Investment Risks: Types and How to Manage Them

17 Apr 2025

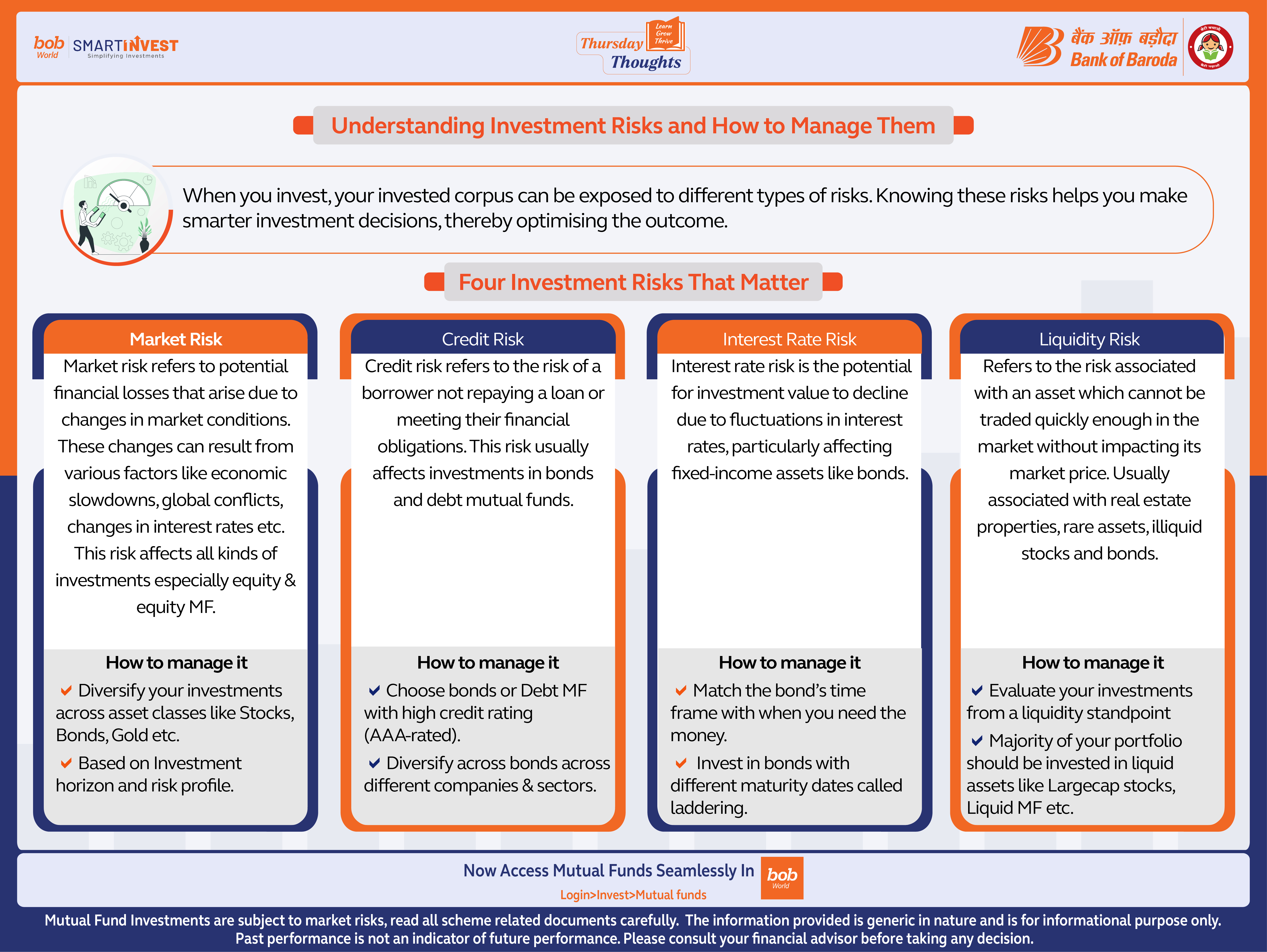

Understanding Investment Risks and How to Manage Them

When you invest, your invested corpus can be exposed to different types of risks. Knowing these risks helps you make smarter investment decisions, thereby optimising the outcome.

1. Market Risk (Systematic Risk)

Market risk refers to potential financial losses that arise due to changes in market conditions. These changes can result from various factors like economic slowdowns, global conflicts, changes in interest rates etc. This risk affects all kinds of investments especially equity & equity MF.

How to manage it:

Diversify your investments across asset classes like Stocks, Bonds, Gold etc. based on Investment horizon and risk profile

2. Credit Risk

Credit risk refers to the risk of a borrower not repaying a loan or meeting their financial obligations. This risk usually affects investments in bonds and debt mutual funds.

How to manage it:

Choose bonds or Debt MF with high credit rating (AAA-rated). Diversify across bonds across different companies & sectors.

3. Interest Rate Risk

Interest rate risk is the potential for investment value to decline due to fluctuations in interest rates, particularly affecting fixed-income assets like bonds.

How to manage it:

Match the bond’s time frame with when you need the money. Invest in bonds with different maturity dates called laddering.

4. Liquidity Risk

Refers to the risk associated with an asset which cannot be traded quickly enough in the market without impacting its market price. Usually associated with real estate properties, rare assets, illiquid stocks and bonds.

How to manage it:

Evaluate your investments from a liquidity standpoint Majority of your portfolio should be invested in liquid assets like Largecap stocks, Liquid MF etc.

Mutual Fund Investments are subject to market risks, read all scheme related documents carefully. The information provided is generic in nature and is for informational purpose only. Please consult your financial advisor before taking any decision.

Read morePopular Infographics

Related Infographics

-

Disclaimer

The contents of this article/infographic/picture/video are meant solely for information purposes and do not necessarily reflect the views of Bank of Baroda. The contents are generic in nature and for informational purposes only. It is not a substitute for specific advice in your own circumstances. Bank of Baroda and/ or its Affiliates and its subsidiaries make no representation as to the accuracy; completeness or reliability of any information contained herein or otherwise provided and hereby disclaim any liability with regard to the same. The information is subject to updation, completion, revision, verification and amendment and the same may change materially. The information is not intended for distribution or use by any person in any jurisdiction where such distribution or use would be contrary to law or regulation or would subject Bank of Baroda or its affiliates to any licensing or registration requirements. Bank of Baroda shall not be responsible for any direct/indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information mentioned. Please consult your financial advisor before making any financial decision.