loan are flexible in the way you use them. They can be used for several purposes- home renovation, travel, wedding and medical expenses or for any other purpose as per one’s personal obligations..

Loan amount

The loan amount you can borrow under a personal loan is also significant. For example, with Bank of Baroda offer personal loan amounts based on the eligibility of applicants

Confidential

Personal loans may also be private loans since these loans are often used to meet cash requirements or personal contingencies and thus kept private to a great extent.

Flexible repayment structure

These loans are generally of the nature of short to medium term loans and come with a flexible repayment structure.

Easy to get

For example, Bank of Baroda is popular for personal loans that are quick to get, fast processing, minimal documentation required and offered at attractive rate of interests. Most salaried persons, self-employed and professionals can apply for these personal loans.

Step by Step Guide to Check Your Personal Loan Eligibility

If you want access to immediate cash without providing collateral, a Personal Loan can prove to be an incredible option. With a Personal Loan, you can fund any expense, be it medical emergencies, a dream wedding, long-awaited vacations or home improvement projects. This article explains the eligibility criteria for a Personal Loan, how you can use a Personal Loan Eligibility Calculator and the measures you can take to improve your loan eligibility. Read on.