Unlocking Financial Efficiency: How Cash Management Services Transform Banking

07 Aug 2024

Table of Content

Introduction

In the dynamic world of finance, Cash Management Services play a pivotal role in helping businesses maintain liquidity, optimize cash flow, and ensure smooth financial operations. Banks offer these services to manage their clients' cash transactions efficiently. This blog delves into the nuances of cash management services, highlighting their importance, types, functioning, and benefits.

What is Cash Management Services (CMS)?

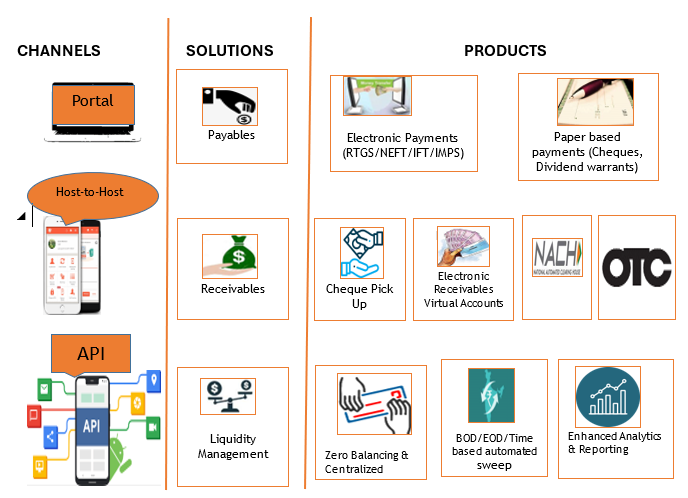

What is Cash Management Services (CMS)? Cash management services encompass a range of financial tools and services provided by banks to help businesses manage their cash flow effectively. These services include handling payments, collections, liquidity management, and providing solutions for short-term investments. The primary goal of CMS is to ensure that businesses have adequate cash flow to meet their operational needs while optimizing the use of their financial resources.

Cash management services are designed to streamline the financial operations of businesses by offering a comprehensive suite of tools that assist in managing cash inflows and outflows. These services are essential for businesses of all sizes, as they help in maintaining financial stability, improving liquidity, and ensuring efficient use of resources.

Importance of Cash Management Services

The importance of Cash Management Services in banking cannot be overstated. Effective cash management ensures that a business can meet its financial obligations, invest surplus cash wisely, and plan for future growth. By leveraging CMS, businesses can streamline their financial operations, reduce the risk of cash shortages, and enhance overall financial stability.

Cash management services help businesses in several ways:

1. Ensuring Liquidity: By managing cash flow effectively, businesses can ensure that they have sufficient liquidity to meet their short-term obligations.

2. Optimizing Cash Utilization: CMS helps businesses optimize the use of their cash resources by investing surplus funds in short-term investments that generate returns.

3. Reducing Financial Risks: Effective cash management reduces financial risks by ensuring that businesses can meet their financial obligations and avoid cash flow problems.

4. Improving Financial Planning: CMS provides businesses with real-time data on their cash position, helping them make informed financial decisions and improve their financial planning.

Types of Cash Management Services

How CMS Works

Understanding how CMS works is essential for businesses looking to optimize their cash flow. CMS typically involves a combination of technology, financial expertise, and banking services. Here's a simplified breakdown of how it works:

1. Integration with Business Systems: CMS integrates with a company's accounting and financial systems to provide real-time data on cash flow.

2. Automation of Transactions: Many cash management tasks, such as payments and collections, are automated to reduce manual effort and minimize errors.

3. Monitoring and Reporting: CMS provides detailed reports and analytics on cash flow, helping businesses make informed financial decisions.

For example, a business can use CMS to automate its accounts receivable and accounts payable processes, ensuring that payments are collected and disbursed efficiently. By integrating CMS with the company's accounting system, the business can monitor its cash position in real-time and make informed decisions about its cash management strategy.

Benefits of Using Cash Management Services

Utilizing cash management services offers numerous benefits for businesses, including:

- Improved Cash Flow: CMS ensures timely collection of receivables and efficient payment processes, leading to better cash flow management.

- Cost Savings: By automating financial transactions and reducing manual intervention, businesses can save on administrative costs and reduce the risk of errors.

- Enhanced Financial Planning: With real-time data and analytics, businesses can make more accurate financial forecasts and plan for future growth.

- Risk Mitigation: Effective cash management helps mitigate financial risks by ensuring that businesses have sufficient liquidity to meet their obligations.

- Increased Efficiency: CMS streamlines financial operations, reducing the time and effort required to manage cash flow and freeing up resources for other business activities.

- Better Decision Making: Access to real-time data and analytics helps businesses make informed financial decisions and improve their overall financial performance.

- Customized Solutions: Banks offer customized cash management solutions tailored to the specific needs of businesses, helping them achieve their financial goals.

Conclusion

In conclusion, Cash Management Services are indispensable tools for businesses aiming to maintain liquidity, optimize cash flow, and achieve financial stability. By understanding the various types of CMS, how they work, and the benefits they offer, businesses can make informed decisions and leverage these services to enhance their financial operations. In today's competitive business environment, effective cash management is not just a necessity but a strategic advantage.

In the case of Integrated solution like H2H or API transaction flow is based on encrypted logic resulting into not only error free but also fast and efficient flow of transaction. Apart from these services we also offer various other facilities to our corporates such as Cash and Cheque Pick up facility under Door Step Banking Services.

For businesses looking to improve their financial management, partnering with a bank that offers comprehensive cash management services can provide the support and expertise needed to achieve their financial goals. By leveraging the tools and services provided by CMS, businesses can ensure that they have the liquidity and financial stability needed to succeed in today's dynamic business environment.

Popular Articles

Tag Clouds

Related Articles

IMPS in Banking – Full Form, Features, Transaction Limit, Charges & how it works

-

Disclaimer

The contents of this article/infographic/picture/video are meant solely for information purposes and do not necessarily reflect the views of Bank of Baroda. The contents are generic in nature and for informational purposes only. It is not a substitute for specific advice in your own circumstances. Bank of Baroda and/ or its Affiliates and its subsidiaries make no representation as to the accuracy; completeness or reliability of any information contained herein or otherwise provided and hereby disclaim any liability with regard to the same. The information is subject to updation, completion, revision, verification and amendment and the same may change materially. The information is not intended for distribution or use by any person in any jurisdiction where such distribution or use would be contrary to law or regulation or would subject Bank of Baroda or its affiliates to any licensing or registration requirements. Bank of Baroda shall not be responsible for any direct/indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information mentioned. Please consult your financial advisor before making any financial decision.

What to Do When You Forget Your ATM PIN

Your ATM Personal Identification Number (PIN) is like the key to your bank account. It’s a vital piece of information that safeguards your funds and ensures that only you can access them. Memorizing your PIN is crucial for security reasons, but we all know that memory lapses can occur, which is why it is important to make sure that your ATM pin is simple and can be easily recalled by you.

How To Activate Debit Card

Congratulations! You have just received your new debit card and you can’t wait to use it! Whether it's a replacement for an old card or your very first one, you're now on the path to making quick and easy transactions, while managing your finances smoothly. However, before you start swiping, tapping, or using your card for online purchases, you need to go through an important process. You need to activate your debit card in order to use it. In this blog, we'll walk you through the process of activating your debit card and provide you with some valuable tips to ensure a smooth experience.